Budget bores bourse

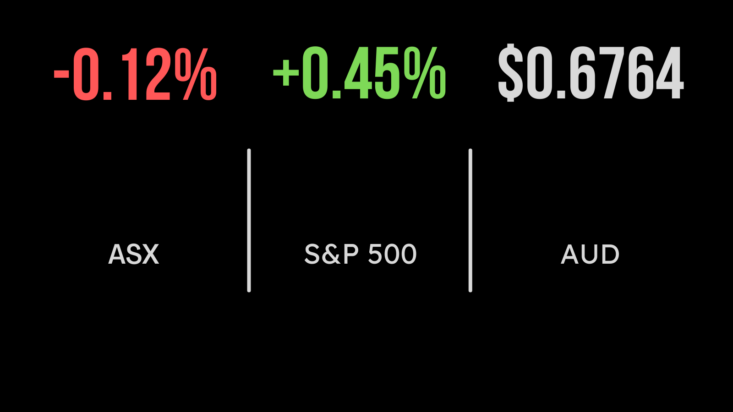

The Australian sharemarket yawned on Wednesday when it came to factoring-in the Budget announced the previous night. The benchmark S&P/ASX200 index closed the session down 8.4 points, or 0.1 per cent, to 7,255, while the broader All Ordinaries index barely moved, down 4.4 points to 7,452.

Some of the healthcare stocks rose, attributed to hopes the sector will be a big beneficiary of the Budget, thanks to a $15 billion welfare package and policies targeting net migration and first-home buyers. Telix Pharmaceuticals surged 35 cents, or 3.3 per cent, to $10.95; Ansell rose 34 cents, or 1.3 per cent, to $26.91; Healius advanced 3 cents, or 1 per cent to $3.05 and CSL was up $3.38, or 1.1 per cent, to $303.2. Sonic Health gained 30 cents, or 0.9 per cent, to $35.64.

In big mining, BHP eased 2 cents to $44.45, Rio Tinto shed 52 cents, or 0.5 per cent, to $110.92; and Fortescue Metals retreated 5 cents, or 0.2 per cent, to $20.63. South32 eased 3 cents, or 0.7 per cent to $4.15, despite its Hermosa zinc, silver, lead and manganese project in Arizona being accepted into the US government’s new approvals fast-track program.

In the coal space, Whitehaven Coal moved 4 cents, or 0.6 per cent, higher to $7.09; New Hope Corporation added 9 cents, or 1.7 per cent, to $5.26; Yancoal Australia gained 8 cents, or 1.5 per cent, to $5.46; Stanmore Resources was up 6 cents, or 2 per cent, to $2.99; and Terracom surged 3 cents, or 5.3 per cent, to 60 cents.

In lithium, Allkem gained 8 cents, or 0.6 per cent, to $12.91; and fellow producer Pilbara Minerals eased 14 cents, or 3 per cent, to $4.55. IGO, which mines nickel as well as lithium, lost 15 cents, or 1 per cent, to $14.48; and Mineral Resources, which produces iron ore and lithium, retreated 97 cents, or 1.3 per cent, to $72.53.

Weaker oil prices kept energy stocks under pressure, with Woodside Energy down 23 cents, or 0.7 per cent, to $33.74; Santos sliding 7 cents, or 1 per cent, to $7.20; Beach Energy losing 2.5 cents, or 1.7 per cent, to $1.42; and Karoon Energy retreating 3 cents, or 1.4 per cent, to $2.04.

Banks mixed, Appen bombs

The financial sector’s day was mixed. NAB lost 27 cents, or 3.5 per cent to $26.40; and Bank of Queensland slipped 5 cents, or 3.9 per cent, to $5.68, as both traded ex-dividend. CBA advanced 51 cents, or 0.5 per cent, to $97.85, and ANZ gained 11 cents, also 0.5 per cent, to $24.11; but Westpac slipped 7 cents, or 0.3 per cent, to $21.70.

Former market darling, tech company Appen, sank 90 cents, or 28.2 per cent, to $2.29, after flagging a significant revenue decline in the 2023 financial year.

Building products maker CSR gave up 14 cents, or 2.6 per cent to $5.33, after warning that the large backlog of new homes approved but not yet built could drag on until Christmas. CSR’s net profit fell 19 per cent to $218.5 million for the year ended March 31, suffering from comparison to one-off items that boosted last year’s result.

Shares in generic pharmaceutical company Mayne Pharma plunged 37 cents, or 9 per cent, to $3.74 following an on-market share buyback program for up to 10 per cent of the company’s issued capital.

Inflation print boosts rate-cut hopes

In the US, the latest inflation figure showed the consumer price index (CPI) rising 0.4 per cent, in April, in line with Wall Street expectations; but on an annual basis, the inflation rate was 4.9 per cent, below estimates, and giving some hope that the trend is lower. Even though inflation remains well above the Federal Reserve’s 2 per cent target, the figure induced traders to lift the chances of a September interest rate cut to close to 80 per cent.

On the share market, the 30-stock Dow Jones Industrial Average dipped 30.48 points to 33,531.33; but the broader S&P 500 index gained 18.47 points, or 0.5 per cent, to 4,137.64, and the tech-heavy Nasdaq Composite index advanced 126.89 points, or 1 per cent, to 12,306.44.

In the bond world, the benchmark US 10-year Treasury bond yield eased 7.2 basis points to 3.45 per cent, while the more policy-sensitive 2-year yield went below 4 per cent, down 11.2 basis points to 3.916 per cent.

In commodities, gold slid US$5.45, or 0.3 per cent, to US$2,030.96, while the global benchmark Brent crude oil grade lost US$1.03, or 1.3 per cent, to US$76.41 a barrel, and US West Texas Intermediate advanced 28 cents, or 0.4 per cent, to US$72.84 a barrel.

The Australian dollar is buying 67.79 US cents this morning, up from 67.66 cents at the local close on Wednesday.