-

Sort By

-

Newest

-

Newest

-

Oldest

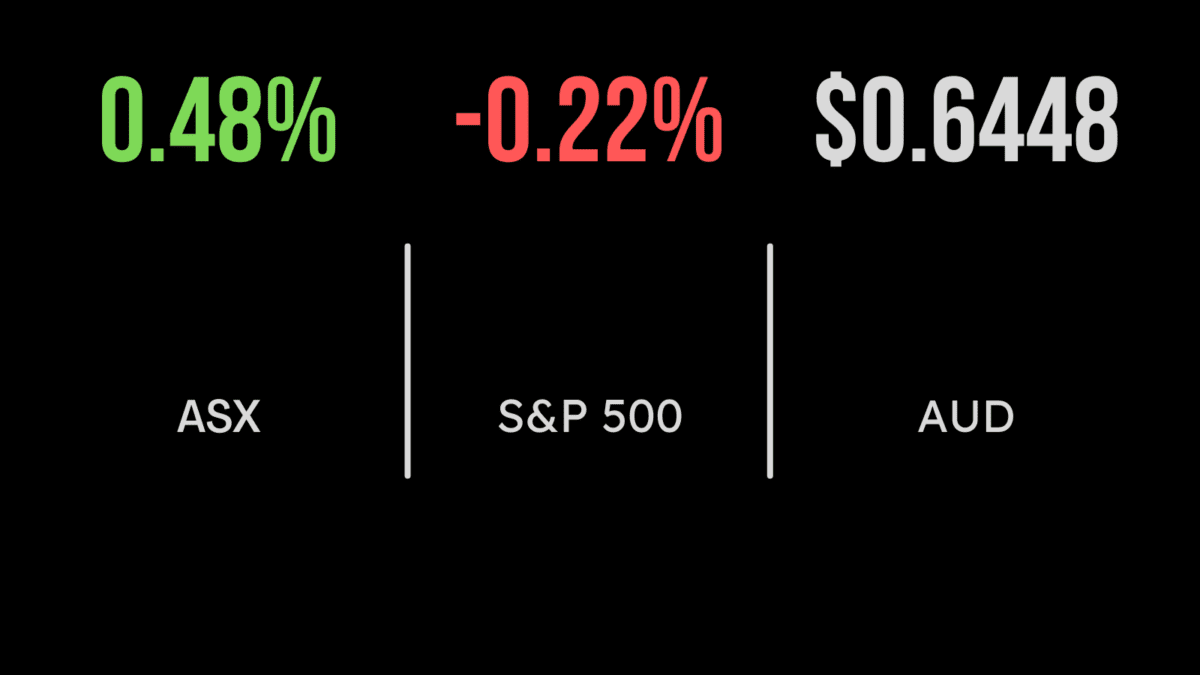

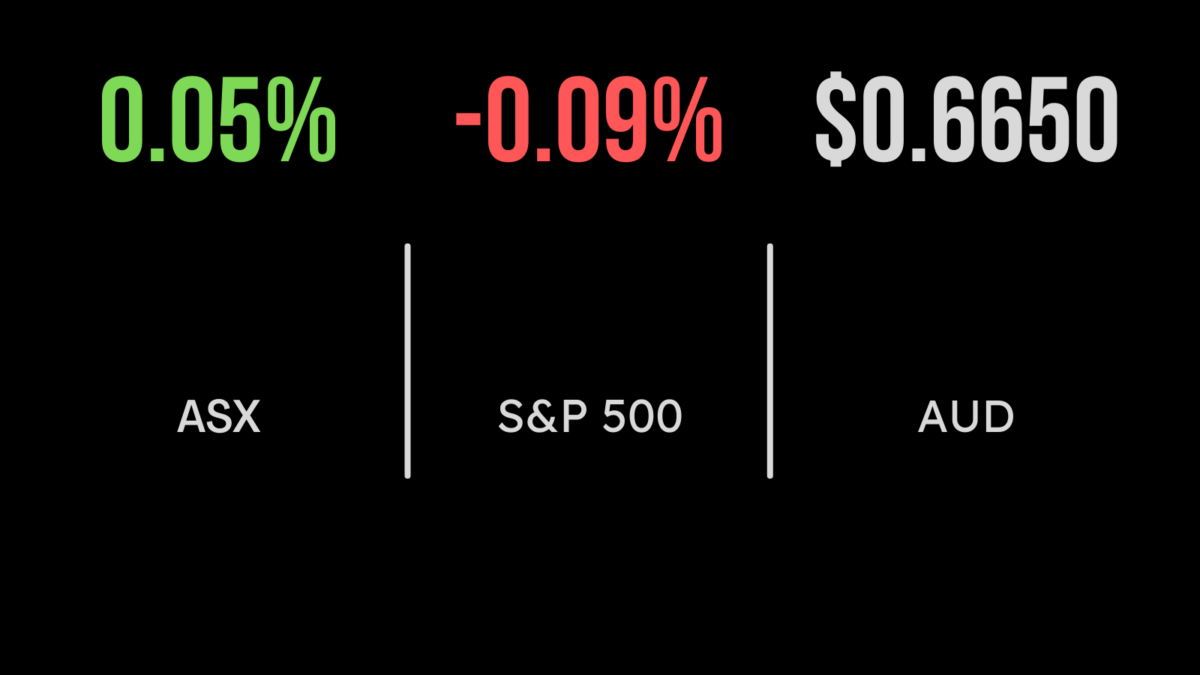

The S&P/ASX 200 Index rose by 0.5 per cent, driven by the increase in iron ore price. This surge propelled Rio Tinto up by 1.7 per cent, while Fortescue advanced by 0.4 per cent, and BHP increased by 1.5 per cent. The materials sector led gains, adding 1 per cent, followed closely by the technology…

It was a comprehensive setback for the Australian sharemarket on Tuesday, with all sectors ending the session in the red. The benchmark S&P/ASX 200 surrendered 81.5 points, or 1.1 per cent, to 7414.8, while the broader All Ordinaries was also down by 1.1 per cent, losing 83 points to 7,647. Softer commodity prices dragged energy,…

The S&P/ASX 200, surged by 0.7 per cent with 10 of its 11 sectors showing gains, the index stands merely 1.3 per cent below its peak in August 2021. Meanwhile, the broader All Ordinaries index also closed up by 0.6 per cent. Additionally, the Australian dollar climbed to a five-month high against the US dollar…

