Growth managers continue to shine

It’s been a while since “value investing” made sense: the style has suffered a dreadful stretch of performance since the 2008 financial crisis. The ‘Warren Buffett’ mantra of buying low (cheap) and selling high has seen value-oriented managers underperform the market year after year. But that’s not to say value investing is dead, it’s just lost its value. I mean, technically, all investing is value investing. Experts say tech dominance, together with record low interest rates and a decade-long bull run, are the main reasons why value investing simply doesn’t work. The smart fund managers are picking growth stocks, like Afterpay (ASX:APT) and Wisetech (ASX:WTC), because of their future earnings potential. Fund managers that stayed clear of growth stocks such as ones in the “Buy Now Pay Later” (BNPL) phenomenon, will have missed out on a once-in-a lifetime tech bonanza. They will have also underperformed the market by a long shot. The divergence in Australian share fund returns in 2020 has been huge, with the difference between the best and worst as much as 30% in some cases.

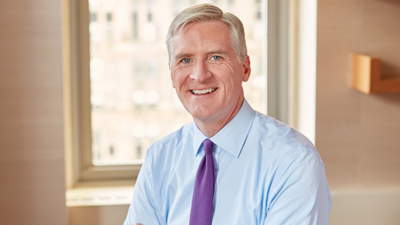

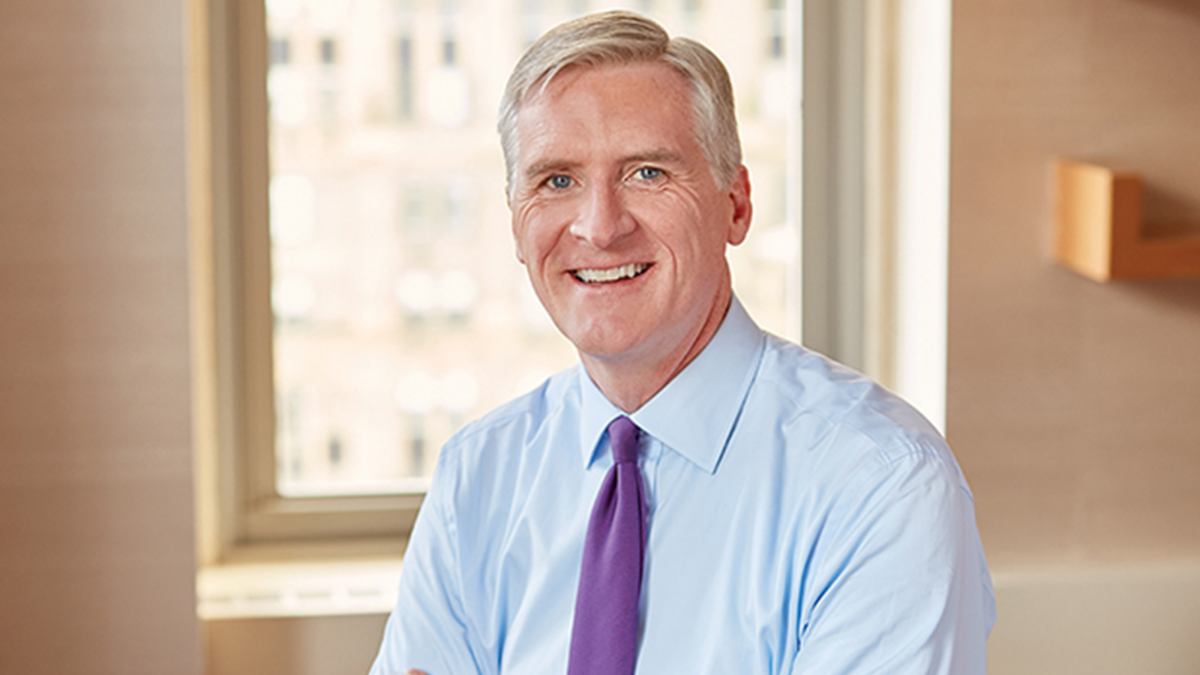

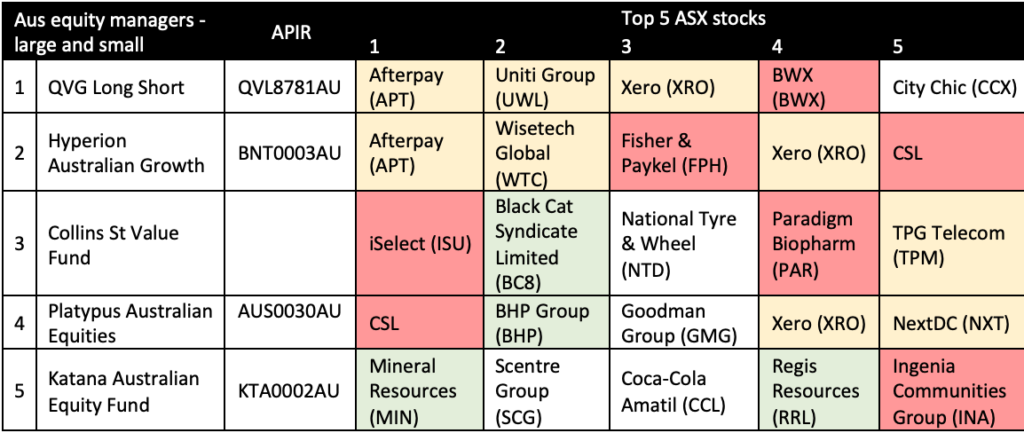

Healthcare, tech and mining were fund-manager favourites in the 2020 financial year. COVID-19 did spice things up a little, but in the end it acted as a tailwind giving the tech, healthcare and BNPL sector a big leg-up. Topping the list from 140 funds was QVG Capital’s long/short fund, which posted an annual return of 29.3%. The top five fund managers for the last financial year are listed in the below table:

From the above table, you’ll notice that we have highlighted tech in yellow, healthcare in red and mining in green. What you will also notice is that the stocks the fund managers picked were mainly small to mid-caps.

