Did you give your clients a bit of the Afterpay magic?

Afterpay (ASX:APT) has been one of those rare share market success stories, where a start-up, having listed at $1.00 in May 2016, successfully develops a platform that captures a new market, the company’s name becomes a verb, and it receives a takeover offer pitched at $126.61 after just over five years on the stock exchange.

Afterpay’s ‘buy-now, pay-later’ (BNPL) platform drew-in an entire market of customers that had no interest in participating in the traditional financial system, and certainly not in the credit card market. Fund managers who jumped on Afterpay from its very early beginnings will be punching the air in delight having backed one of the highest-returning stocks in share market history. It’s a classic “I told you so” moment. Afterpay had “first-mover” advantage in Australia and in many parts of the northern hemisphere, too; moreover, it had the much-prized “network effect,” in which the more people who use the platform, the more people want to use the platform.

A once-in-a-lifetime, 100-bagger stock where a $1,000 initial investment would have netted you a cool $126,000 had you bought in on the float. A success story that’s worthy of mention is the Hyperion Australian Growth Companies Fund, which had an 11.5% Afterpay holding, as the largest stake in the portfolio. Having won Fund Manager of the year, Hyperion knows just how much critical it is to pick the right stocks. According to FE Analytics, the fund with the highest percentage allocated was the Hyperion Australian Growth Companies fund which held an 11.85% weighting.

A number of other funds had significant holdings in Afterpay including First Sentier’s Australian Share strategy with 5.29%, Bennelong Kardinia Absolute Return (4.55%), Ausbil’s Active Sustainable Equity (3.04%), Van Eck MSCI Australian Sustainable Equity ETF (2.82%), CFS MIF Future Leaders (2.47%) and First Sentier Wholesale High Growth (1.48%).

| Fund Managers | APT % |

| Hyperion Australian Growth Companies fund | 11.85% |

| First Sentier Wholesale Australian Share | 5.29% |

| Bennelong Kardinia Absolute Return | 4.55% |

| Ausbil Active Sustainable Equity | 3.04% |

| Van Eck MSCI Australian Sustainable Equity ETF | 2.28% |

| CFS MIF Future Leaders | 2.47% |

| First Sentier Wholesale High Growth | 1.48% |

Roughly 25% of APT’s shareholder base is held by institutional investors. There are fund managers not listed in the above that bought into Afterpay at a time when shares were trading at $4.30 in 2017 and, since then, the share price has soared by more than 20 times. Despite its massive run among retail investors, the stock isn’t all that popular among the older generations and institutional investors.

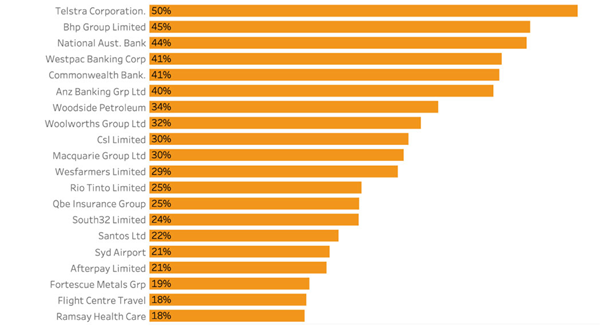

Afterpay is also popular among Sharesight users, which is a portfolio tracking system. Roughly 21 per cent of whom hold the stock in their portfolio. The stock’s popularity has doubled since the COVID-19 dip, growing from 15 per cent of users in January to 29 per cent in March this year.

What is clear, is those fund managers that avoided Afterpay will have a tough time explaining to their clients the missed opportunity. Not only has Afterpay’s share price gone up, but its market capitalisation exploded to about $18 billion. That means fund managers without a stake have struggled to perform. Ones that did, will be high-fiving in delight.11.