Infrastructure companies deliver the goods

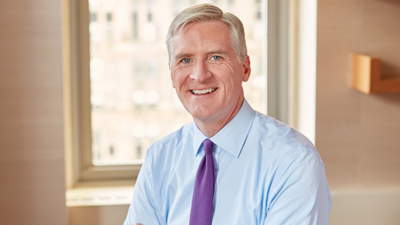

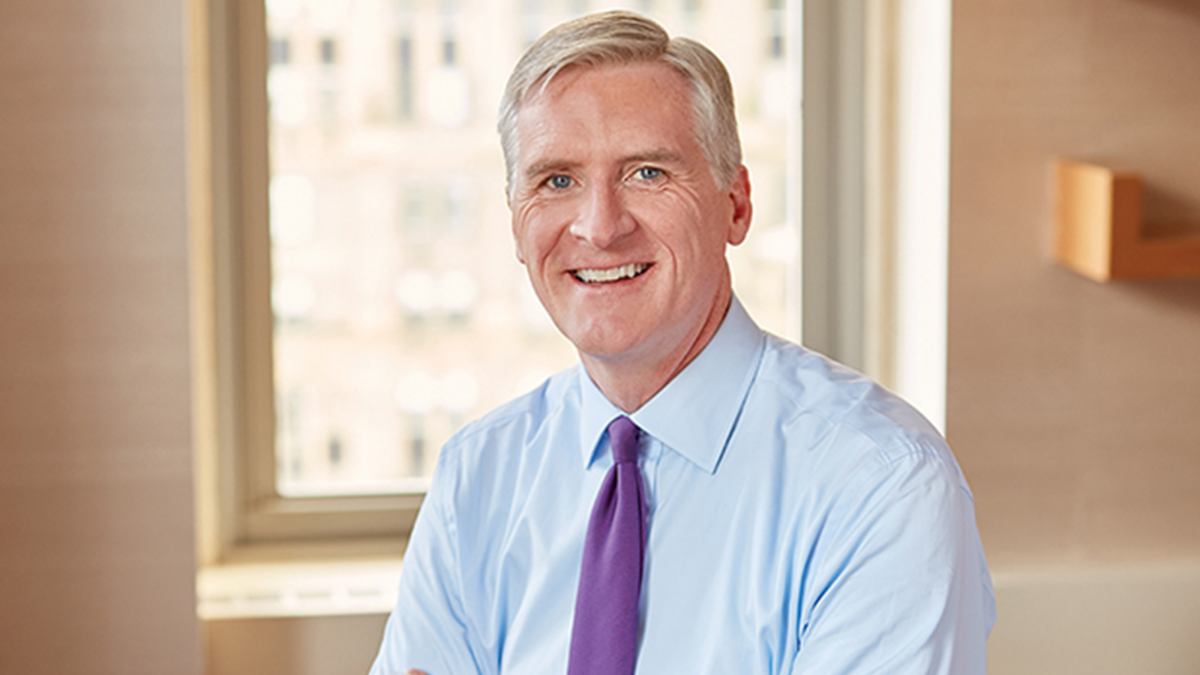

Listed infrastructure has the potential to deliver significant growth in dividends to investors, which are likely to grow well above the inflation rate, with the sector also benefitting from the move to renewable energy, according to Charles Hamieh, managing director and portfolio manager at ClearBridge Investments.

