Managed Accounts FUM climbs with asset markets

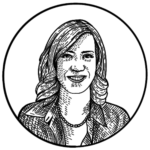

Funds under management (FUM) in managed accounts jumped in the second half of 2021, with continued growth expected in 2022 through more volatile asset markets, according to new data from the Institute of Managed Account Professionals (IMAP).

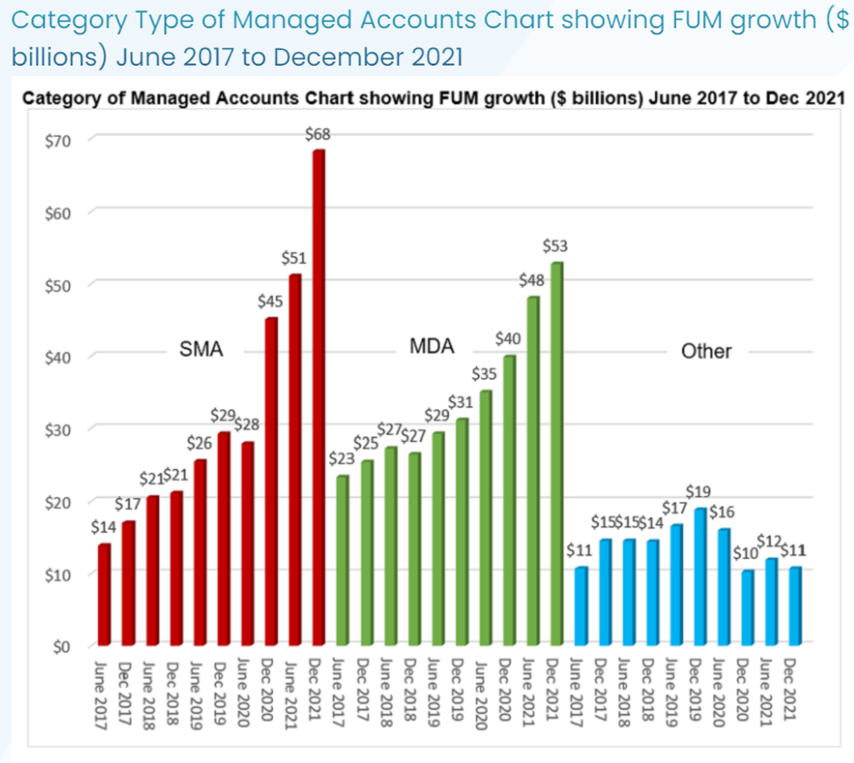

As at 31 December 2021, FUM in managed accounts stood at $131.65 billion, an increase of $21.06 billion in the six months from 30 June 2021 and a significant 38 per cent increase from FUM a year earlier.

Toby Potter, Chair of IMAP, said the growth rate in managed accounts is approaching 40 per cent per year, with annual growth rising from approximately 30 per cent as recently as June 2021.

“The increased use of managed accounts – managed discretionary accounts (MDA) and separately managed accounts (SMA) – is a good thing, not just for the value added in dollar terms, but because it is achieved through personal advice provided to clients,” said Mr Potter.

The value which the systematic approach of managed accounts embodies is even more critical in the worldwide crisis we are currently facing,” said Mr Potter.

Victor Huang, Milliman’s Practice Leader, Australia, said investment markets grew steadily in the last half of 2021, with the value of the ASX/S&P200 Accumulation Index rising 3.8 per cent over the period, compared with the 12.9 per cent increase in the prior six months.

He expects continued growth in FUM, with the level of volatility ‘definitely higher’ in the current period compared to 2021, “requiring skilful portfolio management for both the short and longer term.”

Zenith’s head of consulting Steven Tang said the strong growth would likely continue as advisers came to understand the benefits of managed accounts more widely.

“Managed accounts have experienced strong growth in the last few years, growing around 30 per cent in the past year alone. According to a recent study by Investment Trends, almost 50 per cent of advisers now use managed accounts.

“There are benefits to both the adviser and the end client. From an adviser perspective, they free up time due to the reduced administration burden, which they can spend better servicing their clients. For the end client, managed accounts result in them being invested in a professionally managed portfolio that is continually reviewed and maintained,” he said.

Not a solution for all

Tang observes that from Zenith’s client base, advisers use of managed accounts varies. “From what we observe from our client base, managed accounts are unlikely to account for 100 per cent of an advisor’s FUM given each client likely has unique circumstances and requirements, for example tax and liquidity.

“What we see is that a large cohort will use the managed accounts as a core holding and build client investment strategy around this,” says Tang.

Scott Keeley, Senior Financial Adviser with Wakefield Partners, says that in his smaller financial planning firm, portfolios are put together individually for each client and managed accounts aren’t used.

“While we understand the potential efficiencies of managed accounts, our tailored portfolio approach provides regular touch-points with the clients ensuring a more personalised service, as well as a significant portion of our income,” says Keeley.

“Outsourcing the portfolio construction, review and maintenance via managed accounts would create efficiencies, however I’d always be concerned that we lose part of our identity if we started heading down a ‘one size fits all’ path.

“Given we market ourselves, and make money from, creating tailored portfolios for individuals (i.e. no two clients have the same investments), managed accounts are the complete opposite of how we do business,” Keeley says.

Managed funds rise overall

According to data from the Australian Bureau of Statistics, the total managed funds industry rose 2.0 per cent to $4.48 trillion in FUM in the December quarter. Total assets of superannuation funds rose $93.4 billion or 2.7 per cent to $3.52 trillion during the December quarter while funds invested in retail managed funds rose 3.9 per cent to $495.2 billion.

Australians are investing record amounts in overseas markets seeking diversification and strong equity returns, according to ABS data. Offshore assets held by all managed funds, including superannuation funds, struck a record $815.0 billion, up from $780.5 billion in the September 2021 quarter. This exceeded the levels held in Australian shares which stood at $673.7 billion in the December quarter, up from $650.4 billion in September.

In contrast to rising equity investments, the amounts invested by all managed funds in cash deposits fell to $253.8 billion, down from $259.5 in the September quarter, in line with interest rates remaining at historically low levels.