Term deposits set to reach peak attraction as hiking cycle crests

With official interest rates close to peaking, savers may want to consider locking into a term deposit now before they fall in the months ahead. But it’s essential to shop around, analysts warn, as smaller banks are rewarding savers with more attractive interest rates than the big four.

The Reserve Bank of Australia (RBA) increased the cash rate for the 10th consecutive month in March to 3.6 per cent, the highest since May 2012, before pausing in April. The good news is that term deposit rates have kept on climbing; the average interest rate on banks’ one-year and three-year term deposits was 3.2 per cent per annum in March, both up from just 0.25 per cent a year earlier.

But some experts doubt that interest rates will keep rising given the pace of consumer price inflation is slowing in Australia.

“Money markets are starting to factor in interest rate reductions ahead, and term deposit rates will lead the way down,” said Canstar group executive Steve Mickenbecker. “Some of the better deals are likely to shrink in the coming months and might not be available moving forward.”

Graham Cooke, head of consumer research at Finder, reported the organisation’s panel of economists is predicting one more rate rise. “It is, however, true that we are near the probable cash rate peak, so locking in a solid term deposit rate for one or two years is worth looking at,” he said.

However, Sally Tindall (pictured), director of research at RateCity, said that while the peak of the official cash rate could be near, term deposit rates could still climb in the next couple of months.

“The RBA is still mulling over at least one more cash rate hike in coming months, which could pull term deposit rates slightly higher in the short term,” she said. “Competition could also see some term deposit rates inch higher as banks look for affordable options to fund their home loans.”

Smaller banks paying more

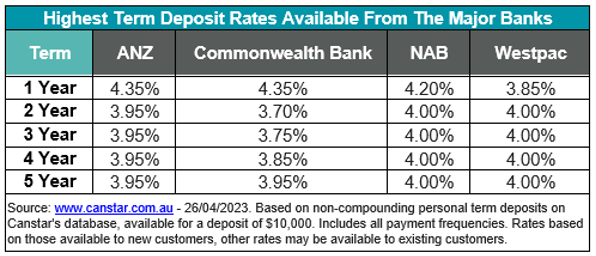

According to Cooke, the best term deposit rates on the market right now are offered by the smaller lenders. “For example, the Bank of Sydney and Gateway Bank are currently offering 4.55 per cent and 4.5 per cent, respectively, on a six-month term deposit, significantly higher than the 3.55 per cent offered by [National Australia Bank] – the best available rate from the big four,” he said.

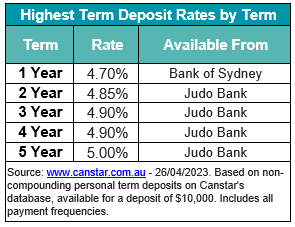

“The Bank of Sydney and Gateway Bank are both currently offering 4.7 per cent on one-year terms, with AMP slightly behind at 4.65 per cent. For two-year deposits, Judo Bank is offering 4.85 per cent, the best rate in Finder’s database, with G&C Mutual next best at 4.65 per cent per annum” (see chart).

The big banks typically can pay less for term deposits because of the legacy of their market reach, brand strength and the perception of financial strength, according to Mickenbecker (see chart).

“The gap between the best term deposit rates on offer in the market and the rates of the big banks are very wide, peaking at above 1 percent for the five-year term,” he said. “Judo Bank, one of the newer entrants, has the leading rate for terms of two to five years, and Bank of Sydney, a customer-owned bank, for the 12-month term.

“The gap is too huge for savers to exclude smaller banks from their consideration, and with the government guarantee for deposits up to $250,000, the barrier of perceived security has been eliminated.”

Or, as Tindall put it: “Just because a bank has a funny name, doesn’t mean your money isn’t safe. If you’ve got your savings in an authorised deposit-taking institution, or ADI, the government has your back in event of a collapse.”

Consider laddered deposits

With the prospect of a peak in interest rates, Mickenbecker said, it can make sense to set up a term deposit ladder – a series of term deposits that mature at progressively later dates – if investors want to keep some cash available rather than committing to a single, larger term deposit for a longer maturity.

“There is always risk that interest rates might move up again unexpectedly and savers will be locked into sub-market returns,” he said. “An approach to counter being locked into this position for a long term is to place funds into varying terms with rolling maturities.”

Once each term deposit matures, the investor can take the money out or reinvest the term deposit at potentially more attractive interest rates.