Smaller company sell-off offers opportunity – Twidale

The Australian market is in a world of its own, pushing ahead with a strong post-pandemic-led recovery while a rebound of the global economy is edging closer and looks like it will come over the coming quarters. The team at DNR Capital Australian Emerging Companies Fund continues to select quality growth stocks for its Australian small-cap investors and the results are as impressive as are the companies they select.

Australia’s economic recovery remains driven by exports, which hit a record of $36 billion in April, with iron ore the largest source of export revenue, accounting for $16.5 billion of the total, or 55 per cent.

With this in mind, Sam Twidale, portfolio manager for the DNR Capital Australian Emerging Companies Fund, explains the strategy for the rest of 2021. “We are positioned across a broad range of opportunities, including the more cyclical areas of the market like resources and consumer discretionary, reopening stocks that will benefit from a normalisation of the pandemic, and quality growth stocks that we believe are attractively priced… given this backdrop, many of the more cyclical sectors of the market performed strongly recently.”

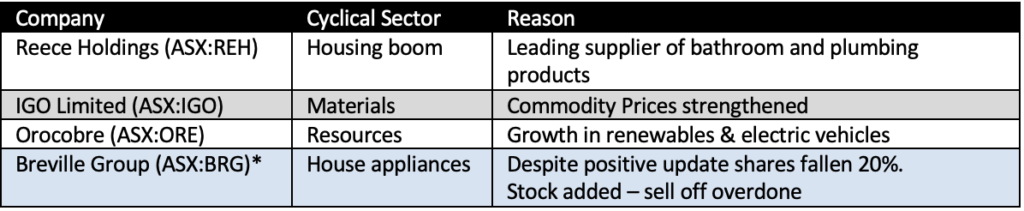

DNR has applied these metrics to its investment strategy and has selected companies that exhibit cyclical sector qualities. Here are a few of the firm’s holdings:

Twidale acknowledges that an uptick in inflation is a risk that shouldn’t be ignored, especially given the unprecedented scale of the stimulus measures. “A number of companies are already warning of increased inflationary pressures, which we expect to build further as the global economy recovers and capacity utilisation tightens,” he says.

All in all – a positive update from the fund manager, which also received a ‘Recommended’ rating from leading ratings house Zenith Investment Partners.

The fund has returned 16.18 per cent p.a since its inception in August 2018, outperforming the S&P/ASX Small Ordinaries Accumulation Index by 8.39 per cent p.a.