How to save 48 days of admin per year

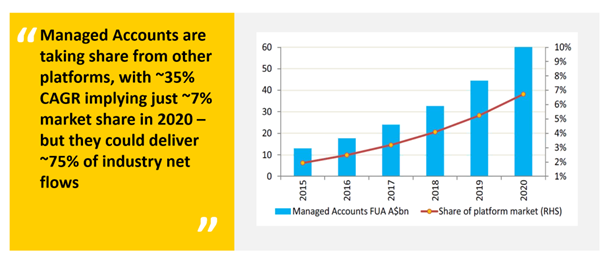

Managed accounts have been around for close to two decades, but they’ve only just started to take off. That charge is being led by financial planners and IFA’s who are shifting away from direct shares. In-fact managed accounts now make up $86 billion in funds under advice, according to Rainmaker Information’s latest Wholesale Advantage Report.

Managed accounts have continued to gain recognition primarily amongst financial advisers, increasing in funds under advice by 23 per cent over the past year and 53 per cent in the last three years.

For those that don’t know, there are three types of managed accounts – Separately Managed Accounts (SMAs), Managed Discretionary Accounts (MDAs) and Investor Directed Portfolio Services (IDPS) – SMAs are growing the most rapidly as the preferred option. The main difference with a MDA or say a managed fund is that the client owns the individual assets directly, rather than in a unit trust. Managed account use among IFA’s is due to simple fact that they can implement them a lot quicker and cheaper more rapidly because they could make faster choices on how they managed their clients’ funds.

Head of Portfolio and Business Consulting at Russell Investments, Sophie Antal-Gilbert, discussed how they help advisers adopt managed accounts and the benefits both for advisers and investors. Antal-Gilbert first talks about how MDA’s can address the challenges that advisers face. These include technological disruption, regulatory scrutiny and client changing preferences.

Antal-Gilbert highlights, “There was some research done on advisers who outsource and use professional money management and use managed accounts. The study looked at advisers using managed accounts who were outsourcing 50-89 per cent of their AUM. How much time were they able to gain back? The report said roughly 7.7 hours per week. Take that out to a year and that’s 385 hours per year or 48 days. If you had this time given back, what would you do?”

With portfolio’s being managed professionally, the performance of portfolios built by professional managers can vary quite dramatically from a portfolio managed by a financial adviser. Antal-Gilbert says, “Managed accounts provide clients with many benefits. For example, we can match a client’s objectives to the portfolio and vice versa when using managed accounts.”

Clients are looking most for a personalised experience. That asset allocation experience. Behaviour and emotional coaching. They seek someone to hold their hand through the doom and gloom. Investment platforms such as Netwealth, have made the whole process a lot easier, prompting the shift away from direct equities and onto managed accounts. Platforms provide reporting and administration efficiencies, which save advisers time and lessen the work burden. Managed accounts also provide greater regulatory oversight.

Challenges with existing investment models include – costly and time-consuming Records of Advice. They also are a suboptimal way of managing portfolios. This is where MDA’s can help. Fund of fund managed accounts provide efficiency but are expensive. ETFs are the next option – cheap. But where is the value add? Especially given the ETF and Robo advice offerings coming to market.

Multi asset portfolios combine the best of both worlds. There are no ROAs. Active management with scope for alpha generation. Much greater scope for adviser to demonstrate ongoing value add and foster greater client engagement. An adviser can play a key role in investment communication decisions even if they aren’t making themselves.

The direct equities and ETF approach has many advantages, firstly no ROA. Secondly assuming the right fund manager is selected, skills come from the fund manager to provide active management. All in all, this type of managed accounts comes with a 50-70bps points fee. It’s highly compelling and competitive.