Protecting your portfolio from disruption

There is no denying the ripple effect that blockchain technology has had, not only in the cryptocurrency world but the wider world. What started out as being the foundation to Bitcoin soon spread to many facets of life.

It has been used to create a transparent ledger system for compiling data on sales, online payments to content creators such as wireless users or musicians, and has even been tapped to replace the ASX CHESS ledger system in 2023.

Following the widespread use of blockchain, ETF Securities has launched an exchange-traded fund (ETF) that gives investors the opportunity to gain exposure to some of the world’s leading fintech companies. And Australia has been at the forefront of cutting-edge technology, with names such as Afterpay (ASX: APT) proving that a small start-up can rise from zero to making media headlines around the world as the subject of a $39 billion takeover bid.

ETFS has launched on the Chi-X exchange the Fintech & Blockchain ETF (Exchange Code: FTEC).

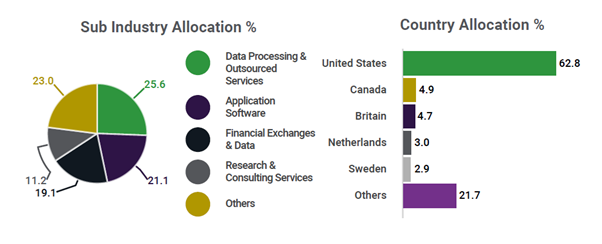

According to ETF Securities the fund “invests in a portfolio of 75 developed-market stocks chosen to reflect several sub-themes in the growing fintech sector. These include decentralised finance; digital payments and point-of-sale payments; payment processing; financial data providers and analysers; finance and tax software; trading and capital markets; and crowdfunding and peer-to-peer lending.”

The over-riding theme in the portfolio is decentralised finance, or DeFi, using blockchain technology. The portfolio invests in up to 20 companies that are blockchain-related or are a leading blockchain innovator.

The fund will track the Indxx Developed Markets Fintech & DeFi Index, which itself tracks the performance of companies from developed markets with significant revenue derived from one of several fintech subthemes: decentralised finance; digital payments; financial data provider and analyser; financial enterprise solutions; peer-to-peer lending and crowdfunding; personal finance software; tax compliance software and backend payment processing; trading and capital markets; and point-of-sale.

So why invest in FTEC?

ETF Securities head of distribution Kanish Chugh says, “This is an exciting growth period for the ETF sector in Australia as investors look for varied exposures to investment megatrends, led clearly by the innovation in technology sector. We have seen a lot of fintech disruption already in the form of digital wallets, robo-advice, instant international money transfers and free share trading. With blockchain adoption looming, the world steadily turning cashless, and the global payments infrastructure becoming standardised, there is much disruption to come.”

With the Biden administration seeking to regulate cryptocurrency, it’s a sure sign that regulation will help clarify questions surrounding investment value and potential uses for the broader economy. Better regulation will benefit investors in crypto-currency and will help support the development of newer technology, especially with blockchain. This only highlights the growth opportunities within disrupting financial services. The ETF can also be used by investors as a hedge against the “traditional” banks, which account for a large portion of most Australian portfolios.

Mr. Chugh says, “The financial services industry has the strongest expected uptake of blockchain of any industry. Cryptocurrencies have shone a spotlight on blockchain and its potential, which extends to potential uses such as the ‘tokenisation’ of assets and ‘smart contracts’. Other major fintech trends include wealth moving online, the rise of alternative credit and big data.”

The launch of FTEC on Chi-X is also a milestone for the exchange. Chi-X Australia chief executive Vic Jokovic says, “Chi-X is excited to partner with ETF Securities to launch FTEC. This is a significant product for Australian financial markets, and we’re pleased that ETF Securities selected to provide Australians with the opportunity to invest in the cutting-edge technologies underpinning the next phase of innovation in financial services.”

Here are the ETF’s top holdings