Western Asset Global Fund rating upgraded

The classic way of thinking has been to ditch bond funds as interest rates rise. Why? Because as rates rise, bond prices have an inverse relationship, and drop in value as newer bonds with higher yields become more attractive. Sounds about right?

An often-ignored impact is that over the longer run, rising interest rates actually increase a bond portfolio’s overall yield. This is because money from maturing bonds can be reinvested into new bonds with higher yields.

With that in mind, this week Zenith Investment Partners has upgraded the Western Asset Global Bond Fund to ‘Highly Recommended’. Western Asset is a global active fixed-income manager, and is part of the Franklin Templeton group. It was the only fund upgrade within the international fixed interest sector during the review period. Morningstar also followed suit, with an upgrade to the same fund, from Bronze to Silver.

Both research houses have highlighted the “strength and stability” of Western Asset’s team, its consistency of process and proven track record over the long term. Zenith says, “Western Asset’s investment philosophy is premised on long-term fundamental value investing with a focus on capturing multiple return sources. It has consistently applied the same investment philosophy over multiple decades with proven success. The fund has a range of excess return sources which can be opportunistically deployed, depending on the prevailing environment.”

Morningstar says, “The process here is simple but effective. The team aims to identify mispricings within regions, sectors, and securities, allocating risk to areas in which it has conviction, while ensuring diversification to damp volatility across market environments.”

Investors should note, this bond fund is an actively managed global bond fund that can chop and change its bond positions to add value through country and currency allocation, sector rotation, duration and yield curve management. In certain situations, the bond fund can allocate to high-yield credit and emerging market debt securities.

Matthew Harrison, managing director of Franklin Templeton Australia, says: “These new ratings showcase the ongoing strength of Western Asset’s investment team and its well-structured process. The foundation of Western Asset’s process is its Global Investment Strategy Committee, which provides centralised views on key decisions, such as duration, yield curve, country selection and currency positioning. In addition, specialist sector teams use their best ideas to populate targeted exposures with security selections.”

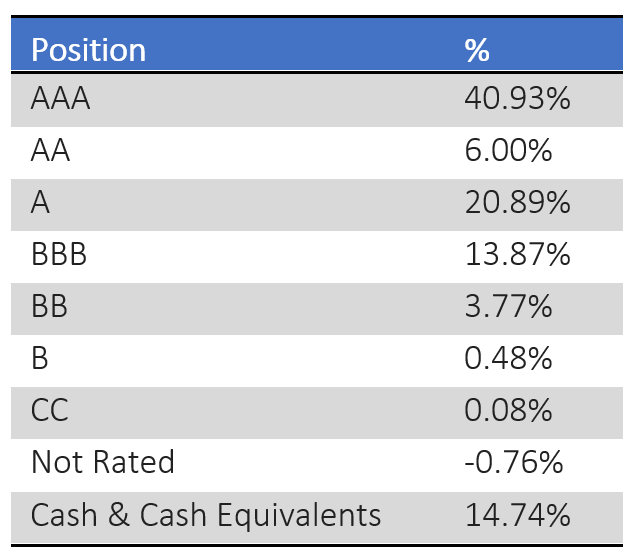

Currently the portfolio is a little over half invested in US fixed interest securities, with a big chunk of that in high-quality +AAA Government securities.

The average duration of the portfolio is seven years, with a cash flow yield of 2.21 per cent at an average credit quality of AA- over about 424 positions. The fund is well-diversified and constructed with a longer-dated duration profile, giving it the ability to withstand a rate rising environment.

Given the active structure of this bond fund, coupons and matured bonds are regularly reinvested; albeit at a higher interest rate in this environment. In a rising rate environment, sure, there will be an initial price decline. But over the medium to longer term, it’s better for a bond portfolio’s total return to be re-investing at the higher interest rates. According to Western Asset Management, the long duration applied to this portfolio means that, if the period of rising interest rates is meaningfully shorter, “the reinvestment of coupons and maturing bonds in the portfolio will likely result in higher total returns for a long-term investor.” Rising interest rates will represent a challenging period across the investment landscape for many advisers and clients. But highly skilled active fixed income managers such as Western Asset have a proven track record of enhancing investor returns, and have the ability to change duration in the face of rising rates. And that’s why this fund stands out from the rest.