ASX retreats amid CSL outlook gloom and US inflation data jitters

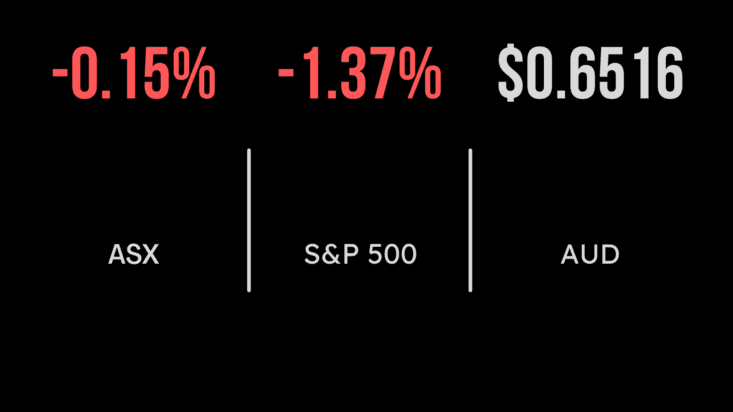

The ASX extended its decline today, succumbing to a second consecutive session of losses. Investor sentiment was dampened by a weaker-than-anticipated outlook from biotech heavyweight CSL Limited and heightened anticipation surrounding key US inflation data. The benchmark S&P/ASX 200 closed down -0.2 per cent, with only four of the eleven industry sectors registering gains. The healthcare sector bore the brunt of the selling pressure, as CSL shares nosedived 2.8 per cent. While the company unveiled an 11 per cent increase in net profit, investors reacted sceptically to their revised outlook for the Vifor therapy unit, acquired earlier this year. Despite mixed earnings reports across other sectors, the market’s primary focus has shifted towards the release of the US Consumer Price Index (CPI) data scheduled for Tuesday (Wednesday AEDT). This inflation data holds significant weight for investors attempting to predict the Federal Reserve’s potential interest rate cut trajectory, with current market expectations hovering between four and five reductions in 2024.

Mixed results on the Australian share market

Seek experienced a 4.6 per cent decline to $25.62 after profit slumped and customer activity returned to pre-pandemic levels. Seven West Media tumbled 11 per cent to 24.5¢ following a 53 per cent drop in TV advertising revenue. James Hardie dipped 8.5 per cent to $54.19 despite similar volume expectations, reflecting a lower net profit margin compared to the previous quarter. JB Hi-Fi gained 5.6 per cent to $63.96, Nick Scali rose 1.3 per cent to $15.46, and Kogan jumped 2.1 per cent to $6.20. Temple & Webster defied expectations with a 23 per cent revenue increase, climbing nearly 10 per cent to $11.01. Contrasting Performances include, Breville which saw a 8.5 per cent drop to $25 due to weaker-than-expected first-half sales. Challenger surging 8.4 per cent to $186.25 after reporting a 16 per cent jump in half-year profit. Macquarie Group dipping 1per cent to $186.25 after warning of a “substantially lower” FY24 profit compared to 2023. Beach Energy and Santos gaining 6.7 per cent and 0.5 per cent respectively. Mining giants witnessed mixed results due to holiday closures in China and Hong Kong.

US Stocks rattled on Valentine’s Day, with higher-than-expected core inflation

Hotter-than-expected US inflation rattled US markets, shattering investor hopes for early interest rate cuts by the Federal Reserve. The Dow Jones suffered its worst day since March 2023, tumbling 523 points (-1.4 per cent). Similar losses were seen across the board, with the S&P 500 dropping 1.3 per cent and the Nasdaq falling nearly 1.8 per cent. Fuelled by higher-than-anticipated figures for both annual and core inflation, as well as month-over-month increases in overall and core consumer prices, the report dampened optimism for a near-term easing of monetary policy. This shift in sentiment triggered a broad sell-off, impacting all major sectors. Technology and real estate bore the brunt of the decline, with tech giants like Microsoft (-2.1 per cent), Amazon (-2.1 per cent), and Alphabet (-1.6 per cent) experiencing significant losses. Even companies like Coca-Cola fell -0.6 per cent, despite meeting or exceeding earnings expectations.