Retirement confidence has nothing to do with markets, but cost of living does

New data shows that when it comes to having confidence in retirement outcomes, immediate cost of living concerns including the rate of inflation and mortgage prices have much more bearing than the vicissitudes of investment markets.

According to the 2023 State Street Global Advisors Global Retirement Reality Report, which surveyed over 4,000 individuals participating in workplace-sponsored savings plans (or the market equivalent) in Canada, Australia, Ireland, the UK and the US, a bumper year in market performance did not translate into retirement confidence.

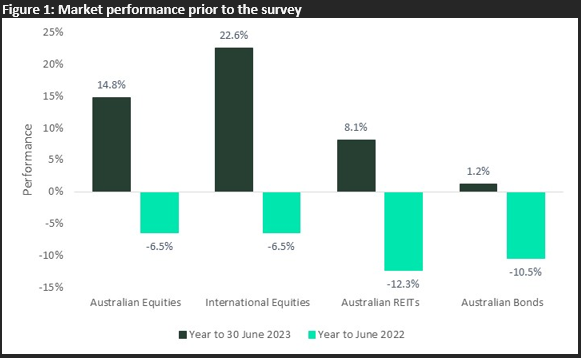

Markets made significant gains in domestic and global equities in 2023 (the survey was conducted in August, 2023), compared to a dour set of returns in 2022 (see chart below), which State Street assumed would result in a rise in retirement confidence – at least for Australians.

“Despite this dramatic reversal in markets, many of the measures of confidence appeared to have weakened rather than strengthened among our Australian respondents,” the report states.

When asked if they believe they will have saved enough to retire by the time they stop working only 20 per cent of respondents replied in the affirmative in 2023, down from 25 per cent in 2022. In 2023 14 per cent of respondents also said they “can’t imagine” being financially secure at retirement, up from 10 per cent in 2022.

Rather than market movements, a staggering 73 per cent of Australian respondents identified “inflation and the cost of living crisis” as the factor most negatively affecting their retirement confidence. “Mortgage debt/rent and housing costs” was the next most significant factor (38 per cent) followed by “medical expenses” (35 per cent).

“These three were selected more often than factors like having spare money for savings, the complexity of the superannuation and pension system and lack of trust in super,” State Street noted. “Clearly confidence in retirement is a function of much more than simple investment returns.”

The annual State Street report came up with a number of other significant findings, including that Australians largely support the Retirement Income Covenant’s mandate that superannuation trustees help their members maximise retirement income, manage risks and maintain flexibility.

Australians are also coming around on annuities, State Street believes, although progress is slow and Treasury has remarked that the take-up of products “remains low”.

“In the 2023 survey, we saw encouraging signs that annuities may have turned the corner in Australia,” State Street advised.

“Acceptance of some of the stereotypical negative statements about annuities has softened since 2022. It isn’t clear whether this softening is due to higher interest rates, or education or some other factor, but it does augur well for trustees looking to include longevity products in holistic retirement solutions.”