Spatium’s secret small cap sauce

Four years ago, old high-school buddies Nicholas Quinn and Jesse Moors were taking in the sunshine at a café on Melbourne’s Southbank, when they decided to take their mutual interest in stock market investment to the next level.

Quinn, a former PwC global tax specialist, and Moors, formerly a business development manager at CPA Australia, had talked often about the idea that would become their investment strategy, a short-term, relative-valuation-driven, high-turnover approach, designed to capture undervalued opportunities in the small-cap space.

It was an approach that Quinn had been honing, in practice, since 2013, consulting to a group of investors who worked for major institutional investors in Singapore, and who went on to form a Singapore-based hedge fund manager, Vantage Point Asset Management. “In the first three years of Vantage Point’s operations, I worked alongside the team and bounced investment trading strategies off them,” says Quinn. “The original thesis was a long-short strategy, but fast-forward seven years, Jessie and I are running effectively what is the long side of that strategy.”

The pair established a company, Spatium Capital, and their strategy was backed by a seed investor in July 2018: the strategy has been available as a SMA since then. Moors and Quinn launched the unregistered managed investment scheme to wholesale Australian investors their Singaporean equivalent, “accredited” investors, in March 2020, in the form of an Australian unit trust, the Spatium Small Companies Fund (SSCF).

The SSCF is a long-only investor, but a short-term one: the entire portfolio is turned over every 30 to 45 days, and a stock would only ever be held for a maximum of 90 days. Quinn and Moors will hold, on average, 25 to 40 positions across the S&P/ASX 300 index: the primary goal is to grow investors’ capital through exceeding the return achieved by the S&P/ASX Small Ordinaries Index – the fund’s benchmark – over the long term.

Moors describes the approach as follows. “We look at the top 300 companies on the Australian market – the S&P/ASX 300 index – and we use five filters to isolate the companies that we think are probably fairly valued. We use a macro filter, an industry filter, a small companies filter, the decay rate and then the hurdle filter as well, and we’re trying to say, right, there’s 200 or 250 stocks that we’re not going to look at any further. The number that’s left is the group of stocks that we want to investigate further.”

The pair applies a relative valuation model to assess the remaining companies, and from that group comes the portfolio, of up to 40 positions.

“We are stock pickers,” says Quinn. “We don’t try to be industry- or sector-weighted, or to have an economic forecast of where we think a sector may be going. We are purely focused on stock selection at the company level.

“We don’t want companies that might be lagging the overall market, but relative to their industry they’re doing quite well. We don’t want companies where the rate of decay of value is probably indicating a more systemic shift. The final filter for us is working out, OK, we’ve got this entry price of, say, $3, and exit price of $3.30 – we’re hoping to get a 10% return.

“It’s not always that large, of course, but making sure that OK, once we account for transaction costs – and the fact that we’re not going to get it right every single time – there’s still going to enough return there for the investors. And again, that helps us build a portfolio and that flows through to the result base we’ve had in the last two-and-a-bit years.”

The fund is benchmarked to the S&P/ASX Small Ordinaries index, which is where Spatium finds most of its value. “By legal structure, we’re locked-into the top 300. We can’t trade outside the S&P/ASX 300, even if we wanted to,” says Quinn. “That said, we would trade approximately 85%, sometimes 90% of our portfolio within the stocks ranked 101-300, the S&P/ASX Small Ordinaries index.

“We will ‘spend’ approximately 10 to 15% of the portfolio on companies within the Top 100, but only when we feel that they’re extremely cheap – and that doesn’t come up too often, just because the Top 100 is so heavily analysed. We find almost all of our value outside the Top 100, which is obviously why we’re running a small-cap fund,” he says.

“If we do see an absolute bargain in the Top 100, we’re not going to exclude it just because we’re small-cap managers – if we think there’s value there, we’ll pounce on it. And we have, we have over the last 18 to 24 months now. But again, they don’t happen as often. And they also tend to realize that little bit quicker because they are getting scrutinized that little bit more heavily. They tend to bounce back that little bit faster than the smaller companies,” Quinn says.