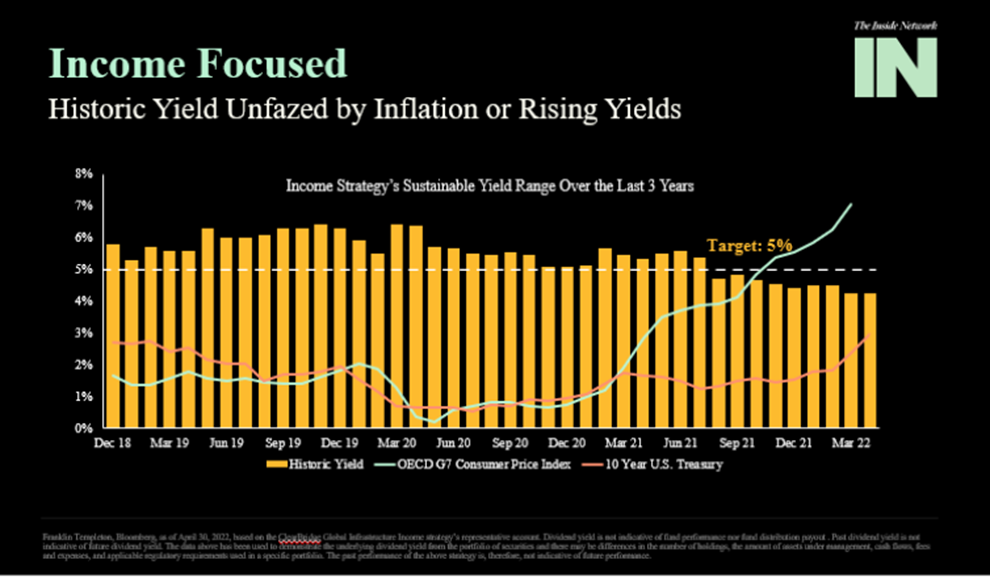

Listed infrastructure companies, such as toll roads, power utilities and airports, provide a powerful hedge against inflation. They typically pass inflation through to customers, which allows listed infrastructure providers to “consistently grow dividend yields well above inflation,” Hamieh says. That yield is not affected by inflation or rising bond yields, as the chart below shows.

Over the last six years, for example, listed infrastructure companies in the ClearBridge Global Infrastructure Income Fund strategy have delivered a yield of 5 per cent to 6 per cent. Going forward that yield will be at least 5 per cent a year, “so that is a very powerful scenario of essential services … delivering strong dividend growth,” says Hamieh.

Behind that strong income growth is the fact that infrastructure companies benefit from cash flows typically linked to inflation. Charges are often regulated by governments or underpinned by regulation or long-term contracts, meaning pricing mechanisms are “unique”, according to Hamieh. That ensures an effective inflation hedge and demand is relatively inelastic irrespective of economic conditions given listed infrastructure assets often delivers essential services. In addition, the market structure of infrastructure providers is unique compared to other real assets, often consisting of a monopoly or oligopoly, says Hamieh.

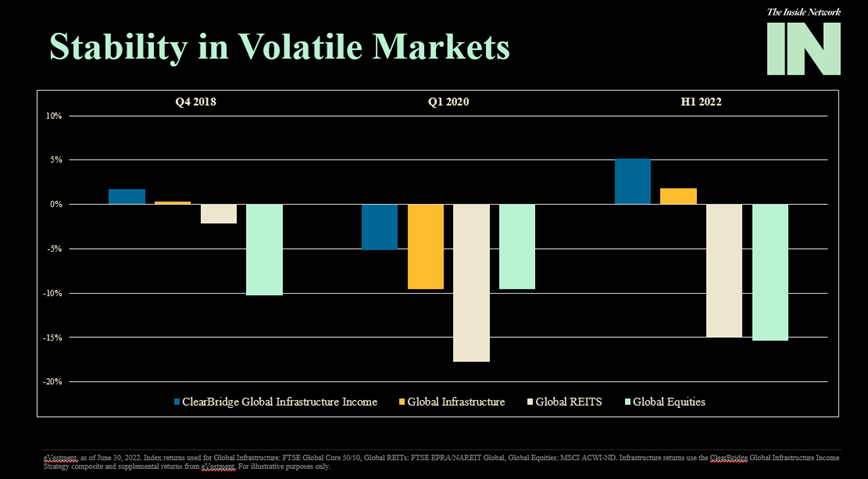

The chart below too shows the defensive element of infrastructure, with the ClearBridge Global Infrastructure Income Fund delivering less volatility than global equities or global real estate investment trusts (REITS) in recent times. Listed infrastructure offers low correlation to most major asset classes with attractive upside and downside beta, according to Hamieh.

ClearBridge believes infrastructure and utilities will see several tailwinds including decarbonisation, and valuations are attractive, according to Hamieh. Energy security too remains an issue, especially in Europe, with that accelerating the move toward decarbonisation and greater investment in energy infrastructure.

“There is no sector that is more at the forefront of decarbonisation than infrastructure and utilities,” says Hamieh.

According to Hamieh, the increase in power sector spending is forecast to rise to US$2.5 trillion annually by 2050 from US$800 million in 2020 to achieve net zero. “This growth is very, very significant … we’re talking about trillions of dollars. Most importantly, a lot of this capital expenditure will be pushed onto private companies that we invest in.”

According to ClearBribde, user-pays infrastructure and utilities performed well in the second quarter of 2022, amid a steep selloff for equities as their stable cash flows, growing dividends, essential service nature and their ability to pass through inflation offered a safe haven in a volatile quarter.

The ClearBridge Global Infrastructure Income Strategy outperformed the S&P Global Infrastructure Index by 7.66 per cent as well as broader equity markets. On a regional basis, Asia Pacific was the top contributor to quarterly performance, where Australian toll road operator Atlas Arteria led performance.

Other sources of relative support from the region included Transurban, which owns a suite of toll road assets that dominate the Australian toll road network in the three state capital cities. The company saw easing concerns on bond rates and paid a slightly better than expected second-half dividend, a sign of ongoing traffic recovery given that Transurban distributes free cash flow. APA, Australia’s largest gas pipeline operator, was also fairly resilient, offering some inflation protection and benefiting from a strong environment for gas.