Value rally slows despite ‘perfect’ conditions

On the whole, value funds underperformed growth despite some volatility in October. Global equities managed to resume their upward trajectory in October and remained in positive territory year to date.

Key sources of positive return came from managed funds which selected stocks in the US, were able to take advantage of short position in China, or held stocks selected in Australia. The Googles, Amazons and Teslas of the world, that value investors already regard as super-pricey pre-COVID, are even more pricey now. Yet they continue to deliver some of the best short-term returns in equity markets.

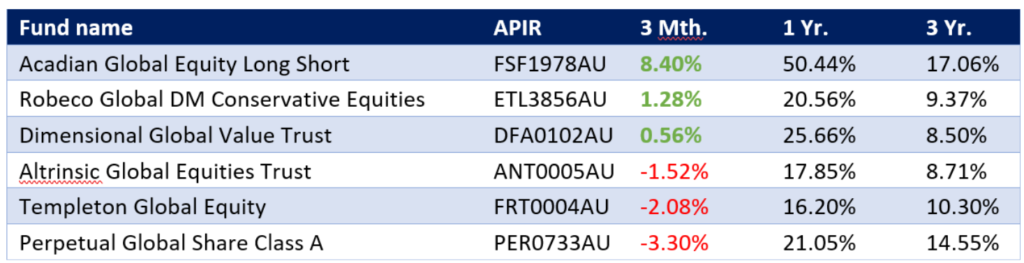

The leading value fund was the Acadian Global Equity Long Short fund which was able to generate 8.40% over the last three months. The fund did extremely well by holding key US stocks such as: Apple, Microsoft Corp, Alphabet, Facebook and Berkshire Hathaway.

The gap in quarterly performance was evident with the next fund managing to return only +1.28%, the Robeco Global DM Conservative Equities fund. In third spot was Dimensional’s Global Value Trust which posted a +0.56% return. The reason for the large disparity is because most value funds did not hold the top index names such as Tesla, and NVIDIA which rose 44% and 23%.

Funds that had little to no exposure in the top US tech companies, suffered larger falls than those that did. The worst performing fund was the Perpetual Global Share fund which returned -3.30% for the quarter.

According to the fund commentary, the “largest overweight positions include Opendoor Technologies Inc, Siemens AG, and GXO Logistics Inc. Conversely, the Fund’s largest underweight positions include Apple Inc. (not held), Microsoft Corporation, and Alphabet Inc. Class A (not held).”

As the world gears up to the eventual reopening of international borders and winding back of Government stimulus measures used to support the economic recovery, rising inflationary pressures are the next major hurdle. Inflation remains a obstacle to growth especially if transitory inflation turns into something more permanent.

Perpetual says, “Although caution is in order, as these risks wane and we continue to see good economic growth, we would expect markets to perform well with greater participation in that upward performance. This will not only bode well for active managers, but we would expect that value stocks will provide strength in this kind of market environment as well.”