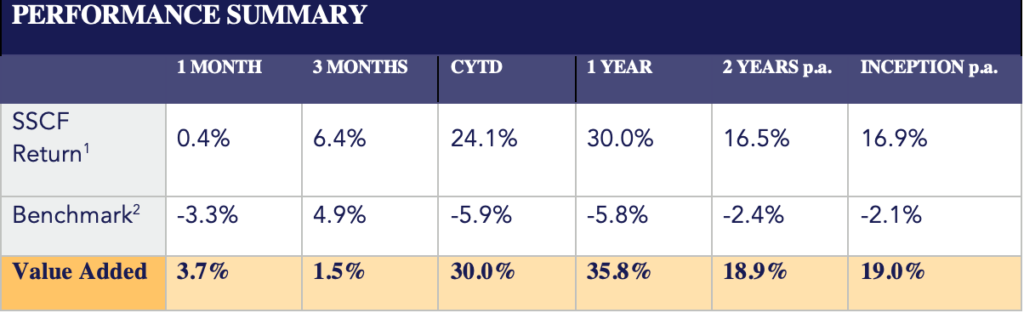

At the end of September, the fund had returned as follows:

Inception: 1 July 2018

The fund’s top-performing positions so far this year have been IDP Education, Austal, and Monadelphous Group, Moors says.

Quinn says the client base is driven by the structure. “It’s obviously going to have tax implications for investors that invest with us – depending on how you’re structured, obviously we’re going to be more tailored towards self-managed super funds (SMSFs) that are only going to pay a top marginal tax rate of 15%, and we might be less beneficial to a high-net-wealth investor who’s going to pay the full marginal tax rate.

“The strategy chooses the clients – there’s nothing we can do to change that, it’s just that how we manage the fund, the high-turnover approach simply suits lower-tax-rate investors, such as SMSFs, charitable organisations, as well as corporates who want to invest. That said, we do have several high-net-wealth investors who have wanted to get on board anyway, just to diversify their portfolios,” says Quinn.

And that goes to the heart of how this fund is probably best used.

“Morningstar describes us as a ‘small-cap strategy blend’ fund, and that is how we are mostly used,” says Moors. “It’s an actively traded value-based approach – we’re not growth investors or holding for the longer term – but if you’re looking for Australian small-cap exposure and you already have two or three small-cap managers in your portfolio, you could add this as potentially a third or fourth allocation.

“The benefit that it gives you first and foremost that liquidity; there’s no lock-up. But also, it doesn’t have the same correlation as the other small-cap managers, that as far as we can tell, and it’s been validated a few times by Morningstar and others, we’re the only small-cap manager with such a significantly high turnover rate. It’s a bit of a differentiating factor.

That said, if you were trying to pigeonhole the strategy, you would say that on the whole, it would be more of. We’re looking at valuations, we’re not So the benefit for some of the financial planners and advisers out there has been that, if you’re going to seek small-cap exposure and you’re already have two to three managers in your family office, or whatever it might be, already, you could add this as potentially a fourth allocation, as a differentiated approach in that space. You’ve just got to balance out that element of the CGT discount never coming into play,” says Moors.

“We’re actually quite a defensive manager, which means we make a good blend with more aggressive managers,” says Quinn. “Our upside capture ratio is 108%, but our downside capture ratio is only 47%. March was a good example of that: the market fell 23%, but we only fell 11%. We’re sitting very consistently with that 47%-50% sort of target. And we do that with a beta of 0.81, which is lower than standard portfolio variance of the market. You get less of a roller-coaster with us, and you can dampen the more violent swings that a more aggressive-style manager might get. That’s pretty attractive to older investors, who are a bit more conservative.”

The target performance is 5%-6% a year above the performance of the S&P/ASX Small Ordinaries index. “Over a monthly cycle, we’d be looking to add about 50-75 basis points to the index, notwithstanding that with the recent volatility off the back of COVID, we’ve been able to deliver outperformance of over 18% a year over the last two years. We would think that in more normal circumstances it would be around the 5%-6% mark,” says Moors.

The fund presently managed just over $5.7 million. “Because it’s a short-term approach, we believe this strategy caps out at anywhere between $130 million-$160 million,” says Quinn. “That’s just so that we can remain agile and flexible to move relatively frequently and not run into a situation where we might be trading against ourselves. Performance is the goal here, not asset gathering.”

The fund is managed for 1.25% a year, with a 15% performance fee that kicks in if the absolute return is positive, the relative return against benchmark is positive, and the high watermark is exceeded.

The fund is majority invested at all times, with a target cash holding of less than 3%. Redemptions are monthly. The trust is forced to distribute its income: almost all of the annual distribution will be income. For the June 2020 financial year, the fund provided a 16.5% distribution.