It’s like the internet in the 1990s

There’s a lot of buzz around hydrogen and its potential use as a renewable energy source. Most hydrogen produced today is “grey” hydrogen, delivered by using natural gas in steam methane reforming. Looking out into the future, “green” hydrogen manufacturing, using electrolysis powered by renewable energy, is under consideration to replace the fossil-fuel-based gas production.

Following Joe Biden’s push for the US to decarbonise, Australia has committed $1.2 billion towards emission reduction technology with carbon offset schemes and four “clean” hydrogen export hubs. Hydrogen is an abundant fuel that emits no carbon. It can be burned as a combustible fuel, or it can generate electricity in a fuel cell. It’s done in four ways:

With virtually no carbon footprint, “green” hydrogen is, for many, the obvious way to go, current technology which is based around fossil fuel-based hydrogen.

Recognising the importance of hydrogen, ETF Securities has launched an ETF that invests in a concentrated portfolio of companies with deep exposure to hydrogen. The ETFS Hydrogen ETF (ASX: HGEN) will give investors access to opportunities in the emerging hydrogen economy, via 30 stocks from developed-world markets, as well as Korea and Taiwan. The portfolio will focus on companies that produce hydrogen fuel cells, make hydrogen refuelling stations and other infrastructure like storage, and companies that generate hydrogen or build electrolysers.

ETF Securities head of distribution Kanish Chugh says, “The new ETF aligns with the company’s focus on providing investment opportunities that tap into social and economic megatrends. The hydrogen economy is a greenfield investment opportunity, still in its early development stage. However, its potential applications are limitless – from making fertiliser to powering the world’s transport systems.”

In the same way Australia has done, governments around the world are providing subsidies to support the development of clean energy technologies, including hydrogen. There is already a significant pipeline of hydrogen power projects in a number of countries. A good example is local iron ore producer Fortescue Metals Group (ASX:FMG), which has pledged to achieve carbon neutrality in so-called scope 3 emissions by 2040. It will do this by making emissions-free steel while providing a renewable fuel for its fleet of eight iron ore carriers. Most of this would be done through absolute emissions reduction rather than the use of offsets. The company has identified a 300 gigawatt pipeline of potential, including 40GW in the Pilbara, and hopes to build as much 1,000GW in the longer-term.

Chugh says, “Hydrogen may be like the internet in the 1990s, or semiconductors in the 1970s. In these instances, disruptive technologies reached tipping points and saw exponential uptake. Their uptake was driven by megatrends – which are one-off structural shifts in the economy and society.”

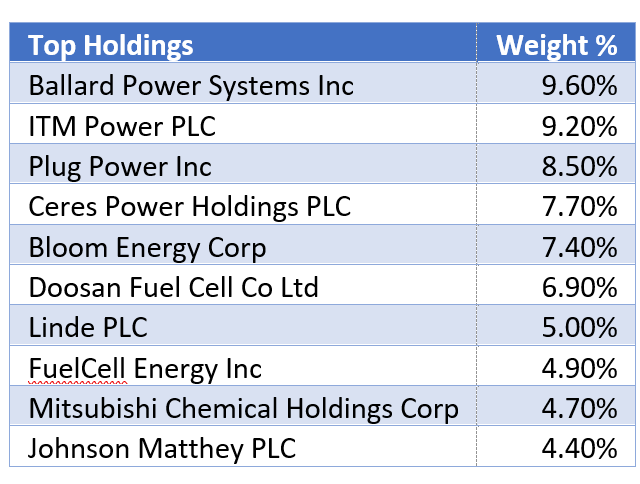

Here are the top holdings in the portfolio:

Bloom Energy in the US and Ceres Power in the UK are two companies in the portfolio that produce solid oxide electrolysers (SOEs). The technology in these devices split water into hydrogen and oxygen. allowing “green” hydrogen to be produced quickly and easily. Waste heat produced by these units can be used to boil the water. Canadian firm Proton Technologies uses advanced coal seam gas technology which can extract hydrogen from abandoned oil fields while leaving the carbon underground. This is done by reacting methane with steam, in a process called steam methane reforming: high-temperature steam is used to produce hydrogen from a methane source, such as natural gas.

Evan Metcalf, head of product at ETF Securities says, “the fund includes an ESG filter, using data from Minerva Analytics, that excludes companies involved in controversial weapons, small arms, gambling tobacco and fossil fuels, or which are non-compliant with the United Nations Global Compact. The fund also removes oil, gas and coal companies.”