Standard 3 review the last order of business for FASEA

The soon-to-be-disbanded Financial Adviser Standards and Ethics Authority (FASEA) is finishing its reign with a flurry, announcing a review of the much-derided conflicts of interest Standard 3 of the recently enshrined law.

Financial advisers and legal experts have raised concerns about the structure of the ethical standards sincetheir inception. In fact FASEA had received 37 submissions to its code of ethics guidance, the majority of which had pointed to the urgent need to refine the wording of Standard 3. The result is that the last order of business for the year has been to put the wording up for review and accept submissions from the broader sector before proposing any amendments.

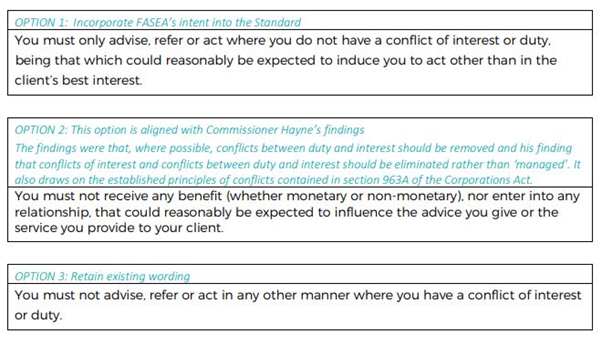

Commenting on the proposal, FASEA said: “Standard 3 received particular comment with a broad range of suggestions made including [to] retain the standard as is, incorporate the wording and intent from the draft guide into the standard to give it legal application, incorporate a reasonable person and materiality test into the standard, revert to the original wording of the standard re inappropriate advantage, [or] change the standard to provide for a disclose-and-manage approach.”

Standard 3 placed a ban on all conflicts of interest or duty. There has been a backlash against the code, and confusion over whether the ban covers certain types of remuneration, such as the lucrative “stamping” fees for LICs and IPOs. Following-on, FASEA attempted to clarify that the government wasn’t looking to ban forms of remuneration not already outlawed. Nevertheless, the financial advice industry remains confused and concerned. As a result, FASEA asked for feedback before amending Standard 3.

Industry bodies have all labelled Standard 3 as “unworkable.” The AFA’s submission was in strong opposition of Standard 3 in its current form and says it is not practical. The FPA too, agrees that the prohibition to act when a conflict of interest occurs, will likely cause ongoing problems. One suggestion was to revert to the original 2018 wording.

According to reports, the options FASEA is consulting on include:

From 1 January 2022, a Financial Services and Credit Panel (FSCP) takes over from FASEA to become the industry’s new single disciplinary body, to police the Code of Ethics. It will be closely watching the outcome from FASEA’s consultation process.