‘Information overload’ creating new paradigm between advisers and clients: WEF

Increasing levels of information symmetry are changing the relationship dynamic between financial advisers and their clients, with highly-informed clients forcing advisers into conducting more responsive, two-way relationships than in previous eras, when information was less broadly available to the public.

Rather than telling clients what they need to know, advisers are engaging with their clients and helping them understand the deluge of information available.

So instead of diminishing the value of financial advice, the plethora of information that abounds in the digital age is actually increasing the need for professional discernment according to a whitepaper released by the World Economic Forum (WEF) this year.

Technology has affected the way consumers interact with financial advice in recent years, the WEF writes in its “The Future of Financial Advice” whitepaper, which was produced in partnership with Accenture. Financial product information reaches consumers in real-time, for example, while ‘finfluencers’ garner huge followings on social media and superannuation funds engage with their members directly via tailored apps.

All this enhanced accessibility draws more people to areas like capital markets, the WEF says, which is a major positive in helping bring long-term wealth security to the masses. But it comes at a cost.

“Alongside the benefits of increased access, the transformation in information consumption habits has ushered in a new era of information overload,” the report states.

“The vast expanse of the internet offers abundant financial data, analysis and opinions, presenting individuals with a myriad of sources to navigate. In this landscape, discerning valuable insights from noise becomes increasingly challenging, underscoring the importance of informed decision-making and reliable guidance in the digital age.”

These changes to financial information pathways has had a profound effect on the relationship advisers have with consumers, the report continues. Instead of feeding information to clients, advisers now manage more holistic discussions and help those clients sort the useful information from the distracting or potentially dangerous.

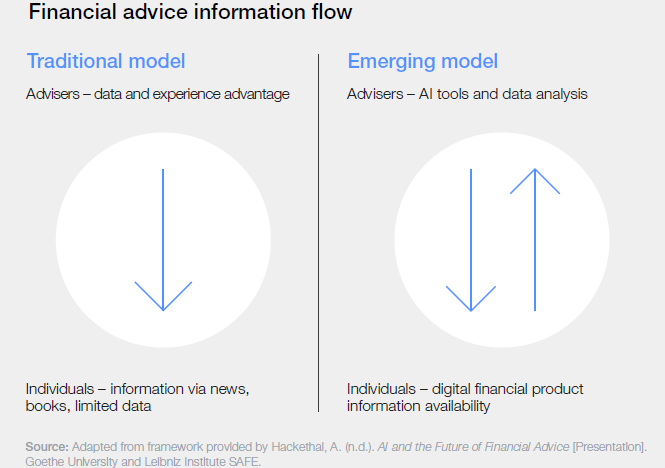

“The availability of information has shifted the traditional one-way model, where financial advisers possessed a significant information advantage, to a contemporary two-way model,” the report states. “In this new paradigm, individuals have access to more financial information. Consequently, advisers must be responsive to inbound requests for better or worse.”

To position for the future financial advice paradigm, the report continues, advisers can no longer rely on a value proposition founded on a “data and experience advantage”. Relationships still form the basis of any advice engagement, but the emerging value proposition for advisers will lean more towards AI tools and data analysis.

New advice age

The six main purposes of financial advice remain the same and need to be in sharp focus, the WEF says. Service and research, portfolio construction, risk management, financial planning, eliciting preferences and providing peace of mind all serve to equip individuals and facilitate financial stability.

But advice is changing, and technology is shifting the way each of these service pillars are provided.

Changing demographics play a role, with investors becoming more diverse and over US$72 trillion expected to be passed down through generations by 20245. The trend towards holistic financial well-being continues, while clients are expecting more digital access and hyper-personalisation. Social media will only grow in importance as a touch-point and consumer will demand pricing that is fairer and more transparent.

The path forward for financial institutions is clear, the WEF adds. Build more diverse teams, innovate and educate, incorporate the shifting goals and needs of clients, be digital-first, transparent on pricing and visible and available on social media.

And in the new advice age even more than the last, be prepared to answer a lot of questions.

There is an evolution in how financial advice is being accessed and delivered, potentially expanding affordability and access points for individuals,” the report states. “The increasing availability of information sources, including social media platforms, is prompting individuals to seek knowledge and ask questions about financial matters.”