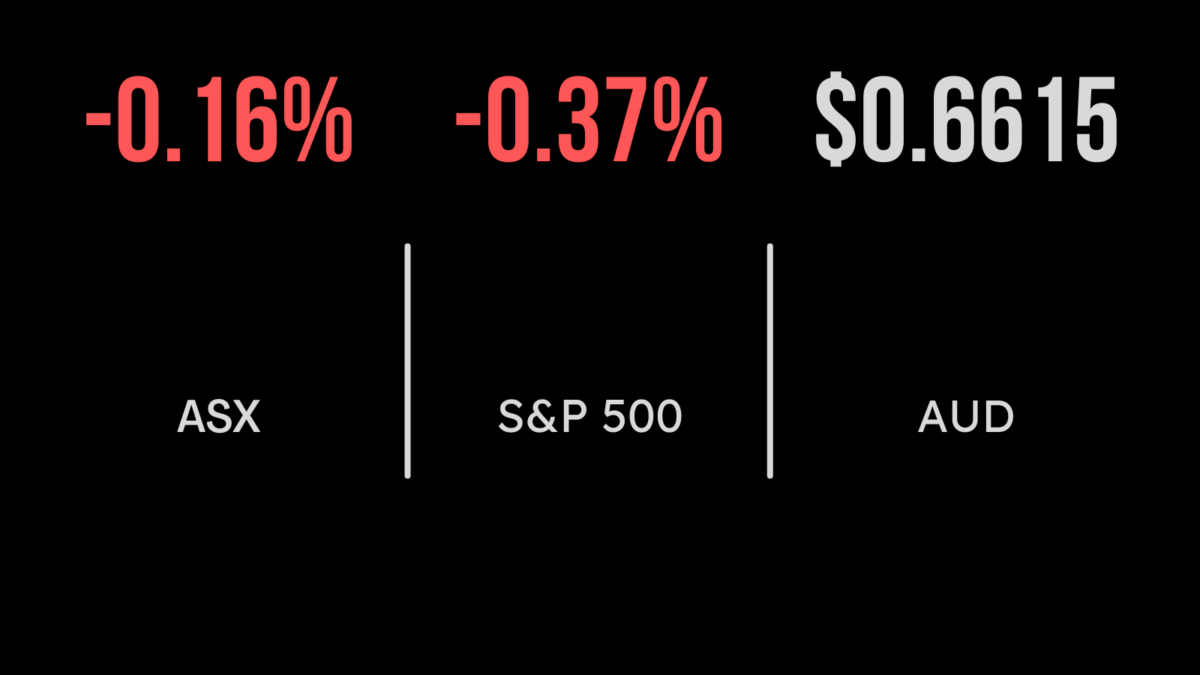

A rough finish to the week wasn’t enough to reverse a strong finish to November, with both the All Ordinaries and S&P/ASX200 (ASX:XJO) falling 0.2 per cent on Friday. The energy sector was a rare winner, adding 0.1 per cent, benefitting from a quick reversal of supply cuts agreed at the latest OPEC+ meeting. Both…

The S&P/ASX 200 concluded the day up 0.3 per cent, led by interest rate-sensitive real estate, technology, and consumer discretionary sectors, all closing over 1 per cent higher. This surge came after the Australian Bureau of Statistics reported a drop in annual inflation from 5.6 per cent in September to 4.9 per cent in October….

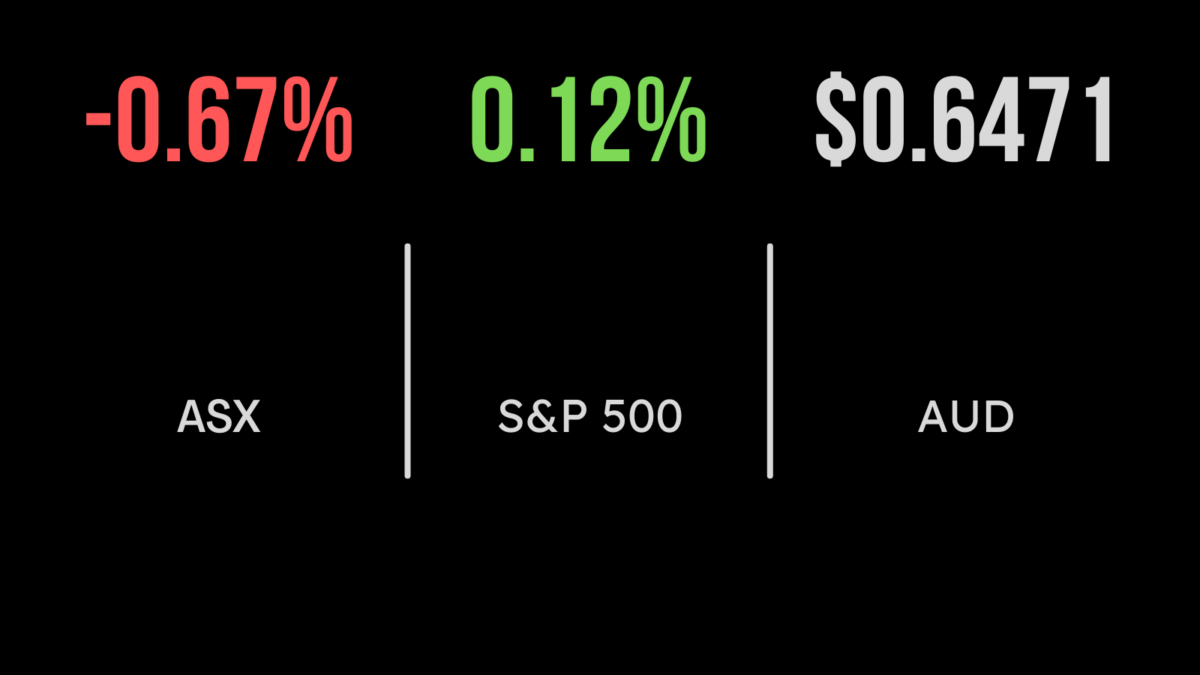

On Thursday, the S&P/ASX 200 index fell 0.7 per cent primarily driven by a sell-off in energy companies, with eight of the 11 sectors falling, overshadowing robust labour force statistics revealing the creation of 55,000 jobs within the Australian economy last month. Despite noteworthy data from the Australian Bureau of Statistics indicating job increases, including a revised…

