-

Sort By

-

Newest

-

Newest

-

Oldest

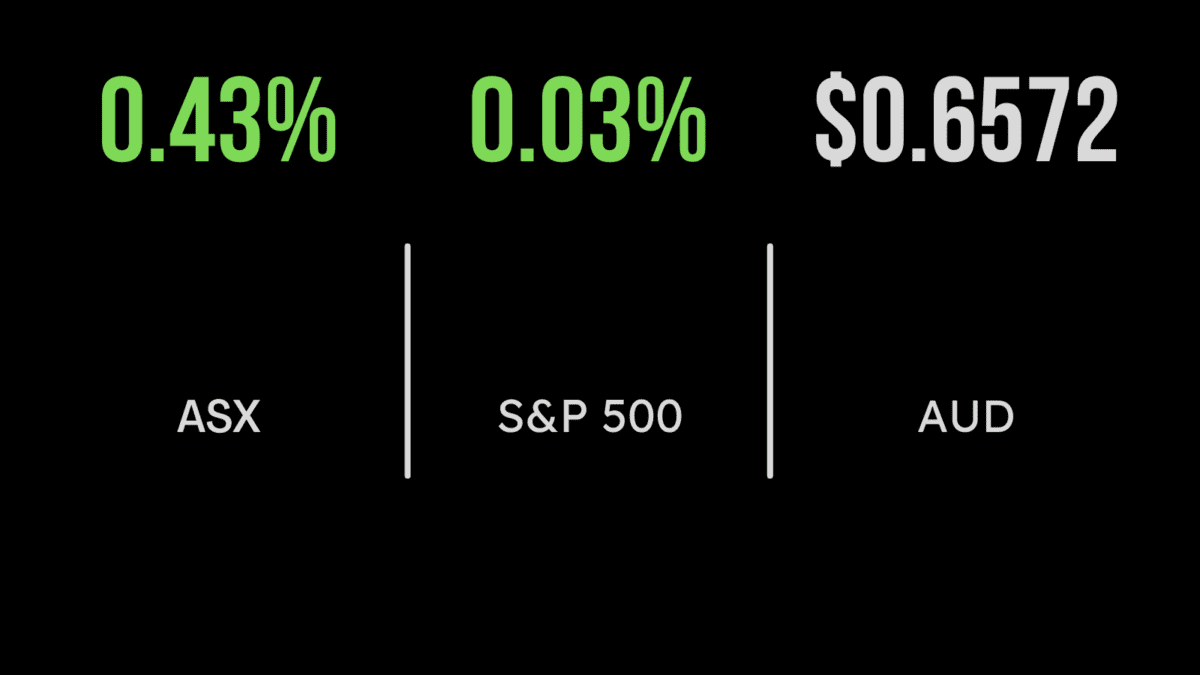

The S&P/ASX 200 Index rose by 0.5 per cent, driven by the increase in iron ore price. This surge propelled Rio Tinto up by 1.7 per cent, while Fortescue advanced by 0.4 per cent, and BHP increased by 1.5 per cent. The materials sector led gains, adding 1 per cent, followed closely by the technology…

