Market awaits RBA decision, energy, utilities rally, Core Lithium raises capital

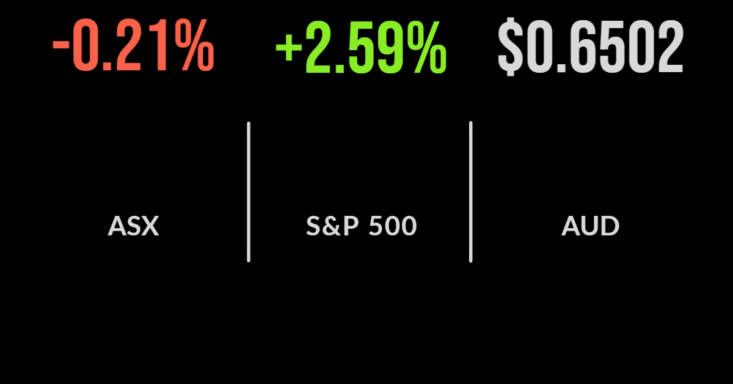

The local sharemarket finished 0.3 per cent lower to begin the new quarter, with strength in the utilities, energy and property sectors not enough to offset broader weakness in the market.

The energy sector gained 1 per cent after OPEC+ announced its intention to cut oil production in response to falling prices, just as investors were seeing the potential for some respite.

The utilities and property sectors also gained 1.5 and 0.8 per cent with Origin Energy (ASX:ORG) the bourses top performance adding 2.9 per cent.

Shares in West African Resources (ASX:WAF) fell 10 per cent, the worst of the top 200, on concerns of the impact of a change in military leadership in Burkina Faso, once again highlighting the geopolitical risk of operating in emerging nations.

Gold miners including Ramelius (ASX:RMS) dragged the materials sector lower, with a 5.6 per cent loss coming on the back of another record inflation print in Europe and a surge in bond yields in the US.

All eyes are on the RBA which is set to meet today with the consensus being another 50 basis point hike.

A2 Milk renews China distribution, Bubs seeks US approval, Core out of halt

A2 Milk (ASX:A2M) shares couldn’t overcome the weaker sentiment, falling 2 per cent, following news that the group had renewed their import and distribution arrangements with China State Farm for another five years. The partnership began in 2013 and will now extend to 2027.

Catalogue owner Infomedia (ASX:IFM) fell more than 6 per cent after management confirmed the company was yet to receive a binding takeover offer from Solera or the TA Associates led consortium seeking to take control of the company. The current offer stands at $1.70 per share.

Carsales (ASX:CAR) bucked the broader trend, falling just 0.3 per cent after the group confirmed the acquisition of Trader Interactive in the US for in excess of US$1 billion.

Shares in Core Lithium (ASX:CXO) finished 4 per cent lower after leaving a trading halt, with the company confirming they had covered the $100 million capital raising to fund further exploration at a price of $1.03.

Bubs (ASX:BUB) gained 1 per cent after confirming they had lodged a letter of intend to the US regulator for permanent access to the market after breaking into the region following a highly publicised formula shortage.

Markets offer respite, Tesla production misses, manufacturing slumps

Global markets offered some respite overnight with all three US indices jumping by more than 2 per cent.

Both the Dow Jones and S&P500 finished 2.7 per cent higher and the Nasdaq 2.4 per cent after a series of more positive announcements.

The first was the UK government confirming the cut to the highest marginal tax rate would be pared back, which came as traders and investors became concerned about the impact of liquidity in bond and equity markets.

Shares in investment bank Credit Suisse (NYSE:CS) regained more than 2 per cent after the group was making headlines due to the growing risk of default.

Credit default swaps which protect borrowers from the risk of default have jumped by more than 15 per cent in recent months.

In stock specific news, Tesla (NYSE:TSLA) fell more than 8 per cent despite confirming production of 365,000 new cars during the quarter, with the amount not up to expectations.

The energy sector was a key driver of the result, as Chevron (NYSE:CVX) and Exxon Mobil (NYSE:XOM) gained more than 5 per cent each after OPEC+ announced its intention to cut production.