Index manager takes out Morningstar’s Manager of the Year

Investment research firm Morningstar announced the winners of their 2022 Fund Manager of the Year this week. Last year the big names included Hyperion Asset Management, First Sentier Investors and Franklin Templeton. This year was saw a suite of different names take out the top awards with a decided tilt towards low-cost, passive strategies. In somewhat of a surprise, fund manager of the year went to Vanguard Investments Australia.

Morningstar Australasia’s Director and Manager Research Ratings, Annika Bradley said, “our 2022 winners have proven themselves to be excellent stewards of investors’ capital.”

“Australian investors are well served by a solid line-up of quality managers, but Vanguard Investments Australia wins our Overall Fund Manager of the Year award for a strong performance across their stable of funds and a preparedness to consistently put investors first,” she said.

Each finalist has been picked using a combination of qualitative research by “Morningstar’s manager research analysts; risk-adjusted medium- to long-term performance track records; and performance in the 2020 calendar year”.

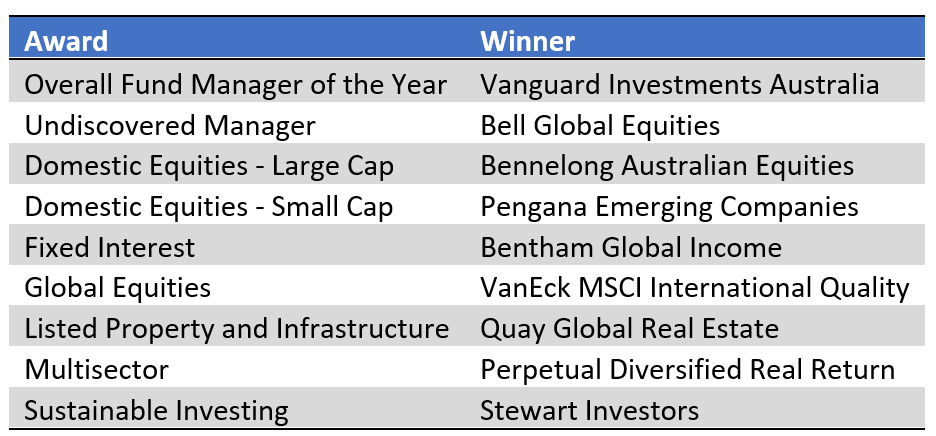

To receive the overall Fund Manager of the Year award, Morningstar says a fund manager must have offered funds in multiple award categories or delivered an outstanding outcome for investors. The table below shows the category winners, including winners for the overall Fund Manager of the Year, Undiscovered Manager and Sustainable Investing.

Ned Bell and Adrian Martuccio from Bell Asset Management took out the Undiscovered Manager award for the Bell Global Equities Fund which has been in operation since 2007. The group has several billion under management with the Global Fund invests in a globally diversified portfolio of listed shares using a long only investment strategy, with a fundamental bottom up approach to stock picking.

It returned 28.5 percent for the year beating the index return of 27.3 percent. Morningstar highlights the fact that “the strategy has flown under the radar in the retail space. The quality of the team, process and investment results makes this strategy deserving of more attention.”

The Bennelong Australian Equities fund delivered strong results to take out the Domestic Equities – Large Cap award while the Pengana Emerging Companies fund took out the Domestic Equities – Small cap award. Steve Black and Ed Prendergast from Pengana, manage the strategy and are considered among the best small-cap managers in the market.

Bentham Global Income was named the Fixed Interest manager of the year for the second time, having received the award back in 2014. The Global Equities award went to Van Eck MSCI International Quality while Listed Property, Infrastructure went to Quay Global Real Estate and Multisector was awarded to the Perpetual Diversified Real Return fund.

Morningstar also included a new category, Fund Manager of the Year Sustainable Investing Award category. Morningstar said., “The award category recognises the increasing interest and engagement in environmental, social and governance (ESG) strategies by investors and Morningstar’s own growing coverage in this area. Stewart Investors Worldwide Sustainability benefits from a best-in-class team and clear investment approach, which makes it a top global equity pick. Managed by Stewart’s Sustainable Funds Group, the strategy’s investment team is impressive.”

Ned Bell and Adrian Martuccio from Bell Asset Management took out the Undiscovered Manager award for the Bell Global Equities Fund which has been in operation since 2007. The group has several billion under management with the Global Fund invests in a globally diversified portfolio of listed shares using a long only investment strategy, with a fundamental bottom up approach to stock picking.

It returned 28.5 percent for the year beating the index return of 27.3 percent. Morningstar highlights the fact that “the strategy has flown under the radar in the retail space. The quality of the team, process and investment results makes this strategy deserving of more attention.”

The Bennelong Australian Equities fund delivered strong results to take out the Domestic Equities – Large Cap award while the Pengana Emerging Companies fund took out the Domestic Equities – Small cap award. Steve Black and Ed Prendergast from Pengana, manage the strategy and are considered among the best small-cap managers in the market.

Bentham Global Income was named the Fixed Interest manager of the year for the second time, having received the award back in 2014. The Global Equities award went to Van Eck MSCI International Quality while Listed Property, Infrastructure went to Quay Global Real Estate and Multisector was awarded to the Perpetual Diversified Real Return fund.

Morningstar also included a new category, Fund Manager of the Year Sustainable Investing Award category. Morningstar said., “The award category recognises the increasing interest and engagement in environmental, social and governance (ESG) strategies by investors and Morningstar’s own growing coverage in this area. Stewart Investors Worldwide Sustainability benefits from a best-in-class team and clear investment approach, which makes it a top global equity pick. Managed by Stewart’s Sustainable Funds Group, the strategy’s investment team is impressive.”