The golden rule of government bond investing

BCA’s Ryan Swift spoke at the Inside Network’s Income and Defensive Assets Symposium, via video feed, just after the Fed raised interest rates by 75bps. As one can expect, there was a lot of volatility in US Treasuries during this period, making it a challenging time for analysts because of all the outside noise and overwhelming opinions.

Swift explained that “nominal Government bond yields should be split into two components – the first being expectations for what the overnight rate will average over the life of the bond and second some term premium to compensate for the risks of those expectations.” Although it seems natural to focus on the rate expectations component, the term premium is equally as important albeit difficult to estimate let alone forecast. Mr Swift’s advice is to set it aside for the time being.

“It’s also difficult to forecast what the policy rate is going to be for the next 10 years for a 10-year Treasury yield. To do this effectively, we forecast the yield for the next 12 months and then apply a two-step process. First calculate the expected 12 month change in the policy rate for this current price in the market and second, decide based on our current economic views, whether that rate is too high or too low,” says Mr Swift.

The theory is: If its too low, short bonds versus cash. If its too high, buy bonds versus cash.

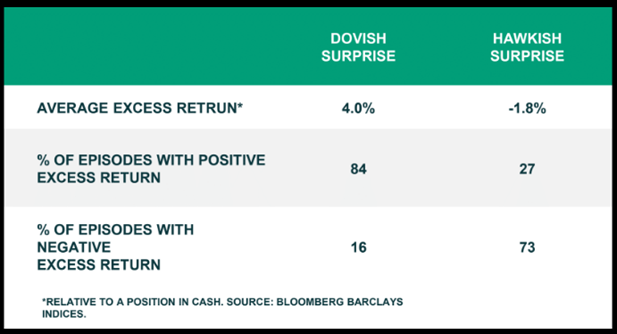

It’s a fairly simple rule but it has a solid track record, and it works. Looking at the chart above, when the Fed surprises to the hawkish side, the market falls in three-quarters of the time. It mostly coincides with negative Treasury returns versus cash and vice versa.

Using the table, dovish Fed surprises, coincide with positive 12-month Treasury returns vs cash roughly 84 percent of the time.

Swift forecasts that rates will be at around 4 percent a year from now. He says, “As of today, the market is priced for 250bps in rate increases for the next 12 months. A year from now, the Fed funds rate is expected to peak at around 4.00 percent. That equates to roughly two more 50bps rate hikes and then downshifting to 25bps per hike per month thereafter.”

BCA estimates that underlying US inflation is right around 4 percent, year on year quarter CPI will naturally slow to 4 percent without the Fed needing to tighten the economy into recession. Following that a recession is ‘probably’ required to bring the rate of inflation down from 4 percent to the Fed’s 2 percent target.

So how does this play out, policy wise?

Inflation is likely to start moving down to 4 percent in the short term, which makes the current 12-month rate expectations seem reasonable in that context. The Fed will raise a few times, before downshifting the pace of hikes when it is clear that inflation is heading lower. However further out, the market may be underpricing the extent of rate increases that will eventually be required to move inflation back to the 2 percent target.

So, what’s BCA’s strategy today?

“We stay neutral on Treasuries versus cash right now. But if our base case plays out, we can see ourselves becoming more bearish on Treasuries once inflation falls closer to our underlying 4 percent trend. At that point the market may not be pricing a sufficiently aggressive 12-month tightening now,” says Swift.