ASX down 1.4% as RBA’s bond battle heats up

ASX finishes lower, but another positive month, Macquarie profit doubles

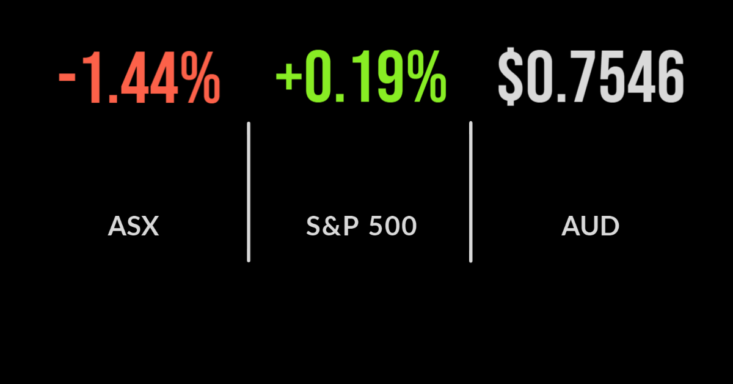

The S&P/ASX200 (ASX: XJO) finished the week and the month of a negative note, falling 1.4% after an unexpected spike in bond yields hit sentiment on Friday afternoon.

The biggest pain naturally came from the real estate and financial sectors, both down 2% or more, after a number of ‘experts’ suggested potential rate increases could send property as much as 20% lower.

The healthcare sector, down just 0.1%, outperformed after ResMed (ASX: RMD) rallied 4.2% after delivering a strong than expected quarter.

The group reported a 20% increase in revenue as competitor products continued to be recalled and consumers turned to their high-quality products.

On the negative side were Vulcan Energy (ASX: VUL) which fell 16% despite delivering a response to J Capital’s recent short report.

It was all about Macquarie (ASX: MQG) though with the company delivering an 107% increase in profit for the half, reaching over $2 billion, and announcing a $1.5 billion capital raising.

The company is seeking to cash up amid an abundance of green energy and other opportunities that are becoming available.

Macquarie Capital was the key contributor having dominated corporate activity, whilst assets under management in their funds division gained 31%. The company doubled their dividend to $2.72 per share.

Across the week smaller companies were hardest hit with Codan (ASX: CDN) and PointsBet (ASX: PBH) down over 20% each and plumbing groups Reece (ASX: REH) and Reliance (ASX: RWC) both 10% higher.

The market was down 1.2% for the week but down just 0.1% for October.

US markets finish at records, Amazon, Apple miss expectations, bond yields fall

The two biggest US indices finished at records on Friday and for the month of October, with the Dow Jones and S&P 500 both gaining 0.2% and the Nasdaq adding 0.3% to finish the week.

Among the biggest contributors was an unexpected fall in the bond rate, the opposite of what has been occurring in Australia this week.

Over the week it was a similar story with earnings season powering the key indices higher, up 0.4, 1.3 and 2.7% respectively with the Nasdaq benefitting from strong reports by Alphabet and Microsoft.

Some 80% of companies have beaten analysts forecast, a record rate, which means earnings are catching up to what many considered an overvalued market.

This came despite two of the largest companies in the world missing expectations on Friday, with Amazon (NYSE: AMZN) and Apple (NYSE: AAPL) both falling around 2%.

In Amazon’s case it was the growing threat of supply chain issues, despite the company controlling most of its network, and weaker earnings result due to labour shortages and rising costs across their network.

In Apple’s case, the short-term semiconductor shortage appears to be biting, after the company delivered a rare revenue miss hitting US$83 billion as lockdowns ended.

Across the week the indices added 4, 5 and 6% respectively, the best October in 6 years.

Telstra’s unique deal, October selloff averted, rate calls grow

They say you learn something new every week, and this week was no different.

On Monday the market was informed that Telstra (ASX: TLS) would be buying Digicel, the dominant telecommunications provider for less than $300 million.

The over $1.7 billion odd in funding came directly from the Australian Government.

This is clearly a great deal of shareholders, but it reflects an unexpected pivot by the Government as they seek to combat the expansion and economic power of China.

The days of public private partnerships of this kind seemed over and when our competitors take similar action tend to be seen in a negative light.

October has historically been the worst month for sharemarkets, with most major sell offs coming before Halloween.

Apart from a bump to finish the month, it seems the curse has been averted, which once again reflects the importance of investing on merit, rather than headlines.

Sticking with headlines, the bond bears are back out in force, with the RBA non-action on Friday seeing the two-year bond yield jump significantly in just a few hours of trade.

The parade of economists forecasting rate hikes well before 2024 continue to grow and bet against the central bank, this is of course the same cohort who predicted Armageddon just 18 months ago.

Whilst an interesting move in bond markets no doubt, more sustained trends are likely warranted before taking action.