Share falls and higher rates bite into superannuation balances

Financial planners are advising Australians to put more money into superannuation and diversify out of property, despite poor superannuation returns in 2021-22 and doubts over returns for 2022-23.

Australians with retirement savings in a balanced option saw their funds drop 5.7 per cent in the year to September 30, 2022, falling 3.1 per cent in that month alone, according to figures on median fund performance from SuperRatings. The coming year could prove even worse, as bond and share prices fall in tandem and market volatility lingers.

“We are expecting a tougher calendar year for super returns [in 2023], although funds continue to have suffered more modest falls than equity markets, reflecting diversification in funds’ portfolios,” says Kirby Rappell, executive director of SuperRatings.

“The current market is toughest for those closer to or early into their retirement,” he adds. “Be prepared to see persistent volatility, while remembering that superannuation remains a long-term game.”

There is some good news, however. Mano Mohankumar, Chant West senior investment research manager, says that while Australian and international share markets dropped off sharply in September as central banks around the globe raised interest rates, a falling Australian dollar will help to offset losses from international share investments. “The Australian dollar also fell sharply against the US dollar, as it usually does during periods of share market weakness, reducing the international shares loss to 3.2 per cent in unhedged terms,” he says.

Household portfolios lacking diversification

While Australia’s superannuation pool is one of the biggest in the world, residential property still dominates household wealth. Around 70 per cent of household wealth is held in property, which totalled $10 trillion in the June quarter compared with $3.4 trillion in superannuation reserves, according to the Australian Bureau of Statistics.

In terms of other assets, Australians held $1.2 trillion in shares and $1.5 trillion in cash deposits. Total Australian household wealth slipped in the June 2022 quarter to $14.4 trillion from a record $14.9 trillion in the March quarter, with property and share values both falling on higher interest rates.

Australians remain overexposed to residential property and underinvested in superannuation, financial planners say. Scott Keeley, a senior financial planner at Wakefield Partners, says people with a capacity to contribute more into superannuation, such as higher income earners, should be salary sacrificing more.

“The tax advantages are pretty much instant, as well as knowing that you are likely improving the quality of your retirement living standards,” Keeley says. “The most tax-effective retirement income sources can only be funded from super, providing the incentive to increase your super balance.”

While there is no ideal level of salary sacrifice as no two people are the same, it is important not to exceed the annual limit of $27,500. “This concessional contribution limit includes any super guarantee contributions that your employer makes for you, so be sure to factor this in,” Keeley says.

“Since 2018, there is also the ability to use past years’ unused concession contributions to make larger, tax-effective one-off contributions,” he adds. “This can be complicated, though, and requires professional advice.”

And the earlier you start, the better. Keeley often sees older Australians selling their family homes or downsizing to fund their retirement. Putting more money into superannuation over the long term through increased regular contributions can create opportunity for Australians through the power of compounding returns, he says, and “can provide an annual tax saving along the way.”

More data on super fund

New data from the financial regulator will cast a brighter light on the performance of superannuation funds. The Australian Prudential Regulation Authority (APRA) has released the first in a series of new publications to improve the transparency of the superannuation industry.

The Quarterly Superannuation Industry Publication provides information on available products and superannuation investment options. The publication also includes data on member demographics, such as gender, age and account balances.

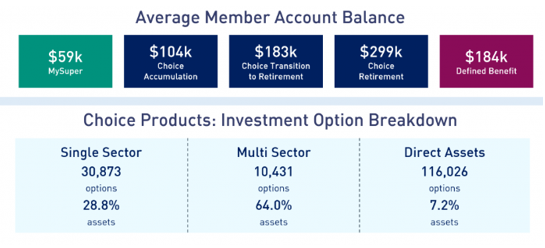

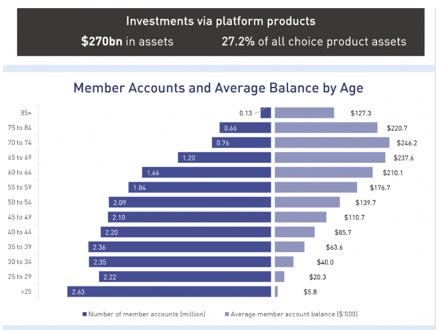

The age group with the greatest balance of superannuation investments held through platforms was those aged 70 to 74, with an average balance of $246,200 as at 30 June 2022. The average member balance in a MySuper account was just $59,000, as the charts below show.

As of June 30, 2022, there were 69 MySuper products, 956 Choice products and 142 Defined Benefit products in APRA-regulated funds, the publication says. Of the $1.95 trillion in member assets held in these products, 41.5 per cent is held in MySuper products, 51 per cent in Choice products and 7.5 per cent in Defined Benefit products.

In the Choice product segment, there were around 10,000 multisector investment options, 30,000 single-sector investment options and 116,000 direct asset investment options, such as shares or term deposits, available to members.