Emissions retreat as energy transition takes effect: Australian Ethical

Fossil fuels still power the majority of Australia’s core energy needs, but the tide is turning as stewards of capital devote resources and capital towards renewable energy sources like wind and solar.

What’s most interesting about the transition, and particularly the stage we’re at in this point in time during the energy transition, is how rapidly it’s all about to change according to Australian Ethical. Emissions have steadily been decreasing since they peaked in 2009, and have actually come down 24.5 per cent since 2005.

But back then, solar and wind were miniscule industries. Now, with investment from stewards of capital like Australian Ethical, which manages over $10 billion, they are robust sectors with strong pipelines and they’re making a real difference to emission levels.

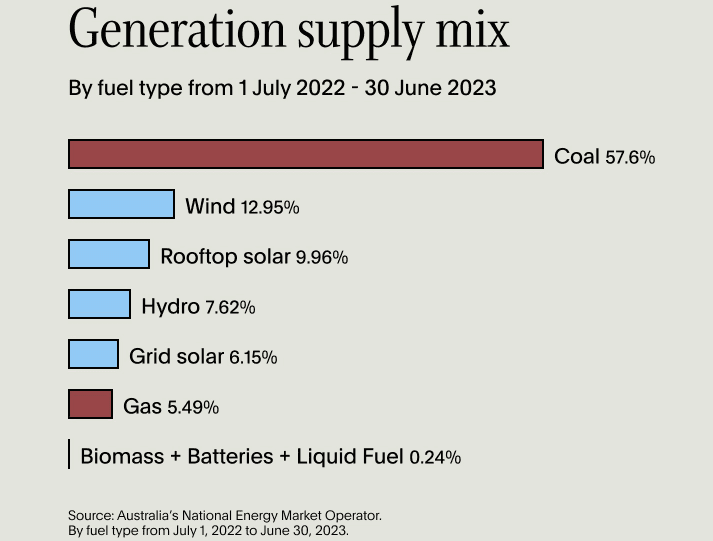

The way we power our phones, turn on our lights and run our companies is still very emissions intensive, with coal (57 per cent) and gas (5.5 per cent) still combining for 63 per cent of our power last year. The emissions produced from this burning of coal and gas to form electricity were responsible for 32 per cent of all emissions in the country to September last year.

But the transmission away from these sources is happening in real time. And it needs to, because the more renewable energy we introduce into the energy grid, the les we need to use the fossil fuels that produce emissions. It’s also cheaper, which validates the investment direction of ethical money managers like Australian Ethical.

The good news, as stated by the Australian Ethical team in a recent post, is that the government is right behind this transition.

“The recent Federal Budget handed down in May carved out massive investment in critical minerals, green hydrogen as well as green metals, batteries and low carbon fuels to accelerate the transition to net zero as part of its so-called ‘Future Made in Australia’ plan,” Australian Ethical stated. “More than $20 billion over the next decade will go towards projects and incentives to get more renewable energy generation and clean dispatchable capacity into our homes.”

The progress on emissions to this point is evidence that the transition to renewable energy sources is working, Australian Ethical argues.

“In the year to September 2023 the energy sector recorded a close to 4.9 per cent decrease in emissions, a direct result of decreases in gas (28 per cent) and coal (4 per cent). During this time Australia’s National Energy Market measured a 15 per cent increase in renewable energy generation,” the group stated, adding that further investment and the natural progression of technology both act as tailwinds in emission reduction.

“It’s rooftop solar as well as grid-scale solar and wind that’s replacing fossil fuel energy generation. This is happening gradually as more capital finds its way to fund these projects, and battery technology gets stronger and lasts longer so energy can be stored and deployed when and where it’s needed the most.”

For the Australian Ethical team, the path from here involves furthering the cause through astute investment in companies that can help Australia move towards its goal of 83 per cent renewable energy by 2030, as per the Paris Agreement.

“For our part, we are seeking out investments in renewable energy generation and innovation that will accelerate the proportion of renewables powering our grids,” Australian Ethical stated. “We do this in part because we think renewable energy is the most cost-effective way to deliver energy and because we believe it is good for long term investment returns.”