-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Alternatives

-

Asset Allocation

-

Crypto

-

Defensive assets

-

Equities

-

ESG

-

ETF

-

Fixed Income

-

Growth assets

-

Private debt

-

Private Equity

-

Property

Investment manager Pinnacle Investment Management (ASX:PNI), which runs a multi-affiliate firm, has bought into private equity investor Five V Capital, buying a 25 per cent stake for $75 million. The relatively new but well-known private equity manager has roughly $1.1 billion in funds under management and invests in market-leading, innovative businesses in industries with strong…

Data released from platform provider Praemium (ASX: PPS) has shown that the rich are getting richer and more confident, moving on quickly from the pandemic. The research report, commissioned by Praemium and carried out by research company InvestmentTrends, surveyed about 11,000 investors of which 2,200 were high-net-worth; it offers valuable insights to financial advisers…

Financial advisers can’t be faulted for feeling pessimistic about the future as another year comes to an end. The last few years have seen the advisery world turned upside down, with those who remain paying for the sins of others. But regulation is only one part of the story, as their primary role providing strategic…

Today’s investors are “riding for a fall,” according to Oaktree Capital founder Howard Marks. Markets could well be in for a repeat of the “Nifty Fifty” large-cap mania of the 1960s. When Howard Marks was just starting his career in finance in 1969, the preceding 20 years had been “a “mostly unchanging backdrop… in front…

The COVID-19 pandemic and associated market sell-off became an unexpected testing ground for many of the more recent advancements in financial markets and investing. One growth area that has passed with flying colours, according to its predominantly institutional proponents, is factor investing. Defined as an investment approach that seeks to target specific drivers of returns…

“Following the money” was the resounding theme during the first, exclusive session of Australian Ethical and The Inside Network’s inaugural ‘Investing for a better world’ Masterclass. Set over the three separate sessions across three weeks in the lead-up to Christmas, the Masterclass has been adeptly structured to bring together industry experts spanning the financial, investment…

“It pays to be green,” was once a premature conclusion, but now that conclusion couldn’t be any closer to the truth. According to Evergreen Consultants, a survey of the firm’s ERIG (Evergreen Responsible Investment Grading) Index data showed responsible investment Australian equity funds to have outperformed the S&P/ASX 200 Index over the past three years….

“Follow the money” is among the most popular sayings in markets, with the regular Bank of America Fund Manager Survey one of the few insights available into how some US$1 trillion ($1.4 trillion) is being allocated. As is the case in the age of social media, click bait and meme stocks, those with the loudest…

Evergreen Ratings, a subsidiary of Evergreen Consultants and a leading research house that specialises in the analysis of closed ended and complex sustainable investment vehicles has given the Aura Venture Fund II a “Commended” rating, highlighting the funds strong team of venture capital specialists. The alternatives wealth manager, Aura Group, recently opened its second venture…

ESG may well be the most commonly used term in financial markets today, replacing growth, or quality in pitchbooks the world over. However, growth in regulatory pressure and concerns of ‘greenwashing’ have seen some experts calling for the end of the term ‘ESG integrated’ when it comes to defining investment funds. Global asset manager Robeco…

Australia’s longest standing responsible investment manager, Australian Ethical, has continued to sustain the top quartile performance of their Australian equity strategies, with a surge in assets under management seemingly having little influence on their returns. In their latest quarterly update, the group highlighted the events of COP26, but with a broader focus suggesting the conference…

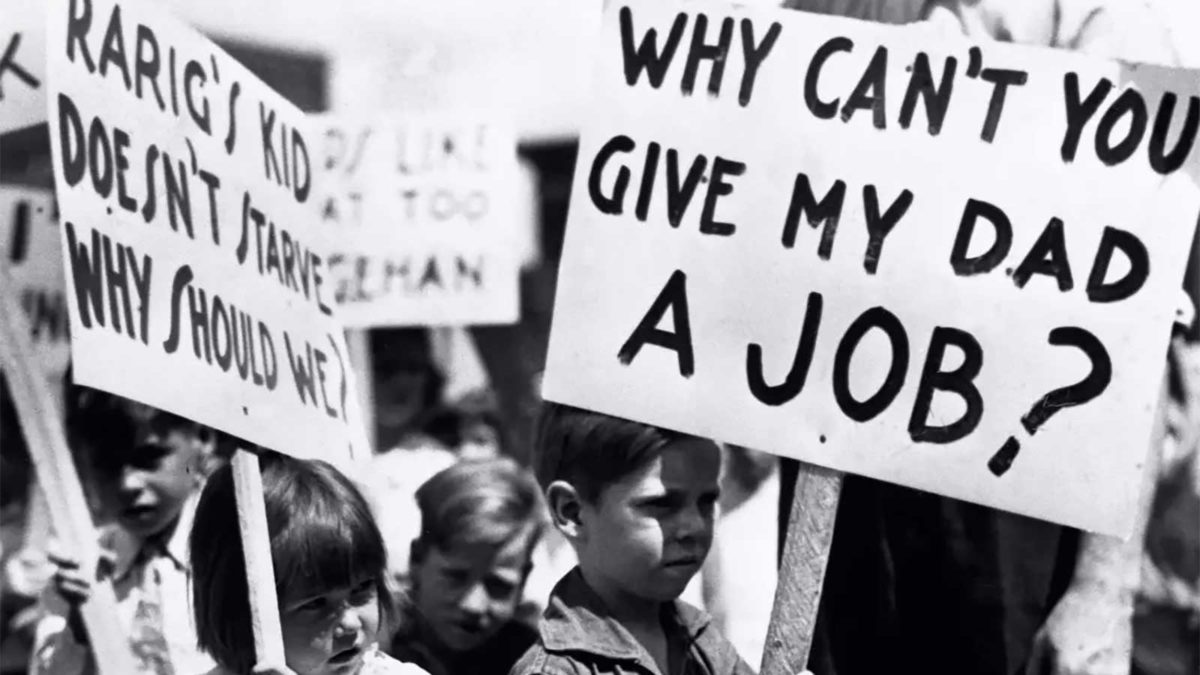

“To work, or not to work” was the title of Franklin Templeton’s Chief Investment Officer of Fixed Income, Sonal Desai’s latest white paper. The detailed analysis on the US labour market offers insights into the future that lies ahead for Australia but also into the unique and difficult conditions the world is in as we…