-

Sort By

-

Newest

-

Newest

-

Oldest

Brokerages raising their target price on Nvidia shares this month have pushed the median view to US$500, and analysts say that may be conservative. After an impressive earnings report, hedge funds and others are piling into the chip maker even as high bond yields threaten tech stocks.

This year’s recalibration of bond prices now reflects the higher interest rate environment, making future returns attractive again for fixed income in 2023 as deteriorating fundamentals threaten other asset classes.

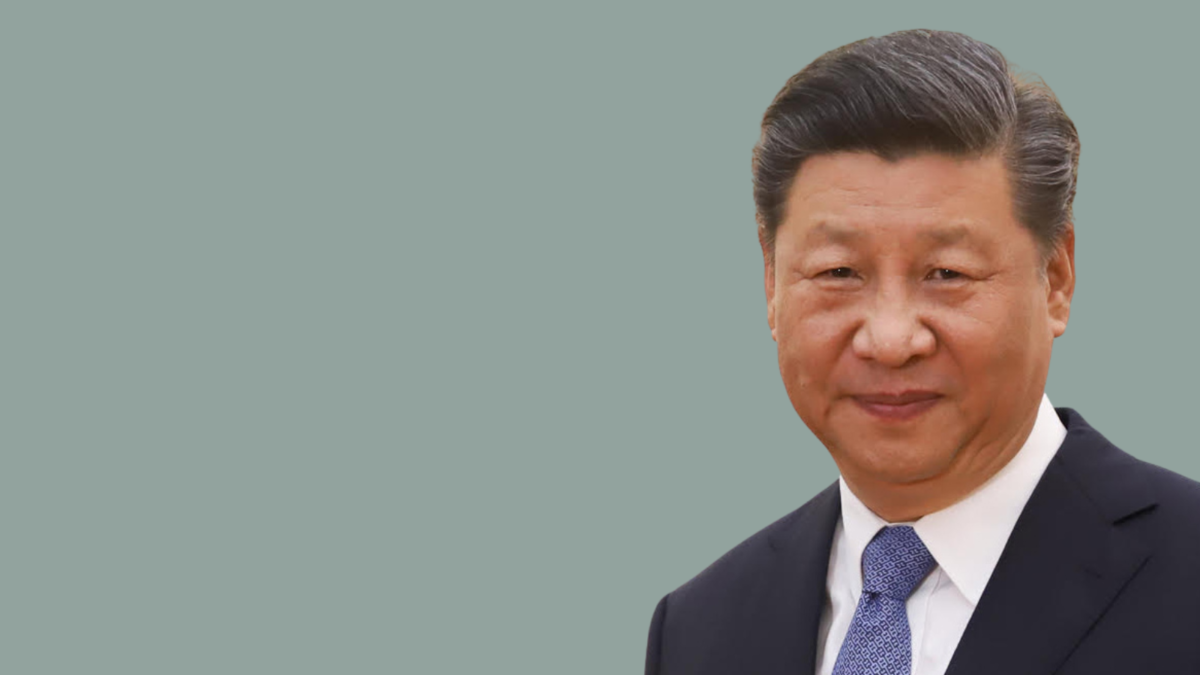

The Chinese government’s announcement of less onerous isolation guidelines prompted markets to rally in anticipating of a move away from zero-COVID policies. While significant short-term challenges remain, market sources say renewed growth may be in sight, representing future opportunity.

According to specialist asset ratings firm, Evergreen Ratings, run by Angela Ashton, who also operates the growing investment consultancy business, Evergreen Consulting, private debt markets continue to offer “one of the most attractive risk-adjusted return profiles” in the market. Commenting after the release of the latest research report, in which Global Credit Investments, or GCI’s,…

Due to its open-source ethos, bitcoin has travelled an unconventional growth path. For starters, no-one seems to know who invented it (rumoured to be a Sydneysider, possible pseudonym Satoshi Nakamoto) but what we know is when it will all end – in 104 years when the last bitcoin will be mined. Putting its start behind…