Earnings season, US inflation on market’s mind

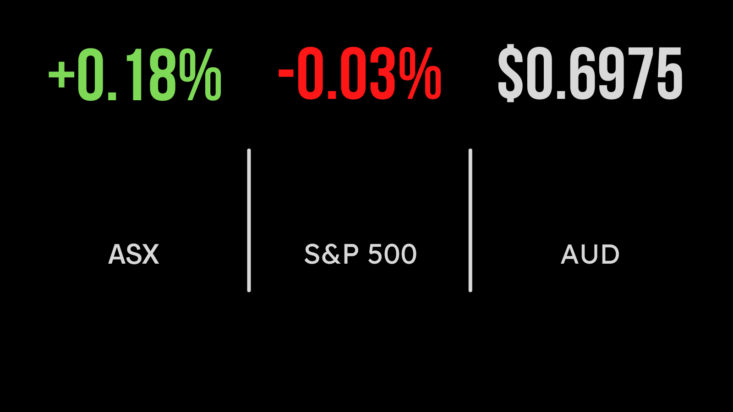

Earnings season and the need to keep a weather eye on the US inflation print competed for influence on the Australian share market on Tuesday. By the close the benchmark S&P/ASX 200 gauge had added 13.1 points, or 0.2 per cent, to 7,430.9, while the broader All Ordinaries index gained 14.1 points, or 0.2 per cent, to 7,628.6.

Leading the gains were investment business Challenger, which jumped 32 cents, or 4.4 per cent, to $7.58 after confirming its guidance for the full financial year; and metal and plastic recycler Sims, which spiked $1.04, or 7.1 per cent, higher to $15.72, despite reporting a 60 per cent fall in interim earnings, as investors factored-in an improving outlook.

Rubber glove and protective equipment maker Ansell downgraded its profit outlook after the market closed on Monday night, warning it was still being hurt by the normalisation of global supply chains after the pandemic. The Monday evening release only delayed the inevitable: Ansell shares tanked 8.7 per cent in early trade on Tuesday, down $2.45 to $25.64, and that’s where the stock closed.

Shell-shocked Star Entertainment Group shareholders thought Monday was bad enough, when the stock plunged 39 cents, or 20.8 per cent, to what was an all-time low of $1.485, but the stock extended that fall on Tuesday, sliding a further 20 cents, or 13.5 per cent, to close at $1.28. In two days, Star has fallen almost one-third. Brokers have flagged the prospect that the embattled casino operator may need a $400 million—$500 million equity raising to recapitalise itself.

Online homeware and furniture retailer Temple & Webster plunged $1.33, or 26.9 per cent, to $3.62, after reporting that sales fell 7 per cent in the first five weeks of trading in 2023.

Appliances star Breville and building products group James Hardie Industries were also hit hard after flagging a challenging outlook. Breville shed $1.02, or 4.7 per cent, to $20.68, while James Hardie lost $1.35, or 4.2 per cent, to $30.40.

Lithium losing lustre

With benchmark lithium carbonate prices falling in China to an 11-month low, the lithium stocks are coming under increasing scrutiny from investors — not to mention the short-sellers that are active in the stocks. Producer Allkem was down 13 cents, or 1 per cent, to $12.50; fellow producer Pilbara Minerals was flat at $4.85; IGO, which produces nickel as well as lithium, slid 10 cents, or 0.7 per cent, to $14.41; and Mineral Resources, which mines iron ore and lithium, retreated $3.76, or 4.1 per cent, to $87.03.

Of the lithium project developers, Core Lithium was down 1.5 cents, or 1.5 per cent, to $1.01; and Lake Resources lost 2.5 cents, or 3.6 per cent, to 68 cents; and Sayona Mining was down 1.5 cents, or 6.1 per cent, to 23 cents.

Of the major miners, BHP surrendered 15 cents, or 0.3 per cent, to $47.72; Rio Tinto lost 82 cents, or 0.7 per cent, to $121.50; but Fortescue Metals managed a rise of 4 cents, to $22.18.

In energy, Woodside Energy eased 39 cents, or 1.1 per cent, to $36.23; Santos moved 4 cents, or 0.6 per cent, higher to $7.11, despite a $469 million impairment, as oil reserves jumped to a record level; Beach Energy gained 3 cents, or 2 per cent, to $1.54; and Brazilian-based producer Karoon Energy advanced 9 cents, or 4 per cent, to $2.32.

In coal, Whitehaven Coal retraced 2 cents to $7.91; New Hope Corporation was up 1 cent at $5.41; Coronado Global Resources surged 9 cents, or 4.5 per cent, to $2.11; Yancoal Australia gave up 2 cents, or 0.4 per cent, to $5.64; and Terracom slipped 2.5 cents, or 3.2 per cent, to 76 cents.

Among the major banks, Westpac gained 16 cents, or 0.7 per cent, to $23.86; ANZ added 5 cents to $25.75; and National Australia Bank closed up 23 cents, or 0.7 per cent, at $31.61; but Commonwealth Bank went against the trend, slipping 5 cents to $109.25. Investment bank Macquarie Group was up $1.26, or 0.7 per cent, to $191.66

US inflation shows staying power

On the US market, the much-awaited January consumer price index (CPI) report showed that inflation grew at higher-than-expected 6.4 per cent annual rate, propelled by higher food, energy and housing costs.

The stubbornly strong inflation report disappointed investors, carrying the heavy implication that the Federal Reserve will continue to take a hard line on interest rates. The 30-stock Dow Jones Industrial Average retreated 156.7 points, or 0.5 per cent, to close at 34,089.27, while the broader S&P 500 index eased 1.2 points to 4,136.13. The tech-heavy Nasdaq Composite managed a rise of 68.4 points, or 0.6 per cent, boosted by a 7.5 per cent lift in Tesla and a 5.4 per cent rise in Nvidia.

On the bond market, the US 10-year yield ticked 3.4 basis points higher to 3.753 per cent, while the more rate-sensitive 2-year yield was up 8.8 basis points at 4.622 per cent.

On the commodity front, gold eased 11 cents to US$1,854.50 an ounce, the global benchmark Brent crude oil grade lost US$1.30, or 1.5 per cent, to US$85.31 a barrel, and West Texas Intermediate crude shed US$1.30, or 1.6 per cent, to US$78.84 a barrel.

The Australian dollar is buying 69.87 US cents this morning, up from 69.72 US cents at the Australian close on Tuesday.