Claremont tops global equity performance tables

Morningstar has released its “top-performing global equity fund managers in 2021” report. This year, the funds that performed the best contained a well-disciplined approach to investing, together with an experienced team capable of producing high-performance numbers.

The research report found that the top three global fund managers also had outstanding longer-term performance numbers. What this means is that the fund manager has its investment style and philosophy mastered to the point where “it can result in high returns being delivered through a range of economic conditions.”

According to Morningstar the message is that the best fund managers are those that have a disciplined approach and a well-thought-out investment style.

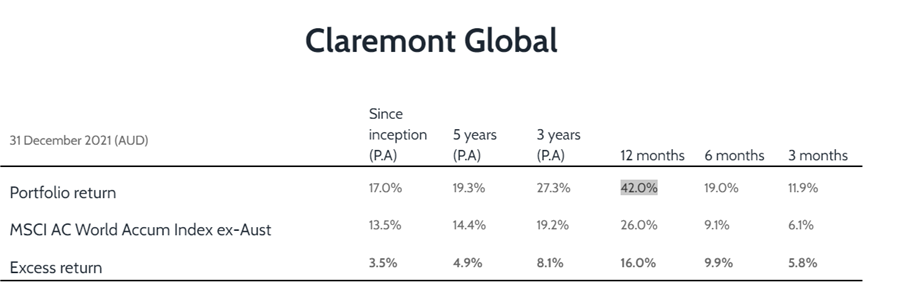

Global equity managers are broken into three categories: Large Blend, Large Growth, and Large Value. In this piece we focus on the “blended,” funds which are neither value or growth managers: The returns were exceptional:

- Claremont Global Fund – 42.06%

- L1 Capital International Fund – 41.16%

- Alphinity Global Equity Fund – 41.13%

- Global Systematic Equities Fund – 39.53%

- iShares Core MSCI World Ex Australia ESG Leaders ETF – 37.80%

Claremont Global, spun out of E&P Financial and run by Bob Desmond, attributes its success to taking profits when stocks have run ahead of their valuations. Claremont not only took profits, but reinvested back into value stocks and out of growth. Quality over high PE stocks.

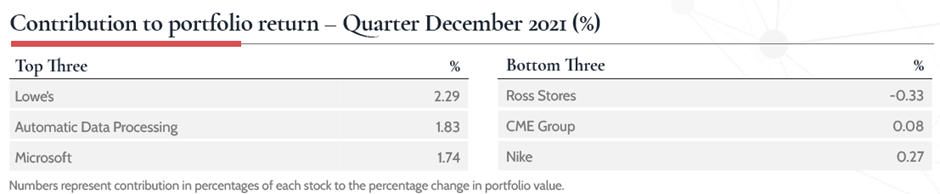

The Claremont Global Fund portfolio rose 11.9% during the quarter, and 42% for the year, outperforming the market by 5.8% and 16% respectively. Key contributors to performance for the quarter were Lowe’s and Automatic Data Processing:

- Lowe’s (NYSE: LOW) – Continued its momentum through the third quarter, delivering same-store sales growth of 2.2%, which came in ahead of consensus expectations. “The professional customer segment grew 16%, with the retail segment posting a 2% decline year-on-year but up sequentially from a 9% decline last quarter.”

- Automatic Data Processing (NASDAQ: ADP) – Delivered a strong 1Q22 result, with organic sales growth of 10%. The strong top-line performance was driven by record first quarter bookings.

- The key detractor was Visa (NYSE: V) – It was a volatile quarter for Visa, which provided a lower-than-expected guide for both FY22 revenue (low-teens growth) and earnings (mid-teens growth).

Following Claremont Global Fund was L1 Capital’s International Fund, with a return of 41.16%, and the Alphinity Global Equity Fund, returning 41.13%.