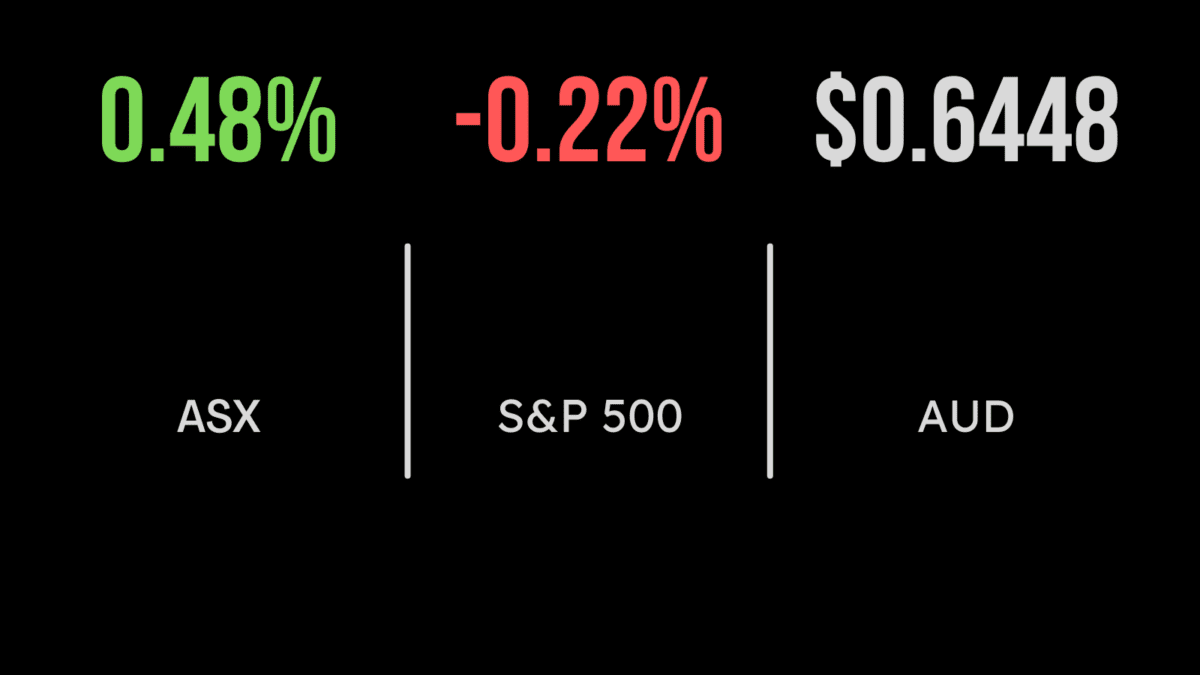

The Australian sharemarket posted a positive finish to the week, gaining 0.4 per cent, but with the S&P/ASX200 still managing to lose 0.2 per cent across the five days. The technology sector was buoyed by NVIDIA’s massive result overnight, with data centre operator Next DC (ASX:NXT) adding 1.9 per cent and hitting another all-time high…

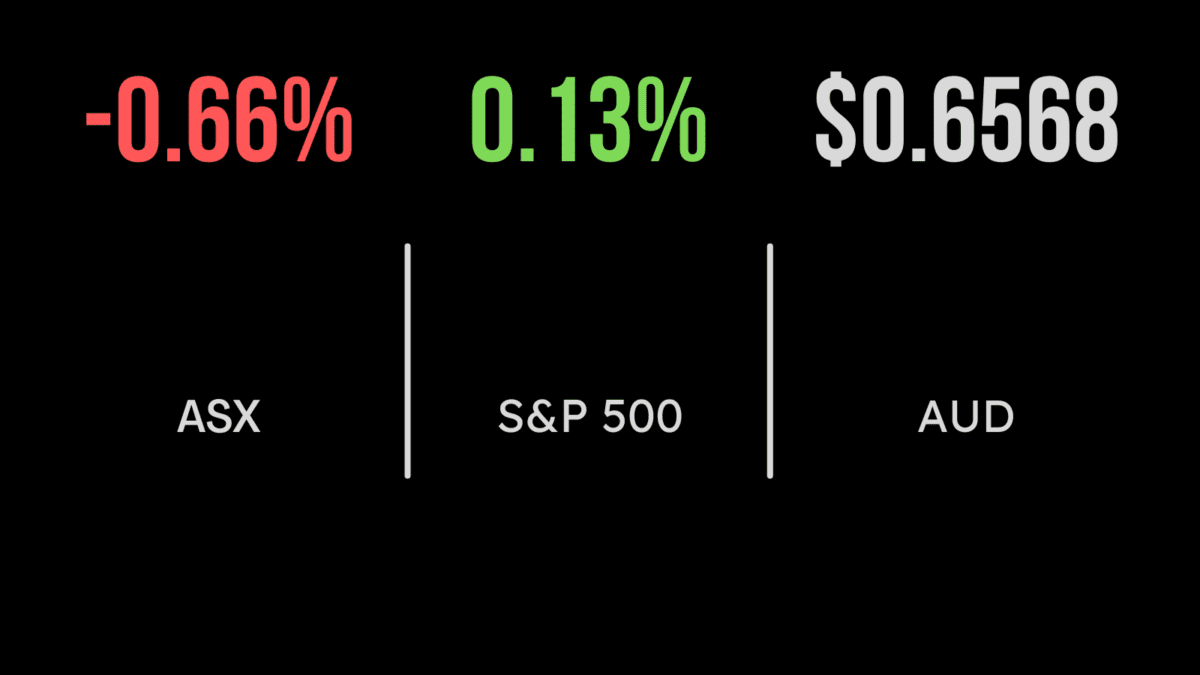

Both Australian benchmarks fell 0.7 per cent on Wednesday, as weakness in the consumer staples sector, which fell 4.3 per cent, offset gains in technology, which added 2.2 per cent. Woolworths (ASX:WOW) fell 6.6 per cent after the company announced the departure of long time CEO Brad Banducci after a TV outburst, with the company…

