Is now the REIT time to buy?

A sharp rise in interest rates over the past year has seen many rate sensitive sectors decline in value as investors apply a higher discount rate to the price that they are willing to pay for these assets and the cost of debt increases. One of the hardest hit sectors are Real Estate Investment Trusts (REITs). REITS by definition are companies that own, operate or finance income generating real estate. Within the sector the main sub-sectors are office, industrial and retail.

REITs often use large amounts of leverage due to the nature of property investments, and the result of rate hikes is that their cost of debt has increased significantly with a ~25 per cent increase in interest expense. At the same time many of the assets held are expected to decline in value, most notably commercial property, and office. A decrease in assets coupled with an increase in debt results in elevated leverage which is a key financial metric for both debt and equity investors. Ratings agencies will also be paying close attention as they will have gearing levels that can trigger a potential downgrade.

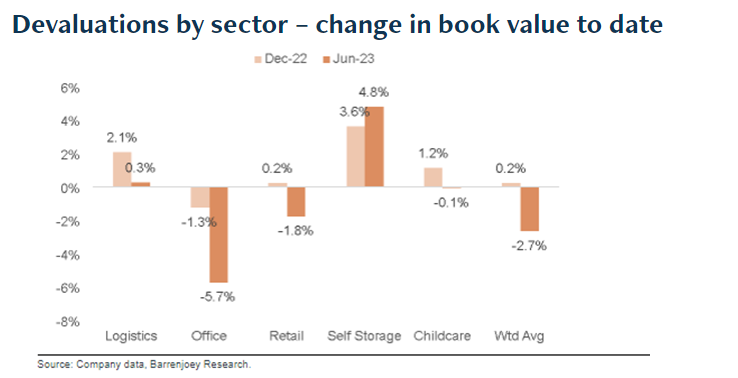

The chart below shows the devaluations that have been experienced so far. Market pricing indicates that there are more devaluations to come and REIT managers will look to smooth these devaluations out. Many expect as transaction volume picks up valuations will be forced into recognition whereas low volumes have potentially enabled REITs to delay the full impacts.

The decline in office valuations shown above has been covered extensively by media and has been expected for quite some time. There are both cyclical and structural headwinds as the original source of this devaluation is the change in working habits brought about through COVID. One of the most notable changes brought from COVID is the shift from full time in office to a hybrid model that many companies utilise, with some staff even working fully remote. The outcome is a reduction in office space required at the same time as there is excess supply due to new builds.

The effect of this change is not the same across the board, with lower grade office spaces being affected much more than A grade offices. Because of this it is important for investors to look at the composition of assets held by each REIT. Another figure to look at is the occupancy rate as this will influence the rent received from the asset. As an example, Charter Hall has a 96 per cent portfolio occupancy in office compared to the national average of 85.1 per cent.

Of course, the occupancy rate is not a failsafe as occupancy rates can mask the real risk i.e. how many workers are actually using the office space. This is something that is usually asked on analyst calls and not reported in print or press releases. Many Office REITs won’t know the true outcome of the reliance of occupancy until another lease renewal cycle takes place. That is key in the coming 18 months as many COVID leases, which were amended and extended during the pandemic years, are due to roll off.

Retail is also a sector with both structural and cyclical concerns. The retail sector is made up of regional shopping malls and large shopping centres. Because of this, their performance is heavily influenced by the end consumer and retail spending which is more volatile than other property segments. This is most notable in the current cyclical shift that we have been experiencing of higher rates and high inflation which has added significant cost pressures on the consumer. Cost of living increases are seeing a lower portion of income spent on discretionary spending especially for mortgage holders.

This is on top of the structural concerns of the growth in online shopping taking market share away from physical stores and shopping malls. Evidence of this strain can be seen by the $2.5bil worth of shopping centres in Australia that have been sitting on the market for over a year.

There are some positive takeaways from recent economic events, however. Many lease contracts have inflation adjustments so over a period of high inflation as we have experienced the level of real income is maintained in these assets. Charter Hall for example has inflation linked annual rent escalations in 21 per cent of all leases. This helps to provide an inflation hedge for investors.

The other benefit is that the structural shift away from retail due to online shopping directly benefits industrial as the need for distribution centres increases. Further it could be argued that much of the online impact has already been felt, with the most obvious in department stores e.g. Myer closing many stores and/or taking much less space. Many bricks and mortar stores have adopted an omni-channel model of online and shop face.

There is no question that the broader REITs sector faces challenges ahead and there will likely be revaluations as more transactions take place, but as the market is forward looking, much of this has already been priced in. The question instead is whether there are opportunities in fixed income markets.

Looking at historical performance, credit spreads tend to reach their highs around the peak of an interest rate cycle and outperform a few months prior to when the RBA begins to cut rates. Whilst the consensus view is that we won’t see the RBA cut rates until the 2H of next year, many economists are saying that we have now reached the terminal rate for this cycle or a possibility of one more rate hike.

The relationship to monitor here is in relation to the 10yr bond yield as there is a negative correlated return between the two so as the 10yr decreases, REIT performance increases. The AUD 10y has trended and remained higher in recent months and although volatility remains relatively high the time to start looking at REITs more seriously seems much closer than it has at anytime in the past 18 months.

A major risk for REITs is their refinancing risks and an increase in leverage as a result of asset devaluations. This makes it even more important than usual to be looking closely at respective balance sheets. What investors should look for is liquidity / funding flexibility and a buffer between current leverage versus leverage levels that would trigger a downgrade.