State of the market – platforms

Building a financial advisery practice isn’t easy. From regulation to compliance, overheads to staff wages and client reporting to administration, there are so many time-consuming, ad hoc tasks that take up the time of an adviser which could be better spent dealing with clients. The solution? Streamline and automate manual, time consuming processes. And this is where wealth management platforms came into play. Not only have they automated time consuming processes, they have helped digitise an entire wealth management industry, cut costs, and empower advisers with new solutions and investment options.

But before delving too deeply, there is some confusion on platform functionality and what value platforms deliver. If we go back over a decade ago, an adviser could only transact in equities, options, and cash using a software program such as IRESS (GBST) or an online share trading platform such as Commsec.

Insurance, superannuation and managed funds were not digitised and involved the completion of lengthy account opening forms. Reporting and tax statements all done manually. Fast forward to today, an almost entirely digital world built in the cloud, and digital wealth platforms have created a way to digitise client investment data.

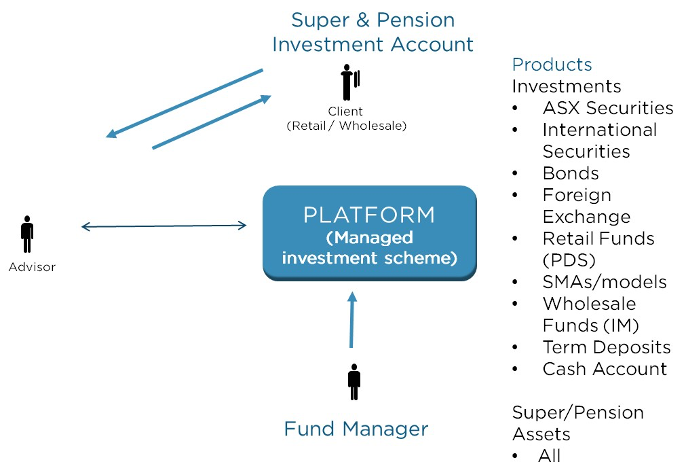

A secure online location for financial advisers to digitise client investments so they can be held, viewed, transacted, and reported on, all in one place. It helps advisers better engage with their clients via new tools and solutions. Consider a portfolio tool which displays client investments all in one place, access not only to equities, but managed funds, alternative funds, superannuation, and insurance. Or perhaps a tool to create tax reports, access an online research marketplace or to send corporate actions online in bulk. Wealth management platforms are essentially a digital place where advisers have everything at their fingertips. A connection with an entire investment community of and products connected to that platform.

An added benefit of using a platform is the ability to use a Managed Discretionary Account (MDA) or a Separately Managed Account (SMA) as an investment option. For those that do not know:

- MDA (financial service) – An MDA is a personal investment account held on the platform where the client has beneficial ownership of assets. The MDA provider has the authority to buy and sell at their discretion. Financial advisers will use MDAs to manage client portfolios. An MDA is a Managed Investment Scheme but one whose provider has been granted relief by ASIC from appointing a Responsible Entity (RE). The account is treated as an advice service not as a financial product.

- SMA (financial product) – Is a managed fund with a Responsible Entity (RE) who ensures that the Investment Manager complies with their mandate and, if applicable, issues the Product Disclosure Statement (PDS). In an IMA or MDA, unlike an SMA, an operator can time or stagger investment decisions in response to market conditions.

Which platform?

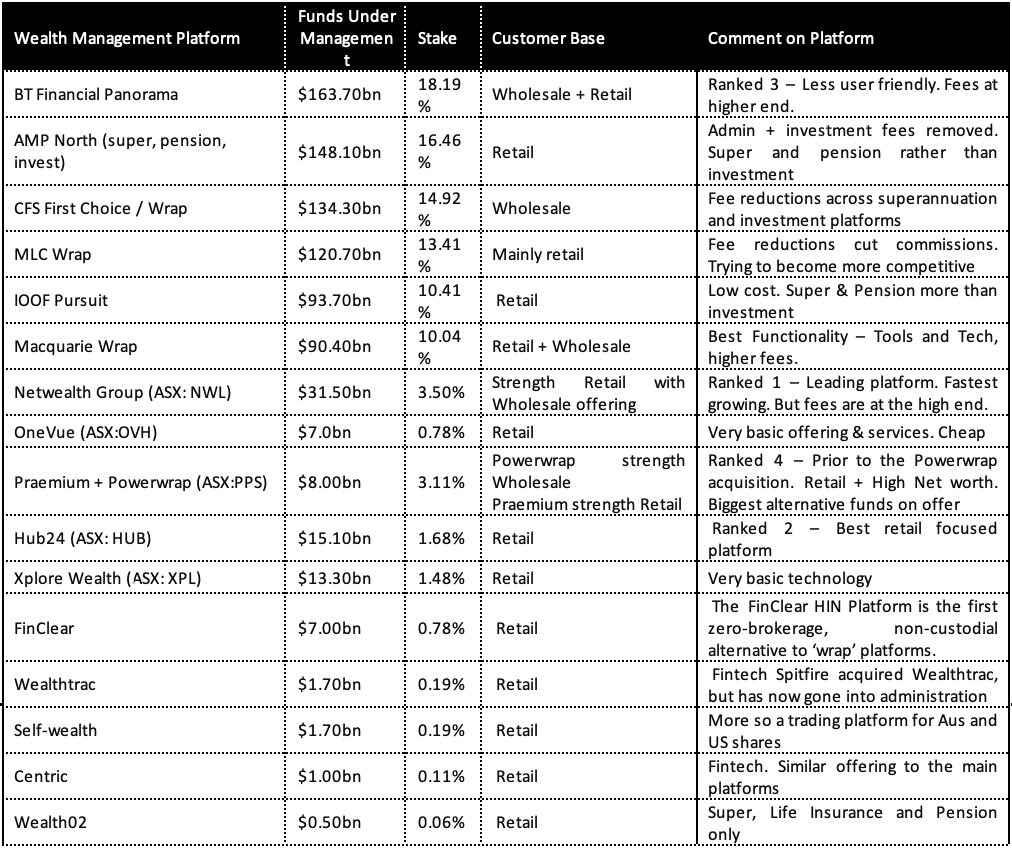

Selecting the right platform is no easy task. Often an advice firm will have two or more platforms. Each platform has its own technology, its own set of varying fees, type of investments, appeal and usability. The platform space is made up of 18 platforms, dominated by the big banks but being fast eroded by new generation start-up platforms that are more nimble, cheaper and more versatile than the older platforms. A summary and my short hand comments follow:

As you’ll notice in the table above, there is no ‘one size fits all’ platform that effectively accommodates all types of advisers/customers. Netwealth and Praemium are probably the best candidates that accommodate both retail and wholesale, but neither is exceptional at both. That’s why most advisery firms usually distinguish “what” type of client they wish to attract and select the platform that best services that client.

It is also important to evaluate the average portfolio size of a client of the firm. This will help narrow platform selection down from 20 to three of four platforms. The rest is all in the price. As they say, “you get what you pay for”, which is fine, as long as it satisfies your client’s needs. Choosing the right platform is entirely about understanding your client. As it should be.