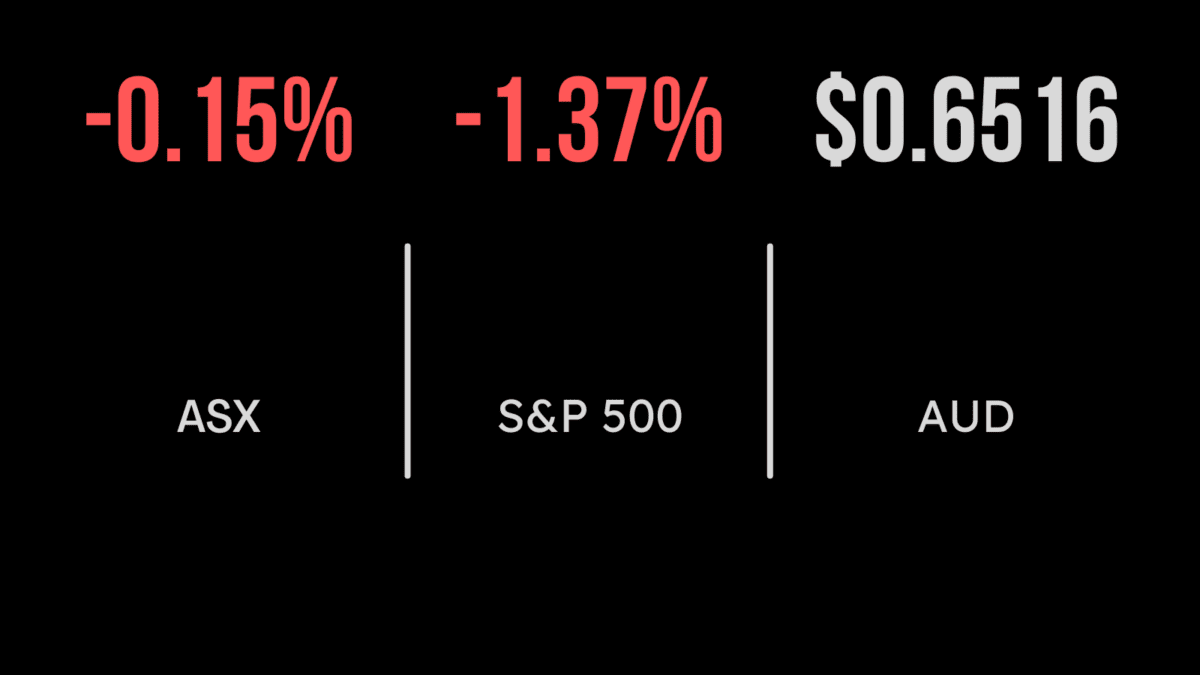

The ASX extended its decline today, succumbing to a second consecutive session of losses. Investor sentiment was dampened by a weaker-than-anticipated outlook from biotech heavyweight CSL Limited and heightened anticipation surrounding key US inflation data. The benchmark S&P/ASX 200 closed down -0.2 per cent, with only four of the eleven industry sectors registering gains. The…

Both Australian benchmarks fell on Tuesday for the second straight day, with the S&P/ASX200 (ASX:XJO) down 0.6 per cent with the energy sector, up 0.4 per cent, the only highlight. The selloff was led by the technology and materials sectors, which fell 1.8 and 1.3 per cent, with Fortescue (ASX:FMG) down 2.9 per cent as…

The Australian sharemarket climbed for a seventh consecutive session on Tuesday, its longest winning streak since June, led by sharp gains across growth stocks. The benchmark S&P/ASX 200 index added 21.8 points, or 0.3 per cent, to 7600.2 at the closing bell, with seven out of the 11 sectors finishing in the green. The All…

Energy stocks carried the Australian sharemarket on their back on Monday, enabling a sixth consecutive rising, as escalating tensions in the Middle East fed into a rally in oil prices and producers. The S&P/ASX 200 closed up 23 points, or 0.3 per cent, to 7578.4, around 50 points shy of its all-time high reached in…

The S&P/ASX 200 closed 0.8% higher on Monday aligning with a surge in US equities that propelled the S&P 500 to new record highs last week. However, gains were tempered by cautionary statements from local mining companies regarding declining commodity prices. Technology and financial sectors experienced notable gains, building on the momentum from Friday. Buy…

Australian stocks surged on Friday, breaking a four-day losing streak, following a robust US labour data report that instilled optimism in the economy and propelled Wall Street and risk assets into positive territory. The S&P/ASX 200 concluded the day 1 percent higher at 7421.2, rebounding from Thursday’s one-month lows. The All Ordinaries also recorded a…

It was a comprehensive setback for the Australian sharemarket on Tuesday, with all sectors ending the session in the red. The benchmark S&P/ASX 200 surrendered 81.5 points, or 1.1 per cent, to 7414.8, while the broader All Ordinaries was also down by 1.1 per cent, losing 83 points to 7,647. Softer commodity prices dragged energy,…

Uranium and gold miners led the way on Monday on the Australian sharemarket, but slumping lithium producers tempered that enthusiasm, as did the big bulk miners. Weaker iron ore prices saw BHP shed 53 cents, or 1.1 per cent, to $47.18, while Rio Tinto lost 83 cents, or 0.6 per cent, to $128.32, and Fortescue…

The S&P/ASX 200 dropped 0.4 per cent, stepping back from its 10-month high recorded the day before! Most sectors, including technology and real estate, showed declines on Thursday. Within the materials sector, gold and lithium explorers, such as Newmont and Allkem, dragged the market down with falls of 1.6 per cent and 5 per cent…