FSC, product providers bemoan lack of support from ASIC on innovation

The corporate regulator’s reluctance to work with product providers on bringing new technology-based financial services products to market is hindering innovation and stifling the ability of licensees and large companies to move the industry forward, according to a panel conducted by the Financial Services Council.

On what was set up as a discussion around the implementation of proposals put forward by the Quality of Advice Review, the topic repeatedly shifted to the frustration providers felt at not being able to work with ASIC to bring compliant solutions to market.

According to Abrdn Australia managing director Brett Jollie, UK regulator the Financial Conduct Authority facilitates a much more collaborative approach than ASIC.

“The FCA effectively assigns us a case officer to work with to provide guidance, support, feedback, and ultimately demonstrate that we’re compliant or not,” Jollie explained. “You’re building something new, so to get to have that confidence [with] the regulator standing behind you saying ‘this is suitable for consumers, we’re signing off on it’… compare that to Australia, where the view at ASIC is very much, ‘we don’t provide guidance or support or feedback on corporate development or any sort of institutional products’.”

It’s a common complaint in the industry and comes as an indictment against ASIC’s ‘enhanced regulatory sandbox’, which is designed to provide an exemption for businesses to try “certain innovative financial services or credit activities” without an AFSL.

Jollie, whose $600-odd billion parent firm is based in the UK, said co-ordinated support from the Australian regulator would make a “massive difference” to helping bring new products to market and bridging the advice gap.

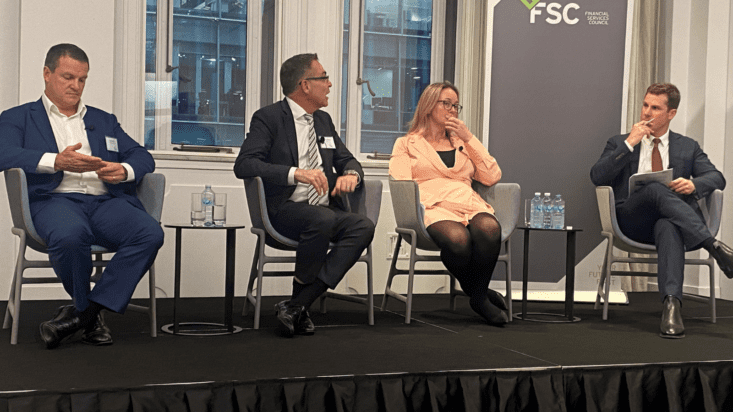

There was a modicum of sympathy for ASIC, however, with an acknowledgement among the panelists, which included FSC CEO Blake Briggs, HUB24 CEO Andrew Alcock and CFS head of super Kelly Power, that the government hasn’t set the regulator up to be an effective collaborator.

Giving confidence to providers wasn’t in the “remit” of ASIC, Jollie said.

The FSC’s Briggs questioned whether policymakers and the regulator carried a “2013 mindset”.

“The benefits consumers and the potential for investment in this market is so great,” Briggs said. “But is the message getting through to ASIC that these changes are necessary to harness this potential? Is that being passed on and is the government hearing?”

Money to burn

Since the banks’ collective exit from financial advice in the wake of the Hayne Royal Commission, there has been a capital void that has left the industry short on providers with deep enough pockets to fund large scale innovation, leaving smaller tech providers struggling to get solutions scaled up and into market.

According to Alcock, investment platform provider HUB24 is one of the entities that should be investing in new tech but struggles to do it effectively without collaboration from the regulator.

“We surprisingly sit on stage here being the company with capital,” Alcock said. “For us it’s about broadening the front offering but it’s also about supporting innovation in advice. Technology can do a whole lot of things; we can work on technology that can do SOAs in different ways and digitise a video into data, we can check for or prevents errors rather than having to detect them afterwards and remediate [clients], but right now we’re spending money investing in things that don’t add value.”

The platform provider is spending capital building processes and systems “that probably shouldn’t exist”, he said, because there’s a limit to what they can currently do.

It would be “wonderful”, Alcock said, if Australian providers could work in collaboration with the regulator to bring new solutions to the market.