Hit to retirement savings expected in 2021-22

As share markets fall, superannuation research houses are predicting a negative financial year for both balanced and growth superannuation funds. But over time, growth and balanced funds have delivered a strong run of returns, according to the researchers.

Chant West has forecast that superannuation growth funds will deliver a median loss of 0.5 per cent for the financial year return ending June 30. Even if growth funds finish the year in negative territory, that would be only the fifth time in 30 years since the introduction of compulsory super in 1992, according to Chant West senior investment research manager Mano Mohankumar.

“Whatever the result this year, it will come on the back of the 18 per cent return in 2020-21, which was the second best in the history of compulsory super,” said Mohankumar.

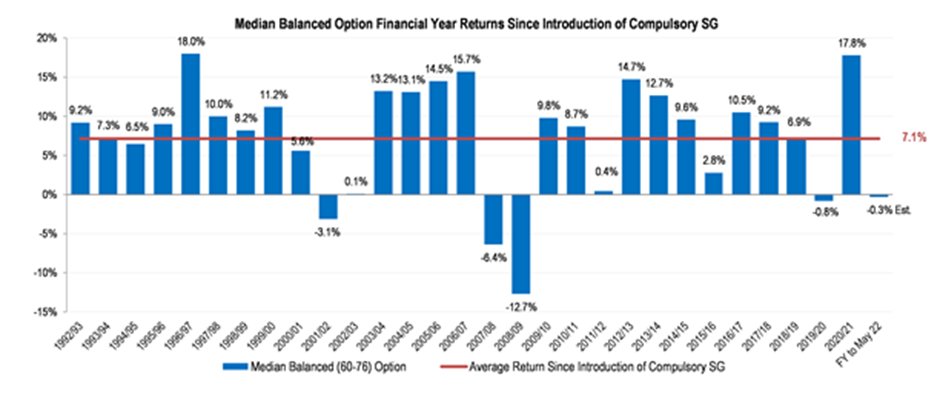

Meanwhile, SuperRatings has estimated that the median balanced option fell by 0.9 per cent in May, to give an estimated loss of 0.3 per cent for the year ending 31 May 2022, which would be down from a return of 17.8 per cent for the previous financial year.

Long-term returns remain strong

Looking back over the past decade, Chant West says superannuation growth funds have seen an unusually strong run of returns averaging 8.4 per cent a year.

“That’s been great, but members shouldn’t expect performance to continue at that sort of level. It’s not sustainable and it’s not what these funds are designed to achieve. The typical long-term return objective for growth funds is to beat inflation by 3.5 per cent per annum (p.a.). That translates to about 6 per cent p.a. in absolute terms,” Mohankumar said.

“And even in FY20, which included the COVID-induced share market meltdown, the loss was limited to just 0.6 per cent. So, super funds have been able to navigate successfully through the worst of the pandemic, and members should take comfort in that,” he said.

Super funds beat volatile share markets

While the investment environment has been difficult, the volatility of super fund returns has been much lower than that of share markets, highlighting the benefits of diversification, said the executive director of SuperRatings Kirby Rappell.

“Whilst it has been a pretty challenging time for markets and savings, it is important to put this all into context. Superannuation is a long-term investment and funds have delivered strong performance on average over time.

“While it’s hard to see your retirement nest-egg bouncing around, it’s important to remain focused on taking a long-term outlook and trying to avoid getting caught up in the noise,” Rappell said.

The median growth option fell an estimated 1.2 per cent in May. Capital stable options were slightly more resilient, with a fall of 0.5 per cent, due to their greater exposure to bonds and cash.

Accumulation returns to May 2022

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SR50 Balanced (60-76) Index | -0.9% | 1.6% | 6.2% | 6.5% | 6.2% | 8.3% |

| SR50 Capital Stable (20-40) Index | -0.5% | 0.0% | 3.0% | 3.6% | 3.8% | 4.9% |

| SR50 Growth (77-90) Index | -1.2% | 2.3% | 7.6% | 7.7% | 7.2% | 9.6% |

Pension returns also declined in May, with the median balanced pension option down an estimated 1.1 per cent; while a drop of 1.3 per cent was estimated for the median growth option and a fall of 0.6 per cent was determined for the median capital-stable pension option.

Pension returns to May 2022

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SRP50 Balanced (60-76) Index | -1.1% | 1.9% | 7.1% | 7.2% | 6.9% | 9.4% |

| SRP50 Capital Stable (20-40) Index | -0.6% | -0.2% | 3.2% | 3.9% | 4.0% | 5.3% |

| SRP50 Growth (77-90) Index | -1.3% | 2.4% | 8.3% | 8.5% | 7.9% | 10.7% |

Source: SuperRatings estimates

Strong performance over time

The chart below from SuperRatings shows that the average annual return since the inception of the superannuation system for balanced funds is 7.1 per cent, with the typical balanced fund exceeding its long-term return objective of 3.0 per cent above the Consumer Price Index (CPI). The estimated loss of 0.3 per cent for the financial year ending 31 May 2022 represents a dip. However, “years in which performance has been negative are typically followed by bounce backs in returns and a positive outcome since 1992 is evident on average,” according to SuperRatings.