-

Sort By

-

Newest

-

Newest

-

Oldest

Investment and superannuation service provider Mainstream Group (ASX: MAI) reported a 20 per cent yearly rise in funds under administration this week. The company, which has broadened its services from traditional administration including application forms and tax reporting, to complementary businesses lines like custody and superannuation, is riding a tailwind of structural growth. Founded in…

With interest rates at all-time lows, and term deposits lucky to be paying 0.5%, investors have simply been forced to look for alternative income-generating investments. The share market has obliged, but not only in the form of normal equity dividends – but in newer listed income-bearing investments. One of the most recent offerings came last…

Platinum Asset Management’s lead portfolio manager on its $5.2 billion Asia-ex Japan fund, Joseph Lai, resigned suddenly over the Christmas period and has left the firm. He had signed off, however, on a stellar year for the group’s top-performing strategy. Lai took over running the Asia ex-Japan managed fund (and the $492 million listed version)…

ASX struggles under COVID-19 weight, banks fall, retail sales recover The ASX200 (ASX:XJO) struggled today, falling 1.1%, as concern around the NSW COVID-19 outbreak weighed on sentiment at the same time that volumes fall ahead of the Christmas break. Every sector finished lower apart from healthcare, IT, and real estate, the latter benefitting from better than expected retail sales figures….

ASX finishes flat, border closures hit travel, AGL Energy downgrades, weaker open ahead The ASX200 (ASX:XJO) finished flat to begin the week, with news that US politicians finally agreed on a USD$900 billion stimulus package not enough to offset the NSW outbreak and subsequent border closures. Every sector was lower apart from materials and consumer staples, with the latter benefitting…

Winning streak hits seven weeks, A2 Milk (ASX:A2M) and Mesoblast (ASX:MSB) battered The ASX200 (ASX:XJO) managed to overcome a 1.2% fall to cap off the seventh straight week of gains, adding 0.5%. The IT sector continued to lead the way behind Afterpay (ASX:APT), finishing 5.9% higher, whilst energy lost 2.4% as the US economy appeared to weaken. The biggest…

The good news for IOOF (ASX: IFL) following the battering it took from shareholders last month is that the Australian Competition and Consumer Commission (ACCC) has approved its MLC takeover. The bad news is that the remaining class action against it has been funded. The ACCC said on Monday it would not oppose IOOF’s $1.4…

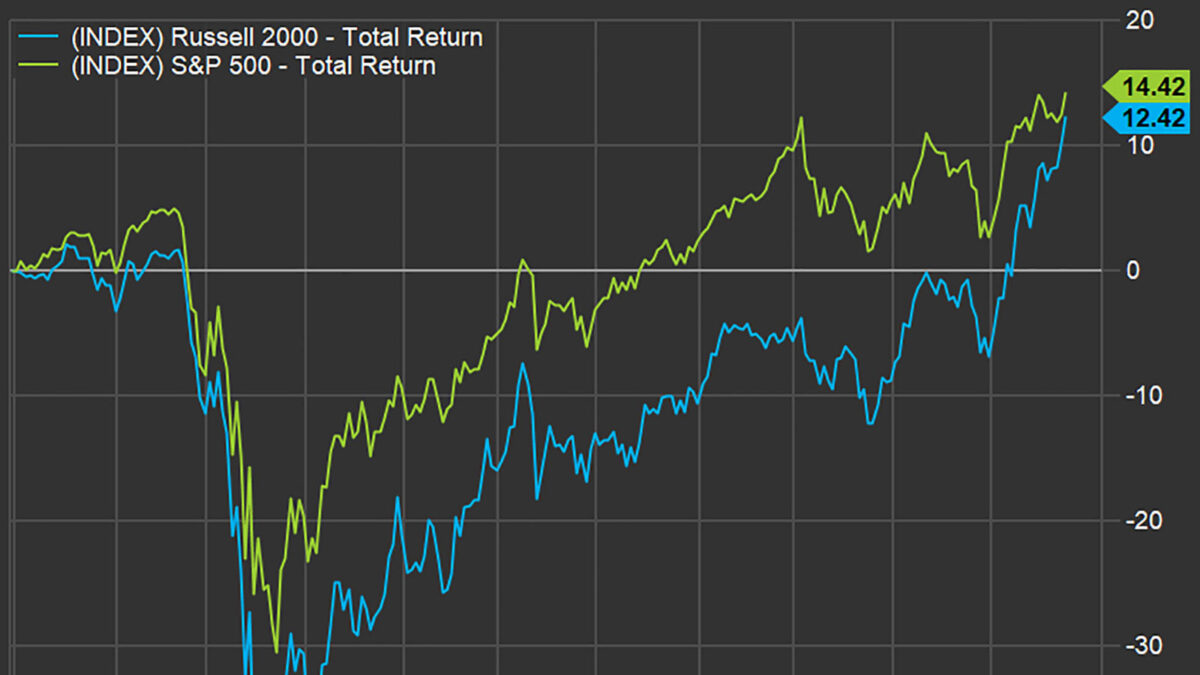

With attention focused on the record-breaking run of the Dow Jones Industrial Average (DJIA), which now sits above 30,000 points for the first time, smaller companies continue to be neglected. Yet with the Russell 2000 currently over 20% higher in November alone, perhaps the tide is beginning to turn. One of the core premises of…

As it stands, the ASX’s November 2020 performance could be the best in over 50 years. It seems impossible when you consider the state of the “real” economy, which is effectively on government life-support following enforced economic lockdowns. Such has been the strength of the recovery that estimates suggest the S&P/ASX 200 now trades on…

Loftus Peak, Australian global equities boutique, has become the second manager to launch a “quoted managed fund.” This looks set to become a strong trend in retail distribution, with a host of managers lining up for the new form of listing and an extra administrator entering this part of the market, Link Fund Solutions. The…