Australian sharemarket slides across the board

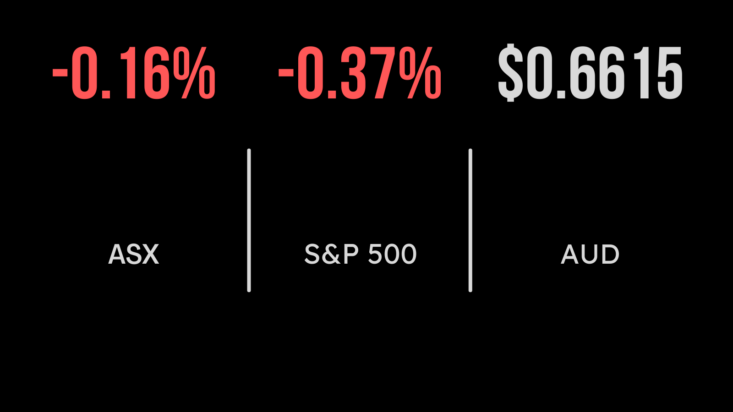

It was a comprehensive setback for the Australian sharemarket on Tuesday, with all sectors ending the session in the red. The benchmark S&P/ASX 200 surrendered 81.5 points, or 1.1 per cent, to 7414.8, while the broader All Ordinaries was also down by 1.1 per cent, losing 83 points to 7,647.

Softer commodity prices dragged energy, utilities and materials stocks lower, with iron ore a particular concern. BHP dropped 68 cents, or 1.4 per cent, to $46.50, Fortescue slid 59 cents, or 2.2 per cent, to $26.65, and Rio Tinto weakened $1.66, or 1.3 per cent, to $126.66. Rio Tinto shares came off despite the company’s iron ore division reporting its best export volumes in five years in 2023.

Similarly, weaker gas prices pressured the energy majors, with Woodside down 50 cents, or 1.6 per cent, to $31.13; Santos losing 14 cents, or 1.8 per cent, to $7.69; and Origin Energy down 20 cents, or 2.4 per cent, to $8.02.

Coal was a sea of red, with Whitehaven Coal down 9 cents, or 1.1 per cent, to $8.04; New Hope Corporation eased 7 cents, or 1.3 per cent, to $5.31; Coronado Global Resources weakened 5.5 cents, or 3.2 per cent, to $1.67; Stanmore Resources had 6 cents, or 1.5 per cent, deleted to $4.04; and Bowen Coking Coal lost 0.7 cents, or 7.2 per cent, to 9 cents.

The uranium boom did not carry into Tuesday trading. Boss Energy lost 4 cents, or 0.7 per cent, to $5.54; Namibia-based producer Paladin Energy eased 2 cents, or 1.5 per cent, to $1.275; and Canada-based explorer and project developer NexGen Energy retreated 12 cents, or 1 per cent, to $11.72. But Peninsula Energy managed a 1-cent gain, up 7.7 per cent to 14 cents.

Gold was mostly weaker, although Genesis Minerals gained 1 cent, or 0.6 per cent, to $1.65, and Newmont was up 13 cents, or 0.2 per cent, to $56.22. But Evolution Mining softened 13 cents, or 3.4 per cent, to $3.75; Bellevue Gold lost 3.5 cents, or 2.3 per cent, to $1.49; De Grey Mining eased 2.5 cents, or 2.1 per cent, to $1.19, Silver Lake Resources slipped 2.5 cents, or 2.1 per cent, to $1.16; Northern Star was down 25 cents, or 1.9 per cent, to $12.87; and Ramelius Resources gave up 3 cents, or 1.9 per cent, to $1.535.

The lithium sector was also under pressure, with producer Arcadium down 14 cents, or 1.7 per cent, to $8.26; but fellow producer Pilbara Minerals pushed 4 cents higher, up 1.1. per cent to $3.60. Project developer Liontown Resources weakened 4 cents, or 2.8 per cent, to $1.38.

Retail retreat

On the industrial side, jewellery retailer Lovisa was the benchmark’s worst performer, losing $1.25, or 5.2 per cent, to $22.77, after it was cut to a ‘neutral’ rating by analysts at UBS. Fellow retail star Super Retail Group retreated 44 cents, or 2.6 per cent, to $16.27 after jumping by a similar percentage on Monday, on the back of a stronger-than-expected trading update.

Consumer staples were also in struggletown, dragged lower by supermarket groups Coles and Woolworths, which are in the government’s sights in a cost-of-living review. Woolworths fell 55 cents, or 1.5 per cent, to $35.66 and Coles slipped 31 cents, or 2 per cent, to $15.48.

Among the big banks, Westpac lost 22 cents, or 1 per cent, to $23.07; National Australia Bank also drifted 22 cents, in its case 0.7 per cent, to $30.73; ANZ softened 21 cents, or 0.8 per cent, to $25.74; and Commonwealth Bank slid 66 cents, or 0.6 per cent, to $113.00.

Biotech heavyweight CSL gave up $4.48, or 1.6 per cent, to $284.69. Another strong performer was property group Charter Hall, which rose 25 cents, or 2.2 per cent, to $11.85.

Rates rethink in US

In the US overnight, markets fell, as bond yields ticked higher and Wall Street sifted through the latest batch of fourth-quarter earnings. The 30-stock Dow Jones Industrial Average declined 231.86 points, or 0.6 per cent, to close at 37,361.12; while the broader S&P 500 index slipped 17.85 points, or 0.4 per cent, to 4,765.98, and the tech-heavy Nasdaq Composite Index dropped 28.41 points, or 0.2 per cent, to 14,944.35.

The benchmark 10-year Treasury note pushed back above 4 per cent, climbing more than 11 basis points to 4.064 per cent after Federal Reserve Governor Christopher Waller indicated in a speech that the central bank may ease monetary policy slower than Wall Street might have anticipated.

Gold is trading US$25.88 lower, down 1.3 per cent to US$2,028.44 an ounce; the global benchmark Brent crude oil grade slid 24 cents, or 0.3 per cent, to US$77.91 a barrel; and US West Texas Intermediate oil lost 28 cents, or 0.4 per cent, to US$72.40 a barrel.

The Australian dollar is buying 65.82 US cents this morning, down from 66.12 US cents at the ASX close on Tuesday.