Which ASX sectors will succumb to inflation?

“Cost of living concerns and fears of a recession are growing, but Australian equity investors shouldn’t panic. Many Australian listed firms have negligible exposure to, or benefit from, rising inflation and interest rates.” That’s the advice from research house Morningstar to help calm investors from becoming too overwhelmed.

According to Morningstar, an Australian recession is possible but highly unlikely. It thinks the Australian economy is “in great shape,” with low unemployment and high real GDP recorded in the March 2022 quarter. To add to it, the research house expects the normalisation of global supply chains to lower inflationary pressures.

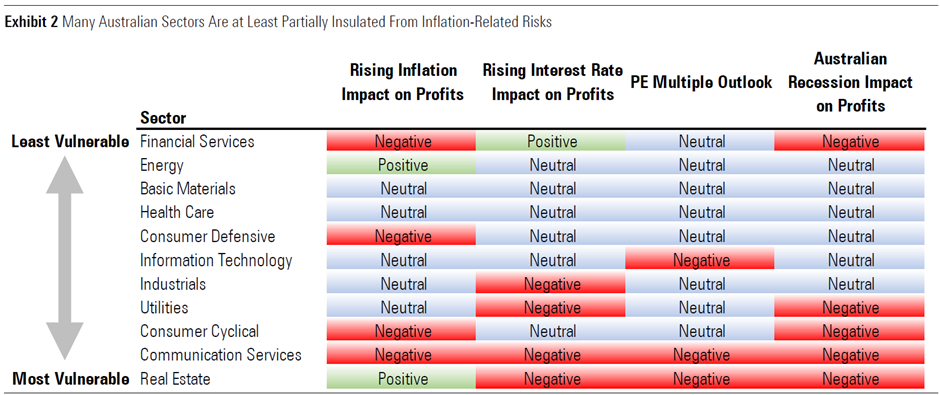

Morningstar goes on to pick several sectors that are well-insulated from risks. The firm expects essential services, such as healthcare, to be insulated from rising inflation, rising interest rates, contracting PE ratios, or an Australian recession.

Financial services companies, such as the big banks, usually benefit from rising rates through higher net interest margins. Insurance companies also benefit via higher interest income on investment portfolios. Energy and Materials should experience a neutral to positive impact, as commodities maintain their value in the face of rising inflation. The other reason is that commodity prices are elevated and are a good source of revenue.

Morningstar regards companies in the Healthcare sector as safe because they are essential services, where rising input costs can be passed onto customers with having a material impact on demand. Consumer defensives, such as food producers Bega Cheese, Costa Group and Inghams, will have a harder time passing on costs, but Morningstar doesn’t expect profits to be affected by rising rates.

Information Technology companies are relatively well-protected because they can pass-on costs to the customer. But the problem with tech stocks is PE compression. When interest rates were falling, tech stocks experienced PE expansion due to faith in the nature of cash flows being expected sometime in the future. Many of these stocks have been de-rated as a result of rising rates.

Rising interest rates for industrials and utilities companies are likely to be negative for sector profits due to the relatively high gearing of the firms in these two sectors, says Morningstar, but it does expect a neutral impact from P/E ratio compression.

Consumer-cyclical companies are affected negatively by rising interest rates. Higher inflation causes a cost of living squeeze in the short term, which can dampen discretionary spending. In the same way, communication services companies are directly impacted by rising rates. Morningstar says, “traditional media stocks are vulnerable to inflation via rising employee costs and the potential for falling advertising income should the economy cool.”

And finally, real estate investment trusts are particularly vulnerable to inflation-related risks. A recession is likely to cause a property downturn which can affect demand for retail, industrial and office-linked real estate.

To conclude, Morningstar says, “It’s important to remember that for inflation to be maintained, and prices to continue rising at the same rate, the drivers of inflation need to continue to change at the same rate.” To highlight this, for inflation to be maintained, energy prices need to continue rising at recent rates, which the firm considers highly unlikely. As the war in Ukraine starts to subside, energy prices should stabilise and inflation fall. Investors should note that inflation arguably has little impact on equities over the longer term, because equities may pass-through inflationary effects.