Outlook for Australia ‘favourable’ compared to ROW: Chronis

The VIX Volatility Index or Fear Index hit a 52-week high of 38.94 last week after $65bn was wiped off the Australian share market. To put that in context, the VIX index rose to 65pts when Covid-19 first hit and peaked at 80 at the start of the GFC.

While the VIX index has broken the 90 percent threshold, it’s nothing we haven’t been through before and isn’t high enough to push the panic button just yet. Last week we heard from Ausbil’s Executive chairman, Paul Xiradis and Chief economist Jim Chronis. Chronis listed four shocks the world is going through right now. They are:

- Waves of supply shocks – First covid and now energy

- Inflation is at an all time high and monetary policy will tighten

- Economic growth will slow

- Australia is well positioned due to its natural advantages

Chronis says, “The first supply shock refers to the pandemic forced lockdowns. The world has largely moved past covid, except for China. Shanghai was recently forced into lockdown amid the resurgence of Covid-19. With 26 million Chinese in quarantine camps, it can pose a real supply disruption.”

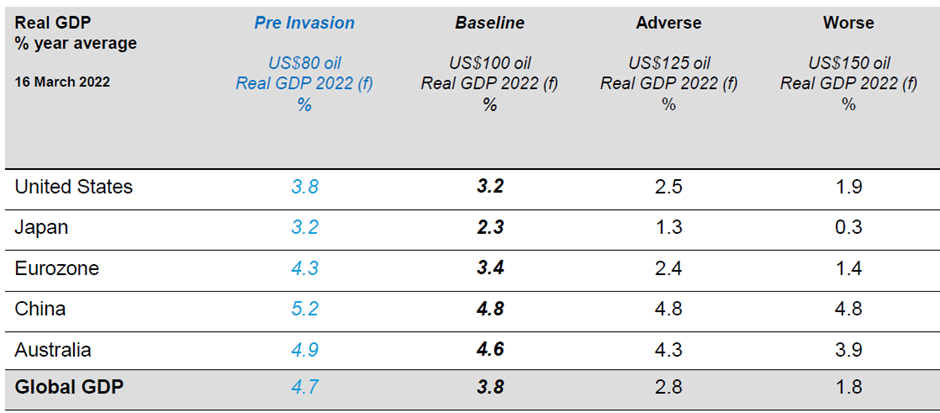

“The second shock refers to the invasion by Russia or Ukraine. The war has led to increases in energy, food and commodity. Crude oil is up 40 percent to $105, LNG is up to $7.25 up 110 percent and wheat is up 35 percent. The end result will be a rise in inflation, which will lower growth forecasts and if sustained you get a faster falling GDP to trend, that’s the profile,” says Chronis.

Chronis also looked at the impact of rising oil on GDP. He used three price forecasts. The general message here is that; if oil prices continue to rise, it will start to affect GDP on a global level, especially at around US$150 per barrel.

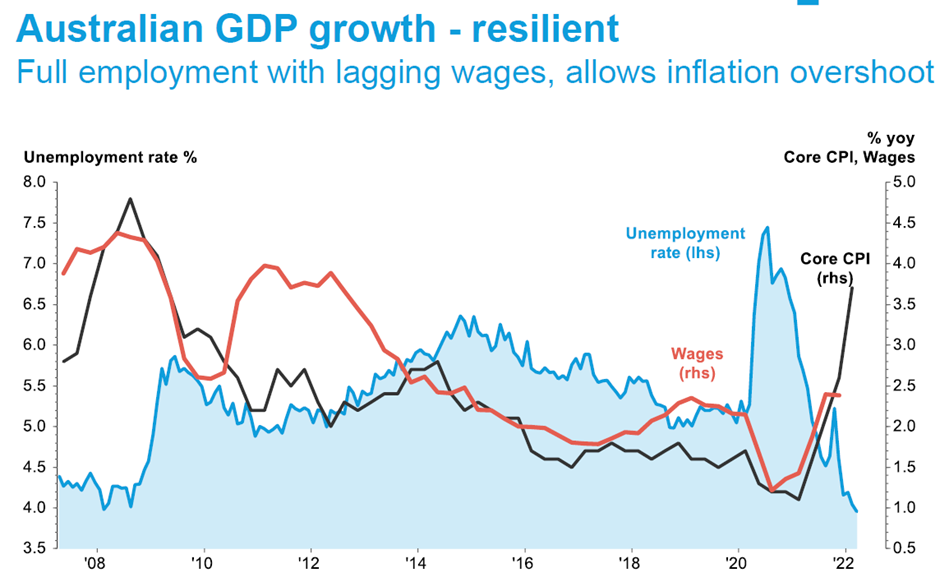

Chronis is overly optimistic in Australia saying, “We are truly a lucky country. I don’t mean that as a throwaway line. We will outperform other economies. Our export income will be greater than imports, we have super trends that will give us positive terms of trade. A strong household balance sheet underpinned by high savings and tax concessions.” He highlights the following:

- Unemployment to fall to 3.5%. Net inbound immigration to rise

- China stimulus, with a 5.5% GDP target in ’22, represents a potential boost

- AUD firming to within US75 80 cents (with upward bias 2h22)

Chronis says Australia needs unemployment needs lower than the 3’s to get inflation back. We are in a strong and favourable position. What is positive for the Australian economy is our exports. We have the largest reserve in iron ore and gas and the fourth largest in coal. Spot commodity prices are higher than what was forecast in the budget. Should these prices continue at their current rates, the net contribution to GDP is $135bn extra.”

So, the commodity outlook for Australia is positive and terms of trade is excellent. Australia’s outlook is once again quite favourable.