Dwelling vacancies up, asking rents down… but real estate crisis far from over: SQM Research

It’s been a long time coming, but there is some positive news for renters with SQM Research reporting a slight increase in national vacancy rates and a much softer rise in capital city asking rents across the country.

The development may lead to “minor relief” for renters, SQM managing director Louis Christopher said, yet shouldn’t be see as the start of a broad rebound for the rental market. Slightly higher vacancies are a natural seasonal trend during the initial cooler months and will climb again during winter.

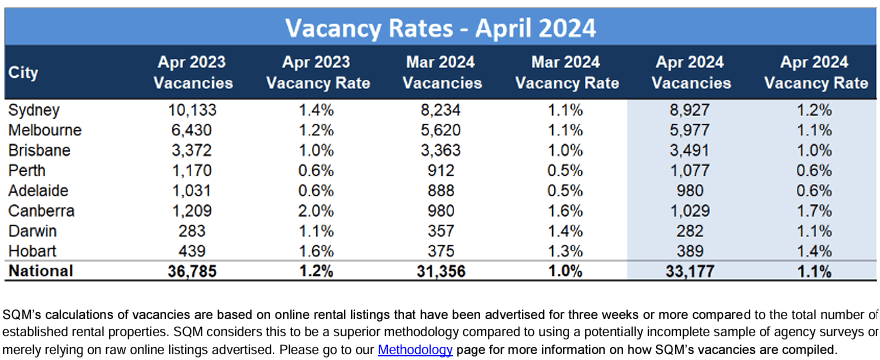

In a recent note SQM revealed vacancies across all dwellings (houses and units) increased from 1.0 per cent to 1.1 per cent, with the total number of vacancies Australia-wide now standing at 33,177 residential properties. “Sydney recorded a rental vacancy rate of 1.2 per cent with 10,133 rental dwellings vacant, up from 1.1 per cent recorded in the previous month,” the note stated. “Melbourne recorded a steady rental vacancy rate of 1.1 per cent.”

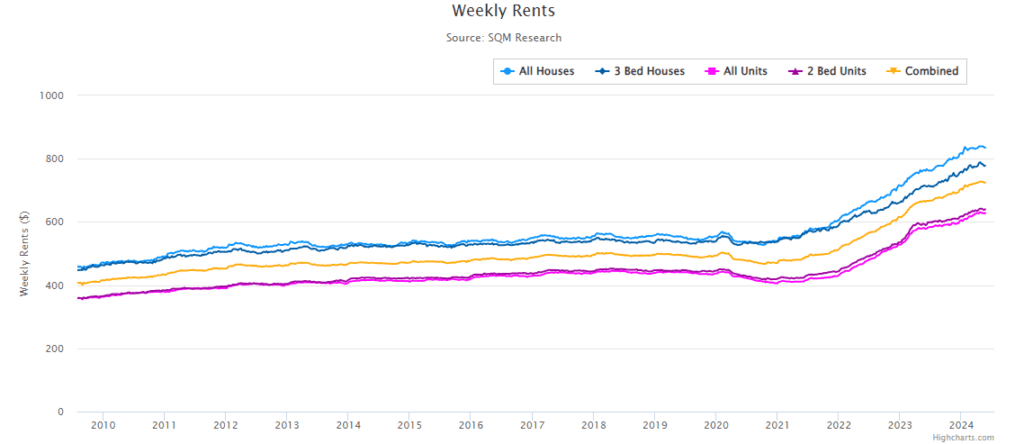

In a similar vein, asking rents have started to plateau after a concerted 24 month period of rapid increases, recording what SQM calls a “softer rise” compared to recent periods. National asking rents increased by just 0.5 per cent in the 30 days to May 12, representing “one of the slower rises in market rents since the outbreak of the national rental crisis in 2021”. See below.

The good news needs to be tempered with the reality that this trend is analogous with many other years, Christopher advised.

“We have recorded a slight easing in rental vacancy rates for April, but the rental crisis is still, far from over at this stage,” he commented. “The immediate outlook is vacancy rates are set to rise somewhat into winter.”

Calling the change “normal seasonality we get at this time of year”, Christopher said pundits should be careful about reading too much into the rises.

“Nevertheless, it might provide some minor relief to tenants who still have excessive difficulties in finding longer term rental accommodation around the country,” he said. “The full year outlook remains the same in that we expect overall tight vacancy rates to be with us for 2024, driven by a fall in dwelling completions relative to ongoing growing demand.”