Mercer released its quarterly performance update for the best (and worst) Australian fund managers at the end of July. The global consulting leader said “Healthcare and IT allocations were the key contributors to positive performance in the last year, with Energy and Financials as the major headwinds. The ‘value versus growth’ conundrum is a global phenomenon and Value-focused strategies e.g. low P/E stocks, continued to frustrate investors over the quarter and one-year horizon, while Quality themes, such as companies with low levels of debt, performed very well during a tough period.”

Mercer also pointed out that “the S&P/ASX Mid 50 Index and S&P/ASX Small Ordinaries Index have both outperformed the S&P/ASX 300 Index in the June quarter, while the large-cap S&P/ASX 50 Index has lagged the market. The higher interest in smaller-market-cap companies appears to signal an increase in risk appetite of investors in the current environment. The outperformance in mid-cap and small-cap stocks this quarter was driven by the likes of JB Hi-Fi, Appen and Kogan.com.”

Growth stocks like Afterpay continued to shine. “As such, while Quality/Growth managers like ECP Asset Management and Greencape Capital continued to perform well, Value managers like Merlon Capital Partners and Dimensional Fund Advisers were also within the upper quartile in the June quarter.”

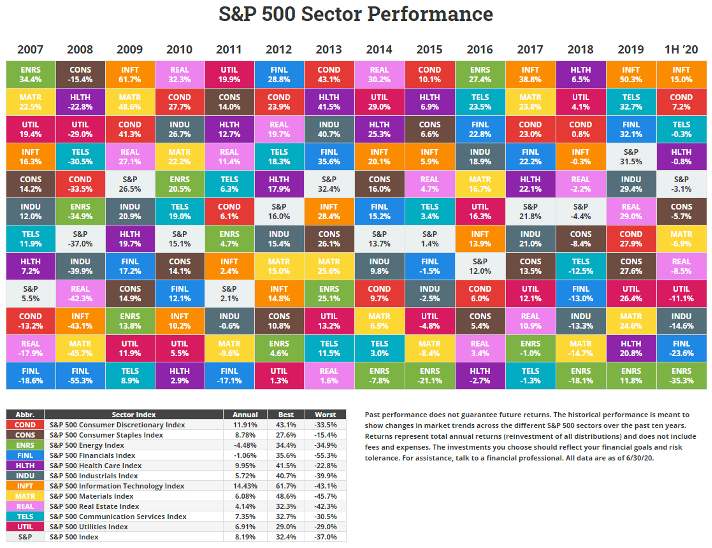

And so, it was another year of small-caps performing better than the larger-cap stocks in the market, driven by IT, Healthcare and Materials; while Energy, Financials and Real Estate lagged. Fund managers exposed to high-growth and quality companies did better than value-based managers. Will this trend continue into 2021?

While it’s too early to say and there is still a long list of geo-political events that are yet to play out, such as the US election, IT and consumer discretionary remain the largest outperformers versus the benchmark for the past three months. COVID-19 has accelerated e-commerce, BNPL and online activity. We cannot see this trend being interrupted anytime soon and expect it continue through to next year.