Putting the income back into fixed income’: Colchester Global

London-based fixed interest manager Colchester Global recently presented “Putting the income back into fixed income” to investors, focusing on the current state of traditional fixed income markets.

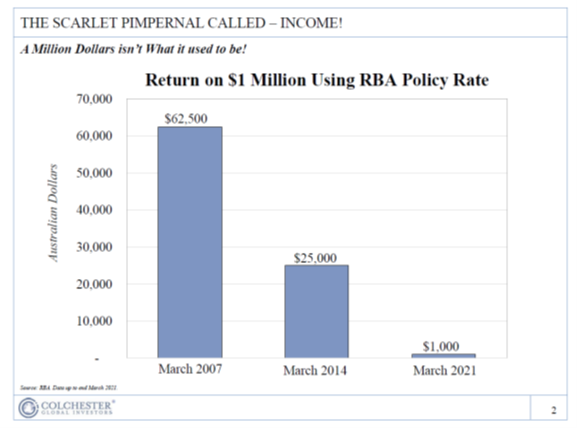

Investment manager at Colchester, Martyn Simpson, explains why fixed income is topical, highlighting that “over the last decade, income has become a bit like the Scarlet Pimpernel. It’s quite an elusive character to find.”

To demonstrate that, he used the RBA base rate and displayed the level of income it would have generated.

- Retiring on $1 million back in March 2007, with rates at the time, will have earnt you $62,500 pa.

- Retiring on $1 million on March 2014 rates, you will have only received $25,000 pa.

- And finally, retiring on $1 million this year will have generated a paltry $1,000.

So, there is a real need to do something about this. The key, says Simpson, is “don’t forget the fixed.”

“Protecting the portfolio is an essential part of portfolio creation. Traditionally, holding a fixed-interest asset has many uses, such as acting as a defensive anchor; giving liquidity during market stress; a low correlation to risk assets; and generating a steady income (albeit that rates must be of substance.” It’s all highlighted in the table below.

During the GFC, global equities halved in value, whereas global bonds gave a return of about 15%. This non-correlation with risk assets is central to fixed-income’s attractiveness. And this is exactly how it played out last year during the pandemic; albeit that magnitudes are a little different. Global bonds were in the black, whereas equities fell over 30%.

Today, Simpson asks the question” “How are we going to generate income?” Some ways could be investment-grade credit, high-yield, asset-backed securities or local-currency emerging sovereign debt. Why is it, that many investors haven’t considered EM debt?

Back in the 1990s, high-yield bonds returned close to 15 per cent and investment-grade corporates around 7%-10%: quite attractive rates in today’s context. Simpson says: ‘Fast-forward to today and high-yield is less than 5%, at an all-time low, and investment-grade credit isn’t as appealing as it once was.’ Looking at the chart below, securities are plotted at the current coupon versus 10-year volatility.

Government bonds at 2%, investment grade at 3%; which surprisingly, returns the same as Aussie equities but a lot less risk. “It doesn’t make sense to use Australian equities as an income generator,” says Simpson – high-yield and local-market emerging market debt are the way to go. Both are generating the same coupon, but EM debt has lower volatility.

Why Emerging markets?

“There has been an improvement in credit quality in some of the emerging market economies,” says Simpson . “With a high coupon rate, the ability to repay is a lot better than it used to be. This asset class also offers relatively low correlation with credit and other risk assets, acting as the perfect cushion for a ‘black swan’ event.”

Simpson concluded with a caution – “don’t throw out government bonds,” saying they “still play an important defensive role.”

“The income they generate is still reasonable. They should act as the bedrock of your portfolio,” he says.

When you get to the ‘How can I add more income?’ that’s where the EM local-currency debt securities come into play. Although these types of securities aren’t well known in Australia, Simpson thinks they can “add great diversification benefits and generate relatively high income for investors’ portfolios.”