-

Sort By

-

Newest

-

Newest

-

Oldest

Private credit is booming across the globe, and while a bullish prognostication from alternative asset manager Blackstone won’t surprise there is enough evidence to suggest the prediction is likely accurate.

In real estate, investors need to think more broadly than the traditional sectors of office buildings and shopping centres. Digital infrastructure and industrial property are one way to update the portfolio.

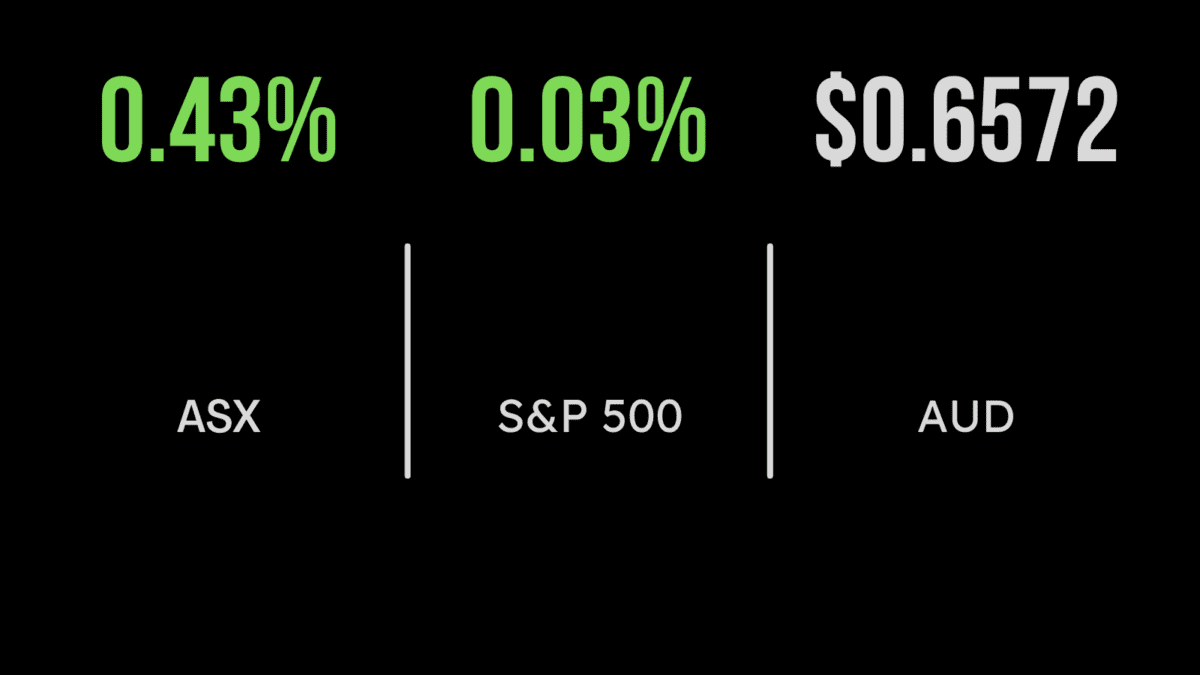

The Australian sharemarket posted a positive finish to the week, gaining 0.4 per cent, but with the S&P/ASX200 still managing to lose 0.2 per cent across the five days. The technology sector was buoyed by NVIDIA’s massive result overnight, with data centre operator Next DC (ASX:NXT) adding 1.9 per cent and hitting another all-time high…

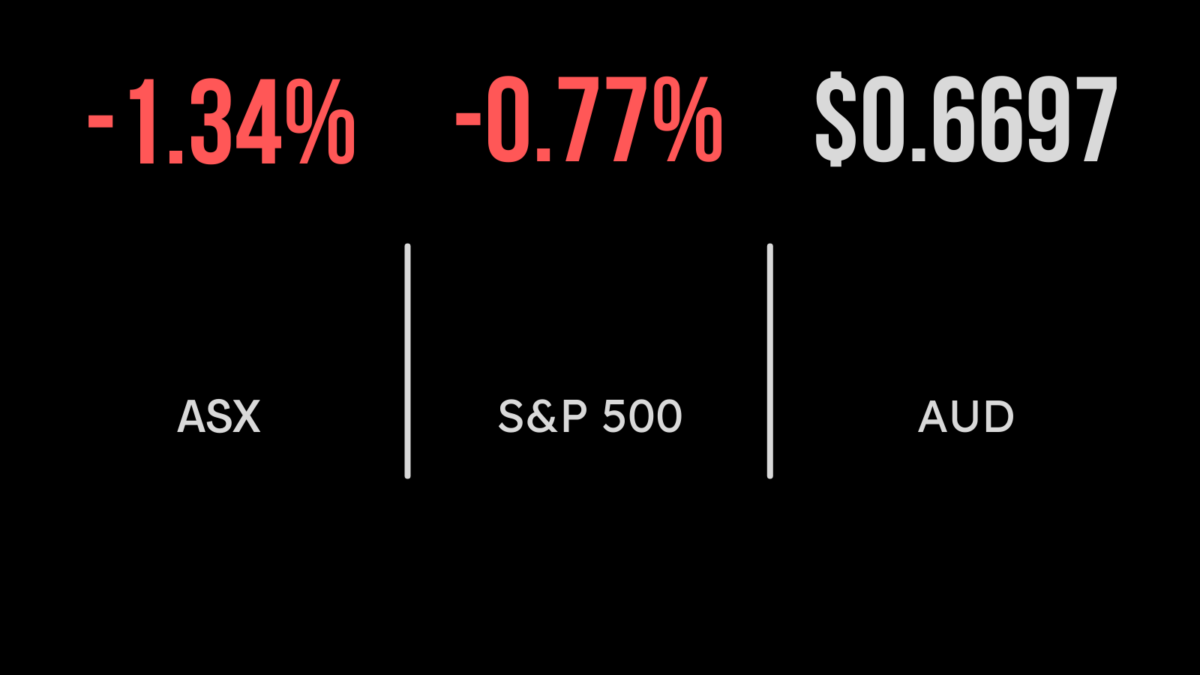

The local sharemarket followed a weak global lead with both the All Ordinaries (ASX:XAO) and S&P/ASX200 (ASX:XJO) dropped 1.3 per cent on Friday, following a 1.6 per cent fall the day prior. Oil and energy prices remain the biggest influence, with the once popular sector falling 4 per cent on Friday and 4.9 per cent…

As potential clients become more discerning, advisers must have a framework through which to consider investments for inclusion in portfolios, but also to extract the most personal of information from clients.

Markets have moved sharply to reprice Chinese assets upwards after the world’s second-largest economy signalled its reopening. However, some doubt the sustainability of the current bull market, saying key ingredients for a lasting recovery are missing.

Despite its lack of liquidity, PE’s popularity in the institutional and wholesale market is set to filter into the retail market with more fund managers offering a conduit to access the burgeoning sector.

Housing conditions are tipped to remain soft in the year ahead as central banks continue to raise credit costs, but experts still believe an all-out property market crash is unlikely.

Matt McNamara from HorizonBio Tech goes in-depth with James Dunn from The Inside Network on breaking down biotech investing.

Bill Prendergast discusses the role of fixed income and its role in portfolios today.

With inflation emerging from a long slumber to become a giant bugbear once more for the global economy and investment markets, investors are intensifying their focus on the search for assets that can offer some protection against inflation.

Anthony Kapetanovic from Akambo Financial Group shares insights with James Dunn from The Inside Network on the biggest challenges facing smaller advice practices in a post-RC environment.