Home /

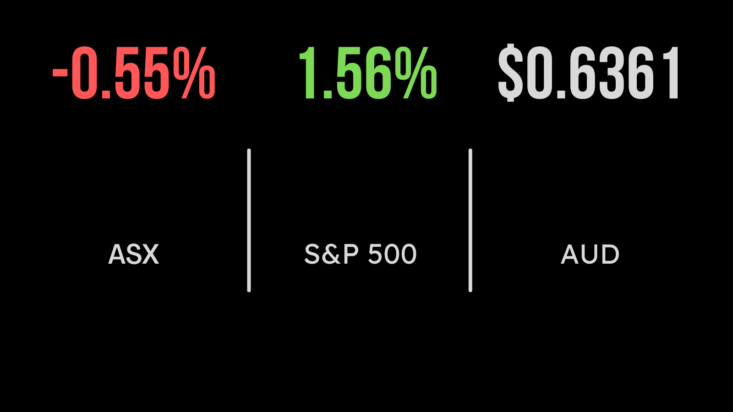

Daily Market Update / A sea of red across Australian Equities on Friday

A sea of red was noted on Friday as with the ASX200 closing down -0.55 per cent, dragged by financials falling -0.9 per cent, impacted by the banking sector with Commonwealth Bank down 0.9 per cent, ANZ down 1.3 per cent, Westpac down 1.3 per cent, and NAB down 1.7 per cent. Energy also weighed on markets falling 1.5 per cent on Friday, and 4 per cent for the week, aligning with the drop in oil prices due to signs of oversupply and reduced concerns regarding the Israel-Hamas conflict. Oil is on track for its third consecutive weekly decline due to mounting concerns about demand and the gradual reduction of the war-risk premium. Trading near $76 per barrel on Friday, West Texas Intermediate (WTI) has experienced a roughly 6 per cent drop for the week. The decline was exacerbated by Saudi Arabia attributing the fall to speculators, along with pessimistic demand signals from China, the US, and Europe. Additionally, the absence of disruptions in oil flows from the Middle East, given the contained nature of the Israel-Hamas conflict, has contributed to the decline. However, this decline in the energy sector was partially counteracted by significant gains in healthcare stocks. CSL, a heavyweight in the sector, increased by 3.6 per cent over the week as investors turned to the traditionally defensive sector amid declines in bond yields.

Imugene Limited lifted an astonishing 106 percent last week Mineral Resources experienced a 2.6 per cent decline on Friday. This came after the company invested up to $60 million, in addition to royalties, to secure rights to lithium, nickel, copper, and cobalt from Pantoro Limited’s Norseman gold project in Western Australia. Conversely, Light & Wonder, a gaming company, saw a positive trajectory, rising by 5.6 per cent. This surge followed its report of $731 million in revenue for the most recent quarter, surpassing analyst expectations. On a different note, the News Corp-owned REA Group faced a setback, slipping by 2.1 per cent to $156.22. Although the property listing site generated $341 million in revenue for the September quarter, with adjusted earnings at $198 million, reflecting a 13 per cent increase, the market response was a decline in stock value. Imugene Limited lifted an astonishing 106 per cent last week, however it is important to note that over 12 months, the stock is still down – 48 per cent. US Equities surprise to the upside, despite strong headwinds US markets continue to surprise to the upside with the Dow up 1.15 per cent, S&P500 up 1.6 per cent, and the tech-heavy Nasdaq up 2.1 per cent. This is despite Jerome Powell’s hawkish rhetoric stating if more tightening is required to bring inflation down to 2 per cent the US Central Bank “will not hesitate to do so”. Interestingly, US markets rose 6 per cent last week, with US technology lifting 7 per cent. All 11 sectors of the S&P 500 showed positive performance, with the technology sector standing out by recording a 2.6 per cent increase. Microsoft reached new all-time highs in the session, concluding the day with a 2.5 per cent gain. Notably, Apple, Meta, Tesla, and Netflix each experienced jumps of over 2 per cent, while Alphabet posted a gain of 1.8 per cent. Despite strong performances in US equities, Moody’s Credit Rating Agency downgraded the outlook of US Credit from “Stable” to “Negative” – citing large fiscal deficits and a decline in debt affordability. This is important as Moody’s is now the third and final credit rating agency to downgrade its outlook on US Credit.