The future of value

Value has suffered a long period of being out of favour. Having thrived for nearly a century, value has lagged since the global financial crisis, suffering the deepest and longest drawdown in its history.

But times change. That underperformance has left value stocks trading at exceptionally attractive prices, even after a good year in 2022. In a still-expensive market that has grown ever-more concentrated in richly-priced US, mega-cap, and tech shares, value stocks offer both a refuge and a source of opportunity.

Value stocks are still cheap

Orbis has looked at a dozen different measures, which combined give a stronger signal across the wide range of periods, regions, and types of companies in world stock markets.

But we look at companies like business owners, and as business owners, the single most important metric is free cash flow. If you own a business outright, free cash flow is your money – to reinvest in profitable projects, buy a competitor, pay down debt, pay out dividends, or buy out your partners. It is the single measure that best captures the true worth of a business. And if we look at the free cash flow valuations of the most neglected companies, we see reasons for excitement.

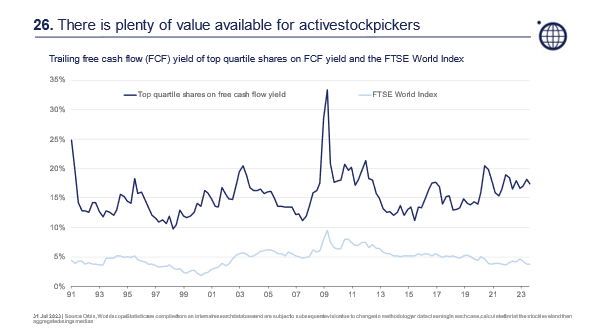

That is not true for the market as a whole. On a price-to-free-cash-flow basis, we see the same pattern as for the other measures. In the years since the global financial crisis, markets in aggregate have got more expensive, and are currently near their richest levels since the original tech bubble in 2000.

The pullback of 2022 barely made a dent. The typical global stock trades at over 25 times free cash flow. If you owned it outright, it would take 25 years of current cash flow to get your money back. Investors are hoping for rapid growth. In fact, the market’s valuation is so stretched that the multiple of the neglected shares is barely discernible.

We can change that by inverting the ratio, and looking at free cash flow yield, or free cash flow divided by price. This reveals a more promising picture.

While the overall market is expensive, the most neglected quarter of shares offer free cash flow yields of 17 per cent. If you bought one of these businesses outright, and they never grew at all, you would reap a return of 17 per cent per year. You would get your entire investment back in about six years – and still own a profitable business at the end of that period.

This excites us, as it suggests a wider opportunity. Cash flow is underappreciated.

As importantly, we don’t believe we’re sacrificing anything in the way of business prospects to get that discount. Our analysts have uncovered shares in a wide range of industries that we believe are much better positioned than last decade’s winners for the environment ahead.

Energy shares remain cheap, particularly those focused on natural gas, which should urgently supplant coal in places where renewables are not yet competitive. Dominant semiconductor manufacturers underpin the success of the US tech giants, yet are available at a fraction of the price. Neglected businesses making electric grid infrastructure are essential to enable the energy transition, but were roundly ignored as investors focused on more obvious plays. Gold and inflation-linked bonds provide protection against stagflation. Defense contractors are already seeing their orders multiply as the West refocuses on security. And cheap, well-capitalised banks in Japan and Korea should thrive if rising global inflation continues to lift interest rates.