Market sinks on US inflation, property, tech lead selloff, Atlas capital raising

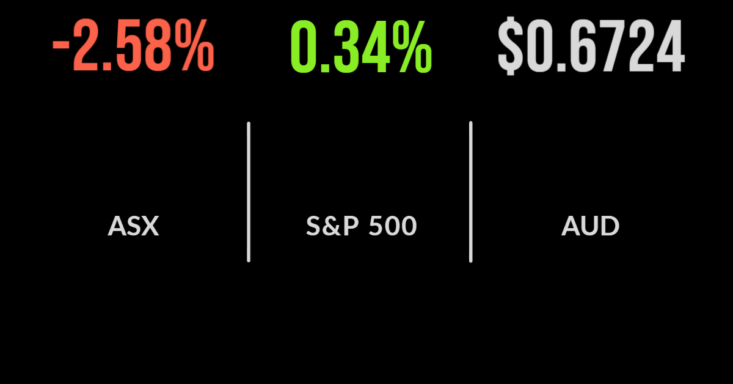

The local market fared better than global shares on Wednesday, falling 2.6 per cent in comparison to the 5 per cent drop in the Nasdaq.

There was red across the board, led by the property and retail sectors, with the likes of Charter Hall (ASX:CHC) and Wesfarmers (ASX:WES) dropping more than 4 per cent on the threat of significantly higher interest rates.

As expected, the healthcare and utilities sectors outperformed amid the volatility, falling 1.6 and 1.4 per cent with Resmed (ASX:RMD) one of just five companies finishing in the black.

In finance news, long-standing head of value manager Investors Mutual, Anton Tagliaferro has announced his retirement, bringing to an end a 25 year career after founding the company in 1998.

Atlas Arteria (ASX:ALX) has continued it’s aggressive defense against IFM Investors, with the group announcing a $3.1 billion equity raising priced at $6.30 per share to fund the Chicago Skyway purchase as the company seeks to expand it’s US footprint.

Lake sinks, Auckland traffic falls, Rio confirms Chinese support

Lithium miner Lake Resources (ASX:LKE) was once again at the bottom of the table, falling 16.5 per cent, the worst day since June.

The fall came after the group advised that the dispute with lithium extraction company Lilac had escalated with growing likelihood that key milestones would be missed.

Lilac believes the cut off is 30 November, whereas Lake believes it is 30 September.

Rio Tinto (ASX:RIO) has entered a joint venture with China Baowu Steel to develop the Wester Range iron ore project in the Pilbara.

Rio will invest $1.3 of the $2 billion but shares fell 2 per cent despite the news.

The news comes as Fitch downgraded iron ore price forecasts due to higher energy costs and a weakening of demand, now expecting US$115 per tonne.

Auckland (ASX:AIA) confirmed a 3.3 per cent fall in passenger numbers in August and a reduction in aircraft movement, sending shares down 1.3 per cent.

Markets hold steady, producer price growth slows, railroads under pressure

The three US benchmarks held off further selling pressure to post small gains across the board on Wednesday.

Led by the Nasdaq, which gained 0.7 per cent, the S&P500, 0.3 and the Dow Jones 0.1 per cent, with a slight weakening of bond yields supporting the market.

It is becoming clear that the market is now pricing in new data faster than ever before, then settling into a new normal.

On the positive side, producer price inflation, paid by companies, fell from 9.8 to 8.7 per cent, reversing the trend in consumer inflation.

Railroad stocks were the biggest drag on the S&P500, with the sector falling 2 per cent on news that several unions were threatening strikes in the pursuit of better conditions.

Finally, German gas importer Uniper, fell more than 18 per cent after the government announced they may consider nationalising the company.