-

Sort By

-

Newest

-

Newest

-

Oldest

It’s been a while since “value investing” made sense: the style has suffered a dreadful stretch of performance since the 2008 financial crisis. The ‘Warren Buffett’ mantra of buying low (cheap) and selling high has seen value-oriented managers underperform the market year after year. But that’s not to say value investing is dead, it’s just…

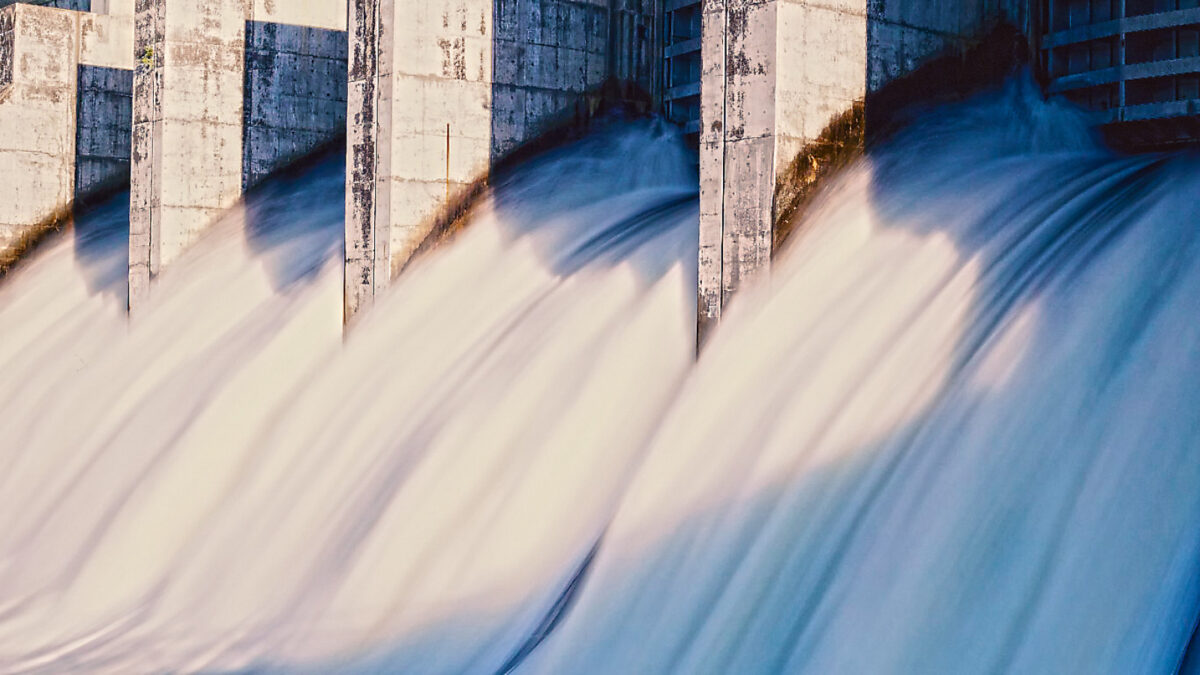

I want to discuss a water utility, which may sound as dull as dishwater – but we global real assets investors have never been averse to safe, predictable, and yes, boring companies. The type of company that pays a dividend that is as dependable as a birthday cheque from Grandma. We have specialist in-house capability…

Shareholders of Link Administration Holdings (LNK), which provides services to the funds management and superannuation sectors and runs the share registry for many of the S&P/ASX 200 companies, have become the latest group to experience the tailwind that a takeover offer can suddenly blow on to a becalmed share price. Last weekend, a consortium of…

ASX struggles higher, rates on hold, giant gold merger, US stocks fall The ASX 200 (ASX:XJO) struggled to a 0.3% gain on Tuesday, the energy, +2.3%, and materials sector, +1.1%, the key contributors. The biggest news was the ‘merger of equals’ between Australian gold miners Saracen Minerals (ASX:SAR) and Northern Star Mining (ASX:NST). The merger…

The S&P 500 Index reached a historic high on February 19th of this year, only to break that record less than six months later. On its face this sounds reasonable, however when considering the unprecedented nature of the events that transpired in-between, this is downright shocking. Over this six-month period the S&P 500 realised its…

While the active versus passive debate rolls on, and on, across the investment world, some active managers have gone to the ‘dark side’, at least partially, by adding more quantitative inputs for new strategies, such as thematic investing. The concept of ‘thematic’ investing, which describes the strategy of identifying sectors of the economy expected to…

Financials, miners hit as the second wave hits Europe, RBA guidance, strong open ahead The ASX 200 (ASX:XJO) fell to a three month low on Tuesday, down 0.7%. The sustained sell off has been driven by signs of a second wave engulfing Europe and the potential for another round of economic restrictions. Materials (-0.2%) was…

ASX 200 ekes out a gain, tech profit taking continues, Trump bans WeChat Global markets continued their negative trend on Friday, the ASX 200 (ASX:XJO) falling 0.3%, but managing to finish the week up a solitary 5 points; outperforming most global markets. It was a similar story in the US, with both the Nasdaq and…

ASX 200 ekes out a gain, tech profit taking continues, Trump bans WeChat Global markets continued their negative trend on Friday, the ASX 200 (ASX:XJO) falling 0.3%, but managing to finish the week up a solitary 5 points; outperforming most global markets. It was a similar story in the US, with both the Nasdaq and…

Vaccine trial restart boosts markets, ASX strength to continue, COVID-19 impacting Macquarie Group A positive lead from Wall Street and news that AstraZeneca plc (NYSE:AZN) had resumed their vaccine trial sent the ASX 200 (ASX:XJO) 0.7% higher on Monday. Positive news on the vaccine front support the energy and industrial sectors amid hope of a…