Earnings, US inflation weigh on market

The local share market slipped on Monday ahead of US inflation numbers on Thursday, and as Australia’s first full week of earnings season kicked off.

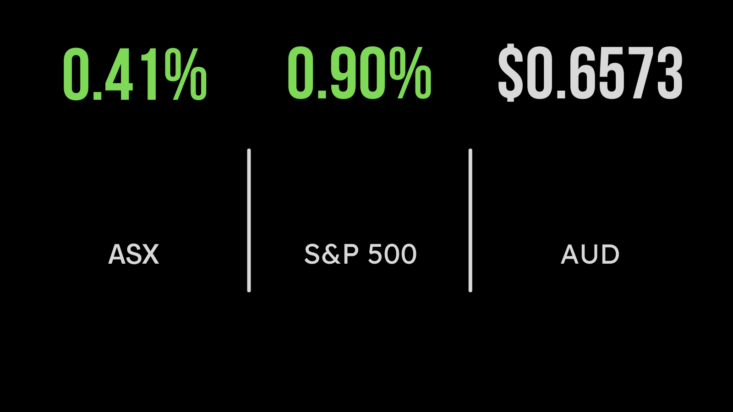

The benchmark S&P/ASX200 index retreated 16.1 points, or 0.2 per cent, to 7,309.2, while the broader All Ordinaries dropped 16 points, also 0.2 per cent, at 7,519.9.

Earnings season begins in earnest this week, with Commonwealth Bank, Suncorp, AMP, QBE, Downer EDI, AGL, Boral, Newcrest, and REA Group among others set to announce earnings results.

Healthcare major ResMed has already reported, and the disappointing result last week continued to weigh on the share price, down a further $1.30, or 4.2 per cent, to a 13-month low of $29.40. CSL also pressured the healthcare sub-index, losing $2.98, or 1.1 per cent, to $262.16. But aged care operator Estia Health jumped 24 cents, or 8.5 per cent, to a five-year high of $3.08, on the back of an $838 million deal by which it will be taken private by Bain Capital (owner of Virgin Australia) for $3.20 a share.

In the major banks, Westpac eased 15 cents, or 0.7 per cent, to $21.83; and ANZ dropped 15 cents, or 0.6 per cent, to $25.30, while National Australia Bank added 1 cent to $27.96, and CBA eased 2 cents to $101.85. The insurance stocks helped to drag the financials index lower, with Suncorp falling 36 cents, or 2.6 per cent, to $13.77; QBE losing 28 cents, or 1.8 per cent, to $15.65; and IAG giving up 10 cents, or 1.6 per cent, to $6.00. Global investment bank and wealth manager Macquarie advanced 64 cents, or 0.4 per cent, to $176.08, while Afterpay’s owner Block lost $11.10, or 10.1 per cent, to $98.41.

Industrial group GUD Holdings led the S&P/ASX200, rising 39 cents, or 3.9 per cent, to $10.37 after selling its pumps business Davey Water Products to ASX-listed water solutions company Waterco, for $64.9 million. GUD will now focus on its automotive accessory brands such as Ryco Filters and AA Gaskets.

Mixed bag in lithium

Among the resources heavyweights, BHP dropped 23 cents, or 0.5 per cent, to $45.57; Fortescue Metals fell 34 cents, or 1.6 per cent, to $21.05; and Rio Tinto eased 89 cents, or 0.8 per cent, to $113.94.

Lithium producer Allkem added 34 cents, or 2.4 per cent, to $14.70; fellow producer Pilbara Minerals gained 19 cents, or 3.8 per cent, to $5.18 as it boosted the mineral resource estimate at its flagship Pilgangoora mine in WA by 36 per cent.

IGO, which mines nickel as well as lithium, walked back 4 cents to $13.76, while Mineral Resources, which produces iron ore and lithium, surrendered 54 cents, or 0.8 per cent, to $69.42.

Sayona Mining gained half a cent, or 3.5 per cent, to 15 cents as it sold its first shipment from its Quebec lithium mine; and junior Lithium Australia shares soared 2.2 cents, or 66.7 per cent, to an 11-month high of 5.5c after striking a deal with mining giant Mineral Resources to develop its lithium extraction technology. But Lake Resources plunged 4 cents, or 18.6 per cent, to a two and a half year low of 18 cents, as it answered a query letter from the ASX regarding Lake’s announcements about its Kachi project in Argentina.

US market on the move ahead of inflation data

In the US, the blue-chip Dow Jones Industrial Average put in its best day since mid-June, adding 407.51 points, or 1.2 per cent, to close at 35,473.13, as investors kicked off a week with more corporate earnings and a key inflation reading.

The broader S&P 500 index advanced 40.4 points, or 0.9 per cent, to close at 4,518.44, while the tech-heavy Nasdaq Composite index moved 85.16 points, or 0.6 per cent, higher to 13,994.4.

On the bond market, the US 10-year Treasury yield gained 4.6 basis points to 4.092 per cent, while the 2-year yield eased 1.3 basis points, to 4.77 per cent.

Gold is trading US$7.30, or 0.4 per cent, lower at US$1,936.60 an ounce, while the global benchmark Brent crude oil grade slipped 90 cents, or 1 per cent, to US$85.34 a barrel and US West Texas Intermediate crude advanced 49 cents, or 0.6 per cent, to US$82.43 a barrel.

The Australian dollar is buying 65.72 US cents this morning, down slightly from 65.75 US cents at Monday’s ASX close.