-

Sort By

-

Newest

-

Newest

-

Oldest

Value investing, for all its history as a robust investment strategy, has been one of the worst-performing ways to invest money over the last few years. Fair enough, the coronavirus has thrown a spanner in the works by wreaking mayhem on investment markets, but value investing still hasn’t outperformed. Since March this year, value managers…

The easiest call to make in 2021 is that the market is overvalued, or for those preferring hyperbole, suggest that everything is in a ‘bubble’. Whilst there is no doubt some assets and stocks that are trading well above their fair value, to suggest that everything is overvalued may well be a stretch. It’s an…

A slew of acquisitions has made homegrown investment manager Perpetual (ASX: PPT) a truly global business. CEO Rob Adams says there’s plenty more to come. A 26 per cent increase in net profit, to $124.1 million, has book-ended what Adams described as a “transformational year,” in which multiple bolt-on acquisitions took Perpetual from a key…

In the beginning, was the word and the word was ‘ethical’. Now we have lots of words: ‘responsible’, ‘sustainable’, ‘stewardship’, ‘environmental’, ‘social’ and ‘governance’. And perhaps a new word: ‘singularity’.The Singularity Group is a Zurich-based global investment boutique and research firm which uses quantitative techniques to seek out companies which have sustainable innovation as part…

Hindsight is a wonderful thing. Looking back at the events of the last 18 months, it becomes abundantly clear what actions both investment advisers and fund managers should have taken, yet this offers little in the way of insights into the future. As it stands today, almost every active fund managers should have delivered 20%+…

Australia’s inflation rate was released yesterday, hitting 3.8% over the year to June, from 1.1% for the twelve months to March. Looking at media headlines this morning, some suggest the June quarter rise in inflation is following the 5.4% rise in the US and looks concerning. Here were the ABS figures: CPI +0.8% in Q2,…

Evergreen Ratings recently awarded the Alceon High Conviction Absolute Return Fund a “Commended” rating for its “tried and tested processes, with risk considerations at its core.” They suggest that fund manager Alceon Liquid Strategies (ALS) has a strong track record of consistently delivering above-average equity returns with low volatility. It demonstrated this capacity with positive…

Afterpay (ASX:APT) has been one of those rare share market success stories, where a start-up, having listed at $1.00 in May 2016, successfully develops a platform that captures a new market, the company’s name becomes a verb, and it receives a takeover offer pitched at $126.61 after just over five years on the stock exchange….

ASX claws back, energy hit, IT takeover rally spreads The ASX 200 (ASX: XJO) spent most of the day clawing back from early losses, ultimately finishing down just 0.2% despite a weak lead from the US market. The story was similar to yesterday with 8 of the 11 sectors down but technology continuing to drive performance, up…

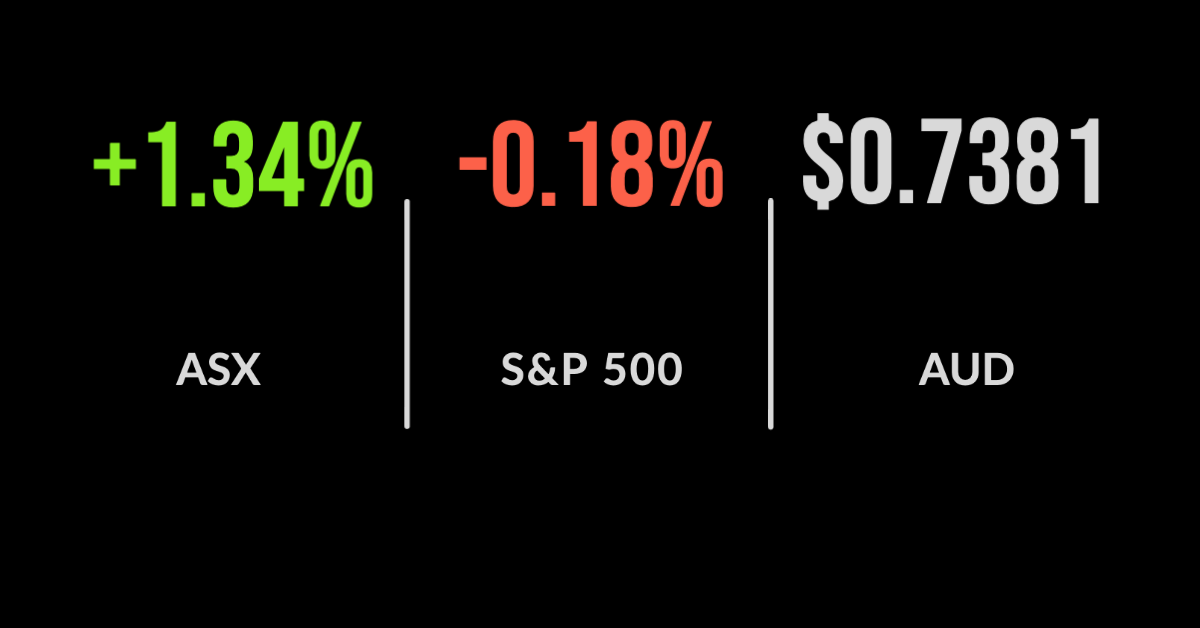

Afterpay powers ASX to record, Santos takes out Oil Search, iron ore tanks The ASX 200 (ASX: XJO) powered to another record close on Monday, jumping 1.3% on what has been dubbed ‘the biggest day in Australian sharemarket history’; the IT sector added 6.5%. Whilst every sector finished the day higher, it wasn’t smooth sailing for materials,…

As concerns grow about record-breaking US and Australian equity market valuations, the nascent recovery in Europe is opening opportunities for value seeking investors. That’s the view of ETF Securities, the multibillion-dollar exchange-traded fund issuer and manager. In a recent article, the research team highlighted a number of companies exposed to the recovery theme. The region…

Munro Partners and its chief investment officer, Nick Griffin, seem to have a unique ability to look beyond the day-to-day noise that occurs in financial markets and frame the opportunity for global growth equities in seemingly simple terms. Since starting from scratch at $0 in assets in 2016 the group recently surpassed $1 billion in…