Review into ASIC funding model recommends levy discount cut and… another review

The government has published the final report on its long-awaited review into ASIC’s Industry Funding Model, which is headed by a key finding that further consultation is required to determine whether the settings for the advice sector remain fit-for-purpose.

While the review provided some hope to the advice industry that rapidly escalating levies would be ameliorated, Treasury recommended “…undertaking further consultation to ensure sub‑sector definitions, metrics and formulas used to calculated levies remain fit‑for‑purpose”.

In a further blow to advisers, the temporary levy relief for personal financial advice licensees that was put in place for 2020‑21 and 2021‑22 in response to rapidly escalating levies will be discontinued.

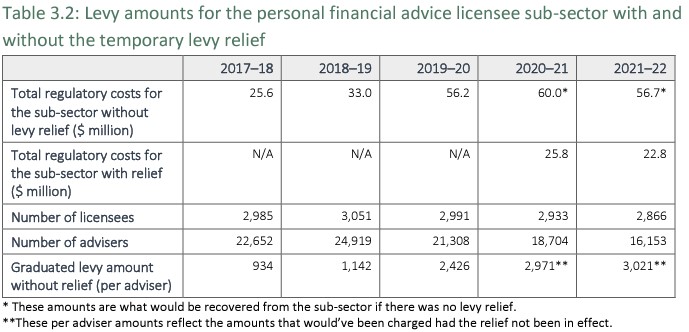

“The former government previously intervened in response to significant increases in levies in the personal financial advice licensee sub-sector,” the report stated, noting that the levy was capped at the 2018-19 level of $1,142 instead of the true cost which was over $3,000 (see table below). “The cost of this relief was borne by the Government (through general taxpayers) and was not recovered through levies charged to other sub-sectors.”

ASIC confirmed the increase a day after the report was released, noting in its annual cost recovery implementation statement (CRIS) that the indicative levy for licensees providing personal advice to retail clients will be $1,500 plus $3,217 per adviser.

ASIC’s estimated cost recovery for the year is $55.5 million, spread across around 16,000 licensed advisers.

Treasury provided two reasons for the levy discount being cut, the first being that the advice sector “is not unique in experiencing” the structural changes that led to advice levies skyrocketing. The credit intermediaries sub-sector has seen its costs rise 58 per cent since 2017-18, the report noted.

The other reason, Treasury added, is that the steep increase in advice levies might not last if ASIC decides to focus its regulatory gaze on other industries.

“The review notes that while certain sub-sectors have been experiencing levies, this could change going forward subject to ASIC’s regulatory priorities which could divert resources and costs to other sub-sectors,” the report stated.

An unfair impost

The lifting of the levy freeze will come as a blow to advisers and licensees, and runs counter to the minister’s stated objective to lift the number of advisers operating in the industry.

According to Financial Advice Association of Australia CEO Sarah Abood, the almost tripling of per-adviser cost is a serious and concerning impost, especially considering the review identified a number of flaws in the funding model that need to be addressed.

“We are extremely concerned to see the impact of the end of the freeze on the ASIC levy resulting in an almost tripling of the per-adviser cost,” Abood said. “This comes before the recommendations of the recently-released review into the Industry Funding Model (IFM) for ASIC have been implemented. The review highlighted several deficiencies in the current model, and the need for reform.”

There are two major issues with the current state of the funding model, Abood argued.

“Firstly, it is evident that important recommendations have not been accepted in the IFM review. For example, current financial advisers appear to be being charged for enforcement activities undertaken against past entities that in many cases are no longer even in the profession.”

This breaches one of the major principles of the funding model, she explained; that those who create the need for regulation should bear the primary cost.

“The moral hazard involved in this is of great concern and a fundamental flaw in the design, that must be rectified. It is unsustainable to have a model in which the good actors in our sector disproportionately bear the costs of the misbehaviour and risk taking of the bad actors, including those who are no longer operating or who are unlicensed.

“The second key problem is that even those suggestions in the review that have been accepted are not reflected this year’s [CRIS],” she added. “It’s deeply unfair to proceed to charge advisers using a model that is already acknowledged to need reform.”