Private equity vs public equity: Can you have the best of both worlds?

Private equity investments are becoming an increasingly mainstream component of a balanced investment portfolio, providing valuable diversification benefits to “traditional” listed equities and bonds. However, the downsides to private equity include the lack of liquidity and the significant capital required to acquire control of a company.

Listed equity investments have long been used in client portfolios, providing daily pricing and liquidity for investors, however depending on the strategy employed (active or passive) returns are largely dependent on a manager picking the right stocks or the broader direction of the market rather than specific skill and involvement of the manager in its portfolio companies. In this article we outline the key differences between investing in listed and private equities and consider opportunities to leverage the advantages of both investment strategies.

Private Equity Investing:

Private equity investing typically involves buying a significant stake in a company with the goal of improving its value through operational improvements, cost-cutting, or other measures. Private equity investors may acquire privately owned companies or seek to take-private publicly listed companies – requiring a control premium to be paid to selling shareholders.

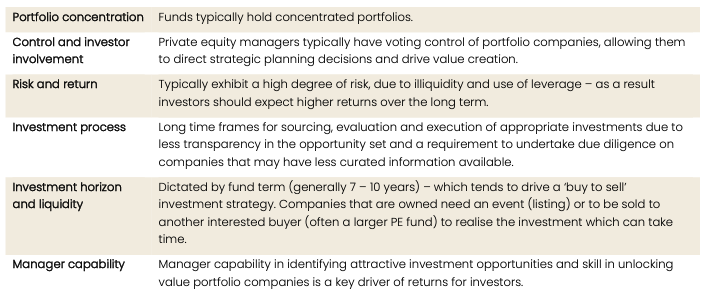

Key attributes of private equity investing:

Traditional listed equity investing

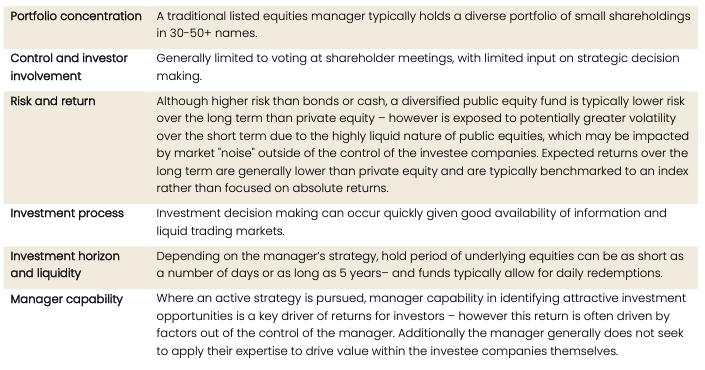

Traditional Listed Equity Investing In contrast, traditional listed equity investing provides a different set of advantages and drawbacks:

Proactive management

Proactive management is a form of “activism” and involves buying a significant stake in a company with the goal of influencing the company’s management and strategic decisions. Proactive management may seek to improve the company’s financial performance, governance practices, and overall value through the expertise and efforts of the investment team.

Over the long term, this approach seeks to generate strong, positive risk adjusted returns that are uncorrelated to the broader equity market.