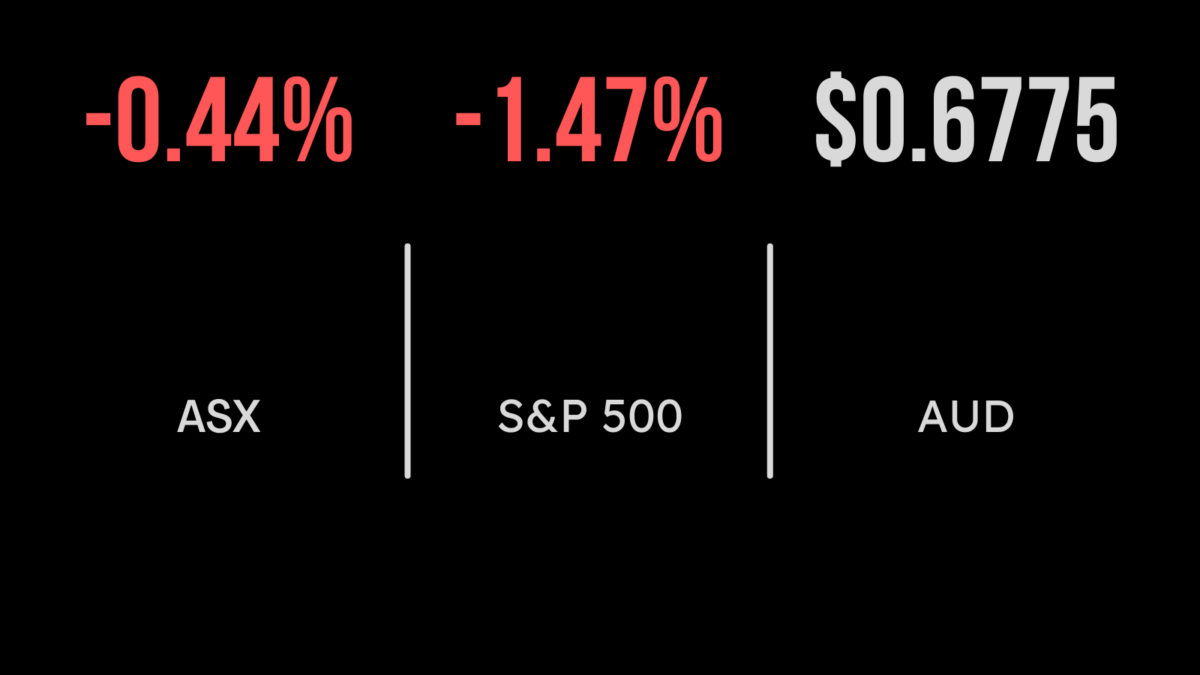

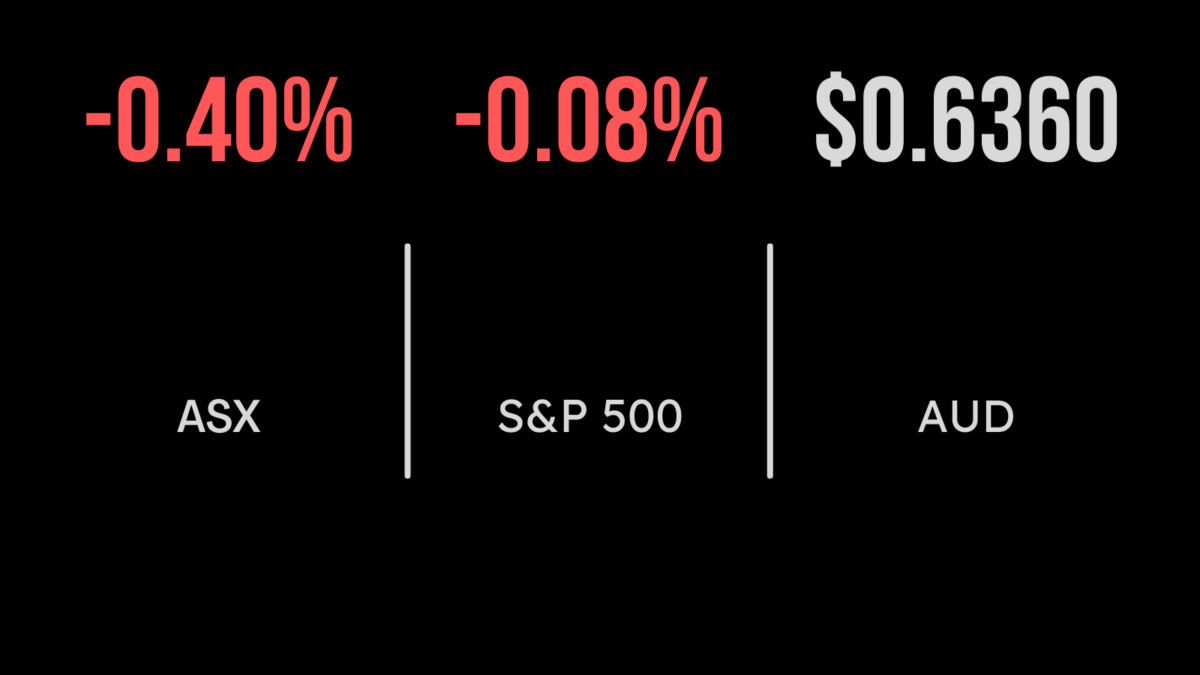

The S&P/ASX 200 index dropped by 0.4 per cent with ten out of eleven sectors falling. The energy sector mirrored the softer oil prices, experiencing a 0.9 per cent decline. Brent crude approached $US81 per barrel, having lost approximately 12 per cent in the last three weeks due to escalating concerns about global demand and the de-escalation of risk…

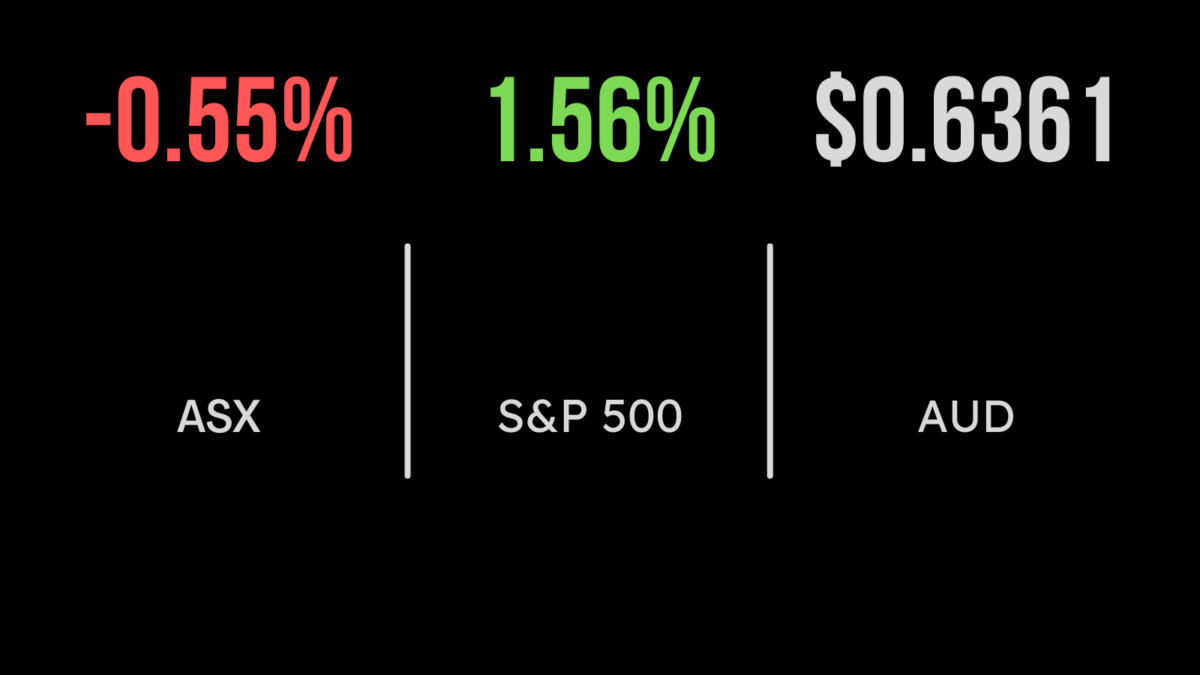

A sea of red was noted on Friday as with the ASX200 closing down -0.55 per cent, dragged by financials falling -0.9 per cent, impacted by the banking sector with Commonwealth Bank down 0.9 per cent, ANZ down 1.3 per cent, Westpac down 1.3 per cent, and NAB down 1.7 per cent. Energy also weighed on markets falling 1.5 per cent on Friday, and 4…

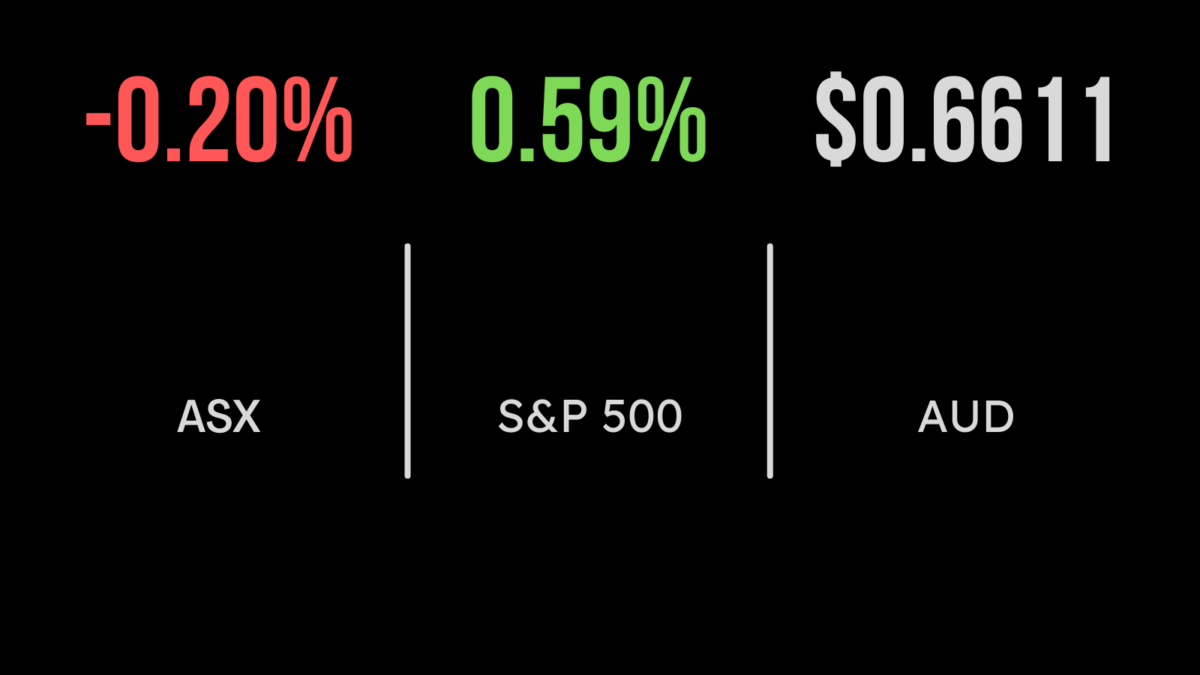

From Hero to Xero for tech star Australian shares rose for the second straight day, with healthcare leading the way, and netting out a tech slump. The benchmark S&P/ASX 200 index advanced 19.5 points, or 0.3 per cent, to 7014.9, while the broader All Ordinaries index rose 16.7 points, or 0.2 per cent, to 7,215….

The Australian share market built on a solid lead-in from Wall Street, with the tech sector leading the way, up 1.9 per cent on the back of enthusiasm emanating from the so-called “Magnificent Seven” US tech stocks. The benchmark S&P/ASX 200 added 18.3 points, or 0.3 per cent, to 6995.4, while the broader All Ordinaries…