‘Not talented enough’: Vanguard indulges in hubris as active equity managers slide

It’s been a challenging era for active equity managers, with the consistent run of equity markets over the past 15 years – broken only momentarily by the pandemic – coinciding perfectly with the popularisation of exchange-traded funds to make passive the investment vehicle de jour for a generation.

That trend continued in the financial year to 30 June 2024, according to Vanguard’s latest S&P Indices versus Active (SPIVA) Mid-Year 2024 scorecard, with 66 per cent of actively managed Australian equity general funds underperforming the ASX.

It’s a result that’s had Vanguard’s chief investment officer for Asia Pacific, Duncan Burns, touting ETFs as a “much better alternative” than active equity managers, which are “highly likely to underperform the market”.

Burns went on to say it was a “dismal result” for the active equity investment teams trying to beat the market.

“But the story gets even worse over longer periods,” he continued. “Over the last three financial years 70 per cent of Australian equity general funds have underperformed their assigned benchmark, and that number numbers rises to more than 80 per cent after 10 years.”

After noting similar results in the US, where 75 per cent of active managers underperformed the S&P 500 over the first half of the year, Burns said most active managers were either “not talented enough or sufficiently different” to outperform markets.

“Put bluntly, Australian investors are increasingly voting with their feet because they’re realising that using an index fund to get the return from the share market is a much better alternative than using active managers that are highly likely to underperform the market,” he said.

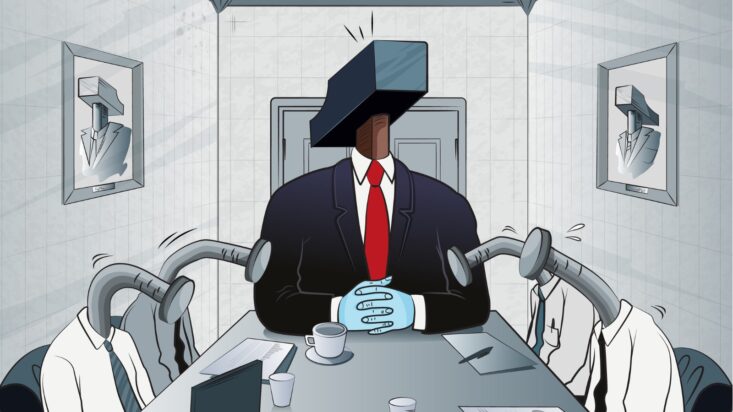

Conviction and hubris

Burns’ commentary is largely typical; one of the CIO’s core roles is to talk up their book by promoting the success of the product line. Active equity managers would do the same if they had comparable results.

His prediction that the Australian ETF market has room to grow is also very likely true. It still only represents 25 per cent of investment in Australia, much less than the US and Europe. The outperformance of ETFs may continue for some time, and is probably the long-term winner over active equity as a standalone asset.

Burns might be right, but his commentary doesn’t serve Vanguard particularly well.

Markets are cyclical, and their dips – which active equity managers typically soften – bring with them a range of risks, especially for retirees. ETFs may be a “much better alternative” to active equity in isolation, but most financial advisers will tell you they’re even more valuable as part of a diversified portfolio.

ETFs are also well suited to some types of markets, but not all. It’s why Future Fund CEO Raphael Arndt, for example, altered his all-passive strategy strategy to re-introduce active last year. “Conditions have changed,” Arndt told Investor Strategy News. “Economies are diverging and companies can better distinguish themselves in a more challenging environment.”

Moreover, when the commentary from a CIO gets invective and they start correlating their competitor’s “talent” to recent market performance, they run the risk of backing themselves into a corner. When markets turn, does that mean the talent equation has shifted?

There’s conviction, and there’s hubris. One is an asset, the other’s usually a warning.