Value investing’s true believers reap the greatest benefits: Pzena

A tendency for investors to compromise into a “value-light” investment style instead of embracing a true value approach sacrifices “core tenets” of the philosophy and precludes them from accessing its full rewards according to commentary from Pzena Investment Management.

The New-York based investment firm, which manages US$56.4 billion ($87.4 billion), has emerged as one the world’s leading deep-value equity investment groups since its foundation in 1996. In a recent commentary note Pzena highlighted the cohort of serious investors that may have belief in value investing, but lack the requisite conviction to fully embrace the philosophy.

Mostly, the note explains, this occurs due to a misconception that value stocks are inherently riskier than large-cap growth stocks like the ubiquitous ‘Magnificent 7’ tech companies (Microsoft, Amazon, Meta, Apple, Google parent Alphabet, Nvidia, and Tesla).

The act of buying unloved companies can also be uncomfortable, Pzena says, and investors are often keen to avoid the “pain and discomfort” of purchasing out-of-favour stocks.

To ameliorate these factors while still capturing some of the upside benefits of buying stocks that carry value traits, some investors have pursued what Pzena calls “value-light” strategies that avoid the most controversial stocks. By staying away from these companies, however, investors are only purchasing stocks “beyond the cheapest quintile”, and sacrificing too big a slice of the rewards that come with true value investing. “Value investing works because most investors shy away from the near-term uncertainty and potential pain of holding out-of-favor stocks,” the note explains.

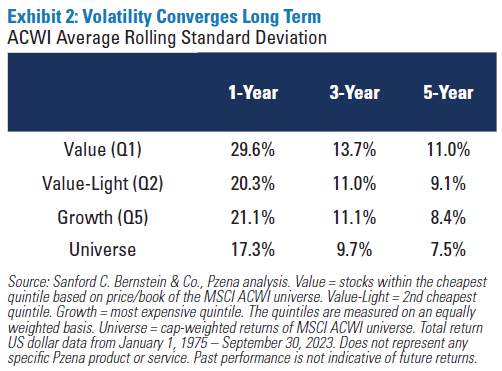

That uncertainty and potential for pain is intrinsically linked to the perception of, and potential for, the increased volatility that comes with value investing. Data shows, however, that this volatility is quite comparable to other investment styles when the position is held for at least 5 years.

“Equities in general are a relatively volatile asset class, particularly in the near term,” the note explains. “While value stocks can be more volatile in shorter periods, we would not recommend any style of equity investing over less than a five-year time horizon, as the volatility is too high to justify the potential return. However, over longer periods, the incremental volatility of value stocks is less material versus other styles and the market (Exhibit 2).”

Compromising on a true value philosophy has been exacerbated by the indexation of value stocks, which Pzena says often involves a “flawed approach”.

“The vagaries of index formation have led to value indices that are filled with stocks that we would not consider bargains,” Pzena explains. “Since value and growth indices match cumulative market caps, expensive mega-caps have caused many growth stocks to fall into the value index… This has caused investors who chose to index their value allocation, presumably to lower volatility, to significantly underperform.”

Much like value-light investment approaches, relying on an index to track true value stocks is likely to result in the omission of the cheapest quintile companies. For investors to really generate significant long-term outperformance, commitment